PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

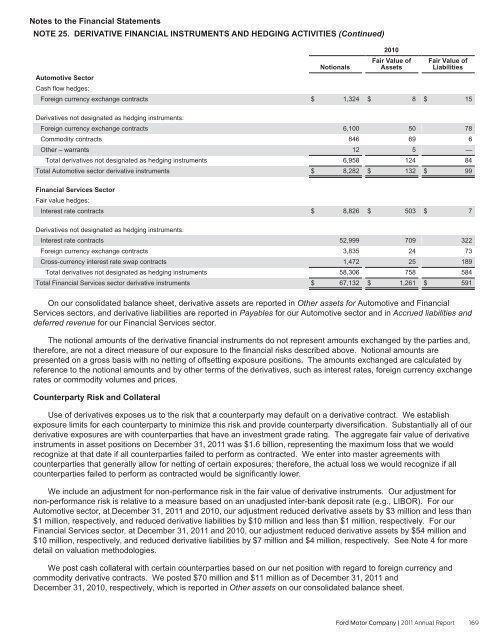

Notes to the Financial Statements<br />

NOTE 25. DERIVATIVE FINANCIAL INSTRUMENTS AND HEDGING ACTIVITIES (Continued)<br />

2010<br />

Automotive Sector<br />

Cash flow hedges:<br />

Foreign currency exchange contracts<br />

Notionals<br />

$ 1,324<br />

Fair Value of<br />

Assets<br />

$ 8<br />

Fair Value of<br />

Liabilities<br />

$ 15<br />

Derivatives not designated as hedging instruments:<br />

Foreign currency exchange contracts<br />

Commodity contracts<br />

Other – warrants<br />

Total derivatives not designated as hedging instruments<br />

Total Automotive sector derivative instruments<br />

6,100<br />

846<br />

12<br />

6,958<br />

$ 8,282<br />

50<br />

69<br />

5<br />

124<br />

$ 132<br />

78<br />

6<br />

—<br />

84<br />

$ 99<br />

Financial Services Sector<br />

Fair value hedges:<br />

Interest rate contracts<br />

$ 8,826<br />

$ 503<br />

$ 7<br />

Derivatives not designated as hedging instruments:<br />

Interest rate contracts<br />

Foreign currency exchange contracts<br />

Cross-currency interest rate swap contracts<br />

Total derivatives not designated as hedging instruments<br />

Total Financial Services sector derivative instruments<br />

52,999<br />

3,835<br />

1,472<br />

58,306<br />

$ 67,132<br />

709<br />

24<br />

25<br />

758<br />

$ 1,261<br />

322<br />

73<br />

189<br />

584<br />

$ 591<br />

On our consolidated balance sheet, derivative assets are reported in Other assets for Automotive and Financial<br />

Services sectors, and derivative liabilities are reported in Payables for our Automotive sector and in Accrued liabilities and<br />

deferred revenue for our Financial Services sector.<br />

The notional amounts of the derivative financial instruments do not represent amounts exchanged by the parties and,<br />

therefore, are not a direct measure of our exposure to the financial risks described above. Notional amounts are<br />

presented on a gross basis with no netting of offsetting exposure positions. The amounts exchanged are calculated by<br />

reference to the notional amounts and by other terms of the derivatives, such as interest rates, foreign currency exchange<br />

rates or commodity volumes and prices.<br />

Counterparty Risk and Collateral<br />

Use of derivatives exposes us to the risk that a counterparty may default on a derivative contract. We establish<br />

exposure limits for each counterparty to minimize this risk and provide counterparty diversification. Substantially all of our<br />

derivative exposures are with counterparties that have an investment grade rating. The aggregate fair value of derivative<br />

instruments in asset positions on December 31, 2011 was $1.6 billion, representing the maximum loss that we would<br />

recognize at that date if all counterparties failed to perform as contracted. We enter into master agreements with<br />

counterparties that generally allow for netting of certain exposures; therefore, the actual loss we would recognize if all<br />

counterparties failed to perform as contracted would be significantly lower.<br />

We include an adjustment for non-performance risk in the fair value of derivative instruments. Our adjustment for<br />

non-performance risk is relative to a measure based on an unadjusted inter-bank deposit rate (e.g., LIBOR). For our<br />

Automotive sector, at December 31, 2011 and 2010, our adjustment reduced derivative assets by $3 million and less than<br />

$1 million, respectively, and reduced derivative liabilities by $10 million and less than $1 million, respectively. For our<br />

Financial Services sector, at December 31, 2011 and 2010, our adjustment reduced derivative assets by $54 million and<br />

$10 million, respectively, and reduced derivative liabilities by $7 million and $4 million, respectively. See Note 4 for more<br />

detail on valuation methodologies.<br />

We post cash collateral with certain counterparties based on our net position with regard to foreign currency and<br />

commodity derivative contracts. We posted $70 million and $11 million as of December 31, 2011 and<br />

December 31, 2010, respectively, which is reported in Other assets on our consolidated balance sheet.<br />

Ford Motor Company | 2011 Annual Report 169