Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

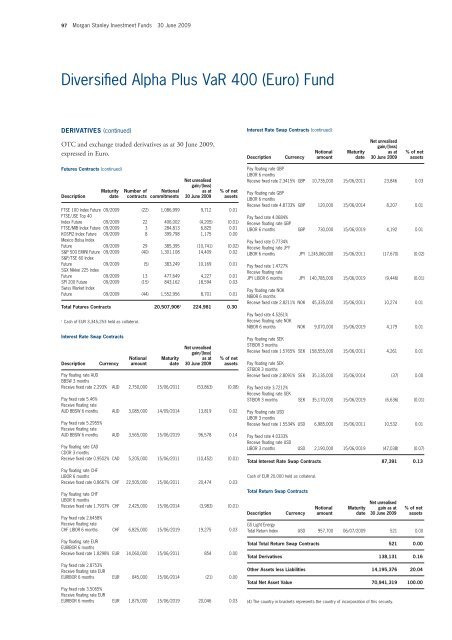

97 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

Diversified Alpha Plus VaR 400 (Euro) Fund<br />

DERIVATIVES (continued)<br />

OTC and exchange traded derivatives as at 30 June 2009,<br />

expressed in Euro.<br />

Futures Contracts (continued)<br />

Description<br />

FTSE 100 Index Future 09/2009 (22) 1,086,999 9,712 0.01<br />

FTSE/JSE Top 40<br />

Index Future 09/2009 22 406,002 (4,205) (0.01)<br />

FTSE/MIB Index Future 09/2009 3 284,813 6,825 0.01<br />

KOSPI2 Index Future 09/2009 8 399,798 1,175 0.00<br />

Mexico Bolsa Index<br />

Future 09/2009 29 385,395 (10,741) (0.02)<br />

S&P 500 EMINI Future 09/2009 (40) 1,301,108 14,409 0.02<br />

S&P/TSE 60 Index<br />

Future 09/2009 (5) 383,249 10,169 0.01<br />

SGX Nikkei 225 Index<br />

Future 09/2009 13 477,649 4,227 0.01<br />

SPI 200 Future 09/2009 (15) 843,162 18,594 0.03<br />

Swiss Market Index<br />

Future 09/2009 (44) 1,552,956 8,701 0.01<br />

Total Futures Contracts 20,507,906 1 224,981 0.30<br />

1 Cash of EUR 3,345,253 held as collateral.<br />

Interest Rate Swap Contracts<br />

Description<br />

Maturity<br />

date<br />

Currency<br />

Number of Notional<br />

contracts commitments<br />

Notional<br />

amount<br />

Maturity<br />

date<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of net<br />

assets<br />

% of net<br />

assets<br />

Pay floating rate AUD<br />

BBSW 3 months<br />

Receive fixed rate 2.293% AUD 2,750,000 15/06/2011 (53,863) (0.08)<br />

Pay fixed rate 5.46%<br />

Receive floating rate<br />

AUD BBSW 6 months AUD 3,085,000 14/09/2014 13,819 0.02<br />

Pay fixed rate 5.2955%<br />

Receive floating rate<br />

AUD BBSW 6 months AUD 3,565,000 15/06/2019 96,578 0.14<br />

Pay floating rate CAD<br />

CDOR 3 months<br />

Receive fixed rate 0.9502% CAD 5,205,000 15/06/2011 (10,452) (0.01)<br />

Pay floating rate CHF<br />

LIBOR 6 months<br />

Receive fixed rate 0.8667% CHF 22,505,000 15/06/2011 20,474 0.03<br />

Pay floating rate CHF<br />

LIBOR 6 months<br />

Receive fixed rate 1.7937% CHF 2,425,000 15/06/2014 (3,983) (0.01)<br />

Pay fixed rate 2.6458%<br />

Receive floating rate<br />

CHF LIBOR 6 months CHF 6,825,000 15/06/2019 19,275 0.03<br />

Pay floating rate EUR<br />

EURIBOR 6 months<br />

Receive fixed rate 1.8298% EUR 14,060,000 15/06/2011 854 0.00<br />

Pay fixed rate 2.8753%<br />

Receive floating rate EUR<br />

EURIBOR 6 months EUR 845,000 15/06/2014 (21) 0.00<br />

Pay fixed rate 3.5065%<br />

Receive floating rate EUR<br />

EURIBOR 6 months EUR 1,875,000 15/06/2019 20,046 0.03<br />

Interest Rate Swap Contracts (continued)<br />

Description<br />

Pay floating rate GBP<br />

LIBOR 6 months<br />

Receive fixed rate 2.3415% GBP 10,735,000 15/06/2011 23,846 0.03<br />

Pay floating rate GBP<br />

LIBOR 6 months<br />

Receive fixed rate 4.8733% GBP 120,000 15/06/2014 8,207 0.01<br />

Pay fixed rate 4.0684%<br />

Receive floating rate GBP<br />

LIBOR 6 months GBP 730,000 15/06/2019 4,192 0.01<br />

Pay fixed rate 0.7734%<br />

Receive floating rate JPY<br />

LIBOR 6 months JPY 1,245,060,000 15/06/2011 (17,670) (0.02)<br />

Pay fixed rate 1.4727%<br />

Receive floating rate<br />

JPY LIBOR 6 months JPY 140,785,000 15/06/2019 (9,446) (0.01)<br />

Pay floating rate NOK<br />

NIBOR 6 months<br />

Receive fixed rate 2.8211% NOK 45,335,000 15/06/2011 10,274 0.01<br />

Pay fixed rate 4.5261%<br />

Receive floating rate NOK<br />

NIBOR 6 months NOK 9,070,000 15/06/2019 4,179 0.01<br />

Pay floating rate SEK<br />

STIBOR 3 months<br />

Receive fixed rate 1.5765% SEK 158,555,000 15/06/2011 4,261 0.01<br />

Pay floating rate SEK<br />

STIBOR 3 months<br />

Receive fixed rate 2.8091% SEK 35,135,000 15/06/2014 (37) 0.00<br />

Pay fixed rate 3.7212%<br />

Receive floating rate SEK<br />

STIBOR 3 months SEK 35,170,000 15/06/2019 (6,636) (0.01)<br />

Pay floating rate USD<br />

LIBOR 3 months<br />

Receive fixed rate 1.5534% USD 6,985,000 15/06/2011 10,532 0.01<br />

Pay fixed rate 4.0333%<br />

Receive floating rate USD<br />

LIBOR 3 months USD 2,190,000 15/06/2019 (47,038) (0.07)<br />

Total Interest Rate Swap Contracts 87,391 0.13<br />

Cash of EUR 20,000 held as collateral.<br />

Total Return Swap Contracts<br />

Description<br />

Currency<br />

Currency<br />

Notional<br />

amount<br />

Notional<br />

amount<br />

Maturity<br />

date<br />

Maturity<br />

date<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

Net unrealised<br />

gain as at<br />

30 June 2009<br />

GS Light Energy<br />

Total Return Index USD 957,700 06/07/2009 521 0.00<br />

Total Total Return Swap Contracts 521 0.00<br />

Total Derivatives 138,131 0.16<br />

Other Assets less Liabilities 14,195,376 20.04<br />

Total Net Asset Value 70,941,319 100.00<br />

(4) The country in brackets represents the country of incorporation of this security.<br />

% of net<br />

assets<br />

% of net<br />

assets