Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

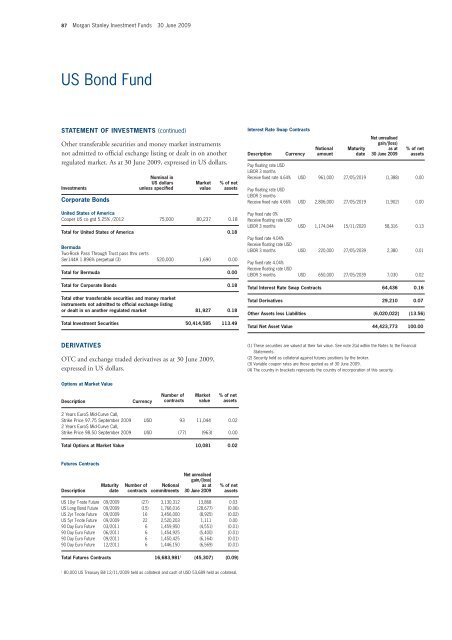

87 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

US Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Other transferable securities and money market instruments<br />

not admitted to official exchange listing or dealt in on another<br />

regulated market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s<br />

Corporate Bonds<br />

United States of America<br />

Cooper US co gtd 5.25% /2012 75,000 80,237 0.18<br />

Total for United States of America 0.18<br />

Bermuda<br />

Two-Rock Pass Through Trust pass thru certs<br />

Ser144A 1.896% perpetual (3) 520,000 1,690 0.00<br />

Total for Bermuda 0.00<br />

Total for Corporate Bonds 0.18<br />

Total other transferable securities and money market<br />

instruments not admitted to official exchange listing<br />

or dealt in on another regulated market 81,927 0.18<br />

Total <strong>Investment</strong> Securities 50,414,585 113.49<br />

DERIVATIVES<br />

OTC and exchange traded derivatives as at 30 June 2009,<br />

expressed in US dollars.<br />

Options at Market Value<br />

Description Currency<br />

2 Years Euro$ Mid-Curve Call,<br />

Strike Price 97.75 September 2009 USD 93 11,044 0.02<br />

2 Years Euro$ Mid-Curve Call,<br />

Strike Price 98.50 September 2009 USD (77) (963) 0.00<br />

Total Options at Market Value 10,081 0.02<br />

Futures Contracts<br />

Description<br />

Maturity<br />

date<br />

Number of<br />

contracts<br />

Nominal in<br />

US dollars<br />

unless specified<br />

Number of<br />

contracts<br />

Notional<br />

commitments<br />

Market<br />

value<br />

Market<br />

value<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of net<br />

assets<br />

% of net<br />

assets<br />

% of net<br />

assets<br />

US 10yr T-note Future 09/2009 (27) 3,130,312 13,868 0.03<br />

US Long Bond Future 09/2009 (15) 1,766,016 (28,677) (0.06)<br />

US 2yr T-note Future 09/2009 16 3,456,000 (8,925) (0.02)<br />

US 5yr T-note Future 09/2009 22 2,520,203 1,111 0.00<br />

90 Day Euro Future 03/2011 6 1,459,950 (4,551) (0.01)<br />

90 Day Euro Future 06/2011 6 1,454,925 (5,400) (0.01)<br />

90 Day Euro Future 09/2011 6 1,450,425 (6,164) (0.01)<br />

90 Day Euro Future 12/2011 6 1,446,150 (6,569) (0.01)<br />

Total Futures Contracts 16,683,981 1 (45,307) (0.09)<br />

1 80,000 US Treasury Bill 12/11/2009 held as collateral and cash of USD 53,689 held as collateral.<br />

Interest Rate Swap Contracts<br />

Description<br />

Currency<br />

Notional<br />

amount<br />

Maturity<br />

date<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of net<br />

assets<br />

Pay floating rate USD<br />

LIBOR 3 months<br />

Receive fixed rate 4.64% USD 961,000 27/05/2019 (1,388) 0.00<br />

Pay floating rate USD<br />

LIBOR 3 months<br />

Receive fixed rate 4.66% USD 2,806,000 27/05/2019 (1,902) 0.00<br />

Pay fixed rate 0%<br />

Receive floating rate USD<br />

LIBOR 3 months USD 1,174,044 15/11/2020 58,316 0.13<br />

Pay fixed rate 4.04%<br />

Receive floating rate USD<br />

LIBOR 3 months USD 220,000 27/05/2039 2,380 0.01<br />

Pay fixed rate 4.04%<br />

Receive floating rate USD<br />

LIBOR 3 months USD 650,000 27/05/2039 7,030 0.02<br />

Total Interest Rate Swap Contracts 64,436 0.16<br />

Total Derivatives 29,210 0.07<br />

Other Assets less Liabilities (6,020,022) (13.56)<br />

Total Net Asset Value 44,423,773 100.00<br />

(1) These securities are valued at their fair value. See note 2(a) within the Notes to the Financial<br />

Statements.<br />

(2) Security held as collateral against futures positions by the broker.<br />

(3) Variable coupon rates are those quoted as of 30 June 2009.<br />

(4) The country in brackets represents the country of incorporation of this security.