Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

69 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

Euro Strategic Bond Fund<br />

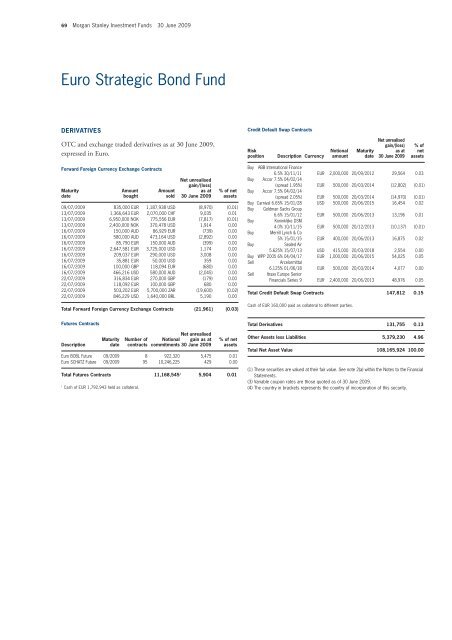

DERIVATIVES<br />

OTC and exchange traded derivatives as at 30 June 2009,<br />

expressed in Euro.<br />

Forward Foreign Currency Exchange Contracts<br />

Maturity<br />

date<br />

09/07/2009 835,000 EUR 1,187,938 USD (8,970) (0.01)<br />

13/07/2009 1,366,643 EUR 2,070,000 CHF 9,035 0.01<br />

13/07/2009 6,950,000 NOK 775,556 EUR (7,817) (0.01)<br />

13/07/2009 2,400,000 NOK 370,478 USD 1,914 0.00<br />

16/07/2009 150,000 AUD 86,929 EUR (739) 0.00<br />

16/07/2009 580,000 AUD 473,164 USD (2,892) 0.00<br />

16/07/2009 85,790 EUR 150,000 AUD (399) 0.00<br />

16/07/2009 2,647,581 EUR 3,725,000 USD 1,174 0.00<br />

16/07/2009 209,037 EUR 290,000 USD 3,008 0.00<br />

16/07/2009 35,881 EUR 50,000 USD 359 0.00<br />

16/07/2009 100,000 GBP 118,094 EUR (680) 0.00<br />

16/07/2009 466,216 USD 580,000 AUD (2,045) 0.00<br />

22/07/2009 316,834 EUR 270,000 GBP (179) 0.00<br />

22/07/2009 118,092 EUR 100,000 GBP 680 0.00<br />

22/07/2009 503,202 EUR 5,700,000 ZAR (19,600) (0.02)<br />

22/07/2009 846,229 USD 1,640,000 BRL 5,190 0.00<br />

Total Forward Foreign Currency Exchange Contracts (21,961) (0.03)<br />

Futures Contracts<br />

Description<br />

Maturity<br />

date<br />

Amount<br />

bought<br />

Number of<br />

contracts<br />

Euro BOBL Future 09/2009 8 922,320 5,475 0.01<br />

Euro SCHATZ Future 09/2009 95 10,246,225 429 0.00<br />

Total Futures Contracts 11,168,545 1 5,904 0.01<br />

1 Cash of EUR 1,792,943 held as collateral.<br />

Amount<br />

sold<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

Net unrealised<br />

Notional gain as at<br />

commitments 30 June 2009<br />

% of net<br />

assets<br />

% of net<br />

assets<br />

Credit Default Swap Contracts<br />

Risk<br />

position<br />

Description Currency<br />

Notional<br />

amount<br />

Buy ABB International Finance<br />

6.5% 30/11/11 EUR 2,000,000 20/09/2012 29,564 0.03<br />

Buy Accor 7.5% 04/02/14<br />

(spread 1.95%) EUR 500,000 20/03/2014 (12,802) (0.01)<br />

Buy Accor 7.5% 04/02/14<br />

(spread 2.05%) EUR 500,000 20/03/2014 (14,970) (0.01)<br />

Buy Carnival 6.65% 15/01/28 USD 500,000 20/06/2015 16,454 0.02<br />

Buy Goldman Sachs Group<br />

6.6% 15/01/12 EUR 500,000 20/06/2013 13,196 0.01<br />

Buy Koninklijke DSM<br />

4.0% 10/11/15 EUR 500,000 20/12/2013 (10,137) (0.01)<br />

Buy Merrill Lynch & Co<br />

5% 15/01/15 EUR 400,000 20/06/2013 16,875 0.02<br />

Buy Sealed Air<br />

5.625% 15/07/13 USD 415,000 20/03/2018 2,554 0.00<br />

Buy WPP 2005 6% 04/04/17 EUR 1,000,000 20/06/2015 54,025 0.05<br />

Sell Arcelormittal<br />

6.125% 01/06/18 EUR 500,000 20/03/2014 4,077 0.00<br />

Sell Itraxx Europe Senior<br />

Financials Series 9 EUR 2,400,000 20/06/2013 48,976 0.05<br />

Total Credit Default Swap Contracts 147,812 0.15<br />

Cash of EUR 160,000 paid as collateral to different parties.<br />

Maturity<br />

date<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of<br />

net<br />

assets<br />

Total Derivatives 131,755 0.13<br />

Other Assets less Liabilities 5,379,230 4.96<br />

Total Net Asset Value 108,165,924 100.00<br />

(1) These securities are valued at their fair value. See note 2(a) within the Notes to the Financial<br />

Statements.<br />

(3) Variable coupon rates are those quoted as of 30 June 2009.<br />

(4) The country in brackets represents the country of incorporation of this security.