Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

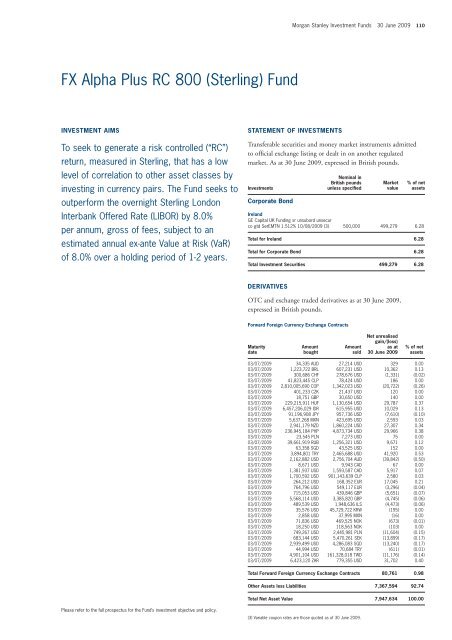

FX Alpha Plus RC 800 (Sterling) Fund<br />

INVESTMENT AIMS<br />

To seek to generate a risk controlled (“RC”)<br />

return, measured in Sterling, that has a low<br />

level of correlation to other asset classes by<br />

investing in currency pairs. The Fund seeks to<br />

outperform the overnight Sterling London<br />

Interbank Offered Rate (LIBOR) by 8.0%<br />

per annum, gross of fees, subject to an<br />

estimated annual ex-ante Value at Risk (VaR)<br />

of 8.0% over a holding period of 1-2 years.<br />

Please refer to the full prospectus for the Fund’s investment objective and policy.<br />

Corporate Bond<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 110<br />

STATEMENT OF INVESTMENTS<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in British pounds.<br />

<strong>Investment</strong>s<br />

Ireland<br />

GE Capital UK Funding sr unsubord unsecur<br />

co gtd SerEMTN 1.512% 10/08/2009 (3) 500,000 499,279 6.28<br />

Total for Ireland 6.28<br />

Total for Corporate Bond 6.28<br />

Total <strong>Investment</strong> Securities 499,279 6.28<br />

DERIVATIVES<br />

OTC and exchange traded derivatives as at 30 June 2009,<br />

expressed in British pounds.<br />

Forward Foreign Currency Exchange Contracts<br />

Maturity<br />

date<br />

Amount<br />

bought<br />

Nominal in<br />

British pounds<br />

unless specified<br />

Amount<br />

sold<br />

03/07/2009 34,335 AUD 27,214 USD 329 0.00<br />

03/07/2009 1,223,722 BRL 607,231 USD 10,362 0.13<br />

03/07/2009 300,686 CHF 278,676 USD (1,331) (0.02)<br />

03/07/2009 41,823,445 CLP 78,424 USD 186 0.00<br />

03/07/2009 2,810,005,690 COP 1,342,023 USD (20,722) (0.26)<br />

03/07/2009 401,233 CZK 21,437 USD 120 0.00<br />

03/07/2009 18,751 GBP 30,650 USD 140 0.00<br />

03/07/2009 229,215,911 HUF 1,130,654 USD 29,787 0.37<br />

03/07/2009 6,457,206,029 IDR 615,955 USD 10,029 0.13<br />

03/07/2009 91,196,908 JPY 957,736 USD (7,610) (0.10)<br />

03/07/2009 5,637,268 MXN 423,695 USD 2,593 0.03<br />

03/07/2009 2,941,179 NZD 1,860,224 USD 27,307 0.34<br />

03/07/2009 236,945,184 PHP 4,873,734 USD 29,966 0.38<br />

03/07/2009 23,545 PLN 7,273 USD 75 0.00<br />

03/07/2009 39,661,919 RUB 1,256,321 USD 9,671 0.12<br />

03/07/2009 63,358 SGD 43,525 USD 152 0.00<br />

03/07/2009 3,894,801 TRY 2,465,688 USD 41,920 0.53<br />

03/07/2009 2,162,882 USD 2,756,704 AUD (39,842) (0.50)<br />

03/07/2009 8,671 USD 9,943 CAD 67 0.00<br />

03/07/2009 1,381,937 USD 1,593,587 CAD 5,917 0.07<br />

03/07/2009 1,700,592 USD 901,143,639 CLP 2,580 0.03<br />

03/07/2009 264,212 USD 168,352 EUR 17,045 0.21<br />

03/07/2009 764,796 USD 549,117 EUR (3,296) (0.04)<br />

03/07/2009 715,053 USD 439,846 GBP (5,651) (0.07)<br />

03/07/2009 5,568,114 USD 3,385,820 GBP (4,745) (0.06)<br />

03/07/2009 489,539 USD 1,948,636 ILS (4,473) (0.06)<br />

03/07/2009 35,576 USD 45,729,722 KRW (195) 0.00<br />

03/07/2009 2,858 USD 37,995 MXN (16) 0.00<br />

03/07/2009 71,836 USD 469,525 NOK (673) (0.01)<br />

03/07/2009 18,250 USD 118,563 NOK (103) 0.00<br />

03/07/2009 749,267 USD 2,445,981 PLN (11,604) (0.15)<br />

03/07/2009 683,144 USD 5,470,261 SEK (13,899) (0.17)<br />

03/07/2009 2,939,499 USD 4,286,083 SGD (13,240) (0.17)<br />

03/07/2009 44,994 USD 70,684 TRY (611) (0.01)<br />

03/07/2009 4,901,104 USD 161,328,018 TWD (11,176) (0.14)<br />

03/07/2009 6,423,120 ZAR 779,355 USD 31,702 0.40<br />

Total Forward Foreign Currency Exchange Contracts 80,761 0.98<br />

Other Assets less Liabilities 7,367,594 92.74<br />

Total Net Asset Value 7,947,634 100.00<br />

(3) Variable coupon rates are those quoted as of 30 June 2009.<br />

Market<br />

value<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of net<br />

assets<br />

% of net<br />

assets