PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

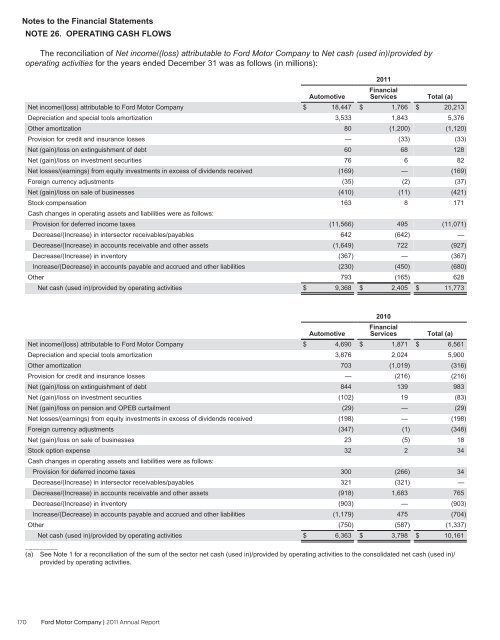

Notes to the Financial Statements<br />

NOTE 26. OPERATING CASH FLOWS<br />

The reconciliation of Net income/(loss) attributable to Ford Motor Company to Net cash (used in)/provided by<br />

operating activities for the years ended December 31 was as follows (in millions):<br />

2011<br />

Net income/(loss) attributable to Ford Motor Company<br />

Depreciation and special tools amortization<br />

Other amortization<br />

Provision for credit and insurance losses<br />

Net (gain)/loss on extinguishment of debt<br />

Net (gain)/loss on investment securities<br />

Net losses/(earnings) from equity investments in excess of dividends received<br />

Foreign currency adjustments<br />

Net (gain)/loss on sale of businesses<br />

Stock compensation<br />

Cash changes in operating assets and liabilities were as follows:<br />

Provision for deferred income taxes<br />

Decrease/(Increase) in intersector receivables/payables<br />

Decrease/(Increase) in accounts receivable and other assets<br />

Decrease/(Increase) in inventory<br />

Increase/(Decrease) in accounts payable and accrued and other liabilities<br />

Other<br />

Net cash (used in)/provided by operating activities<br />

Automotive<br />

$ 18,447<br />

3,533<br />

80<br />

—<br />

60<br />

76<br />

(169)<br />

(35)<br />

(410)<br />

163<br />

(11,566)<br />

642<br />

(1,649)<br />

(367)<br />

(230)<br />

793<br />

$ 9,368<br />

Financial<br />

Services<br />

$ 1,766<br />

1,843<br />

(1,200)<br />

(33)<br />

68<br />

6<br />

—<br />

(2)<br />

(11)<br />

8<br />

495<br />

(642)<br />

722<br />

—<br />

(450)<br />

(165)<br />

$ 2,405<br />

Total (a)<br />

$ 20,213<br />

5,376<br />

(1,120)<br />

(33)<br />

128<br />

82<br />

(169)<br />

(37)<br />

(421)<br />

171<br />

(11,071)<br />

—<br />

(927)<br />

(367)<br />

(680)<br />

628<br />

$ 11,773<br />

2010<br />

Automotive<br />

Financial<br />

Services Total (a)<br />

Net income/(loss) attributable to Ford Motor Company<br />

Depreciation and special tools amortization<br />

Other amortization<br />

Provision for credit and insurance losses<br />

Net (gain)/loss on extinguishment of debt<br />

Net (gain)/loss on investment securities<br />

Net (gain)/loss on pension and OPEB curtailment<br />

Net losses/(earnings) from equity investments in excess of dividends received<br />

Foreign currency adjustments<br />

Net (gain)/loss on sale of businesses<br />

Stock option expense<br />

Cash changes in operating assets and liabilities were as follows:<br />

Provision for deferred income taxes<br />

Decrease/(Increase) in intersector receivables/payables<br />

Decrease/(Increase) in accounts receivable and other assets<br />

Decrease/(Increase) in inventory<br />

Increase/(Decrease) in accounts payable and accrued and other liabilities<br />

Other<br />

$ 4,690<br />

3,876<br />

703<br />

—<br />

844<br />

(102)<br />

(29)<br />

(198)<br />

(347)<br />

23<br />

32<br />

300<br />

321<br />

(918)<br />

(903)<br />

(1,179)<br />

(750)<br />

$ 1,871<br />

2,024<br />

(1,019)<br />

(216)<br />

139<br />

19<br />

—<br />

—<br />

(1)<br />

(5)<br />

2<br />

(266)<br />

(321)<br />

1,683<br />

—<br />

475<br />

(587)<br />

$ 6,561<br />

5,900<br />

(316)<br />

(216)<br />

983<br />

(83)<br />

(29)<br />

(198)<br />

(348)<br />

18<br />

34<br />

34<br />

—<br />

765<br />

(903)<br />

(704)<br />

(1,337)<br />

Net cash (used in)/provided by operating activities<br />

$ 6,363 $ 3,798 $ 10,161<br />

_________<br />

(a) See Note 1 for a reconciliation of the sum of the sector net cash (used in)/provided by operating activities to the consolidated net cash (used in)/<br />

provided by operating activities.<br />

170 Ford Motor Company | 2011 Annual Report