Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

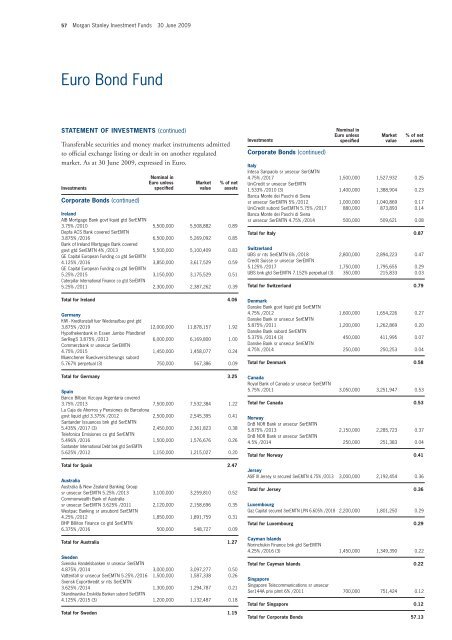

57 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

Euro Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

Ireland<br />

AIB Mortgage Bank govt liquid gtd SerEMTN<br />

3.75% /2010 5,500,000 5,508,882 0.89<br />

Depfa ACS Bank covered SerEMTN<br />

3.875% /2016 6,500,000 5,269,092 0.85<br />

Bank of Ireland Mortgage Bank covered<br />

govt gtd SerEMTN 4% /2013 5,500,000 5,100,409 0.83<br />

GE Capital European Funding co gtd SerEMTN<br />

4.125% /2016 3,850,000 3,617,529 0.59<br />

GE Capital European Funding co gtd SerEMTN<br />

5.25% /2015 3,150,000 3,175,529 0.51<br />

Caterpillar International Finance co gtd SerEMTN<br />

5.25% /2011 2,300,000 2,387,262 0.39<br />

Total for Ireland 4.06<br />

Germany<br />

KfW - Kreditanstalt fuer Wiederaufbau govt gtd<br />

3.875% /2019 12,000,000 11,878,157 1.92<br />

Hypothekenbank in Essen Jumbo Pfandbrief<br />

SerRegS 3.875% /2013 6,000,000 6,169,800 1.00<br />

Commerzbank sr unsecur SerEMTN<br />

4.75% /2015 1,450,000 1,458,077 0.24<br />

Muenchener Rueckversicherungs subord<br />

5.767% perpetual (3) 750,000 567,386 0.09<br />

Total for Germany 3.25<br />

Spain<br />

Banco Bilbao Vizcaya Argentaria covered<br />

3.75% /2013 7,500,000 7,532,384 1.22<br />

La Caja de Ahorros y Pensiones de Barcelona<br />

govt liquid gtd 3.375% /2012 2,500,000 2,545,395 0.41<br />

Santander Issuances bnk gtd SerEMTN<br />

5.435% /2017 (3) 2,450,000 2,361,823 0.38<br />

Telefonica Emisiones co gtd SerEMTN<br />

5.496% /2016 1,500,000 1,576,676 0.26<br />

Santander International Debt bnk gtd SerEMTN<br />

5.625% /2012 1,150,000 1,215,027 0.20<br />

Total for Spain 2.47<br />

Australia<br />

Australia & New Zealand Banking Group<br />

sr unsecur SerEMTN 5.25% /2013 3,100,000 3,259,810 0.52<br />

Commonwealth Bank of Australia<br />

sr unsecur SerEMTN 3.625% /2011 2,120,000 2,158,696 0.35<br />

Westpac Banking sr unsubord SerEMTN<br />

4.25% /2012 1,850,000 1,891,759 0.31<br />

BHP Billiton Finance co gtd SerEMTN<br />

6.375% /2016 500,000 548,727 0.09<br />

Total for Australia 1.27<br />

Sweden<br />

Svenska Handelsbanken sr unsecur SerEMTN<br />

4.875% /2014 3,000,000 3,097,277 0.50<br />

Vattenfall sr unsecur SerEMTN 5.25% /2016 1,500,000 1,587,338 0.26<br />

Svensk Exportkredit sr nts SerEMTN<br />

3.625% /2014 1,300,000 1,294,787 0.21<br />

Skandinaviska Enskilda Banken subord SerEMTN<br />

4.125% /2015 (3) 1,200,000 1,132,487 0.18<br />

Total for Sweden 1.15<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

Italy<br />

Intesa Sanpaolo sr unsecur SerGMTN<br />

4.75% /2017 1,500,000 1,527,932 0.25<br />

UniCredit sr unsecur SerEMTN<br />

1.533% /2010 (3) 1,400,000 1,388,904 0.23<br />

Banca Monte dei Paschi di Siena<br />

sr unsecur SerEMTN 5% /2012 1,000,000 1,040,869 0.17<br />

UniCredit subord SerEMTN 5.75% /2017 880,000 873,893 0.14<br />

Banca Monte dei Paschi di Siena<br />

sr unsecur SerEMTN 4.75% /2014 500,000 509,621 0.08<br />

Total for Italy 0.87<br />

Switzerland<br />

UBS sr nts SerEMTN 6% /2018 2,800,000 2,894,223 0.47<br />

Credit Suisse sr unsecur SerEMTN<br />

5.125% /2017 1,750,000 1,795,655 0.29<br />

UBS bnk gtd SerEMTN 7.152% perpetual (3) 350,000 215,833 0.03<br />

Total for Switzerland 0.79<br />

Denmark<br />

Danske Bank govt liquid gtd SerEMTN<br />

4.75% /2012 1,600,000 1,654,226 0.27<br />

Danske Bank sr unsecur SerEMTN<br />

5.875% /2011 1,200,000 1,262,869 0.20<br />

Danske Bank subord SerEMTN<br />

5.375% /2014 (3) 450,000 411,995 0.07<br />

Danske Bank sr unsecur SerEMTN<br />

4.75% /2014 250,000 250,253 0.04<br />

Total for Denmark 0.58<br />

Canada<br />

Royal Bank of Canada sr unsecur SerEMTN<br />

5.75% /2011 3,050,000 3,251,947 0.53<br />

Total for Canada 0.53<br />

Norway<br />

DnB NOR Bank sr unsecur SerEMTN<br />

5.875% /2013 2,150,000 2,285,723 0.37<br />

DnB NOR Bank sr unsecur SerEMTN<br />

4.5% /2014 250,000 251,383 0.04<br />

Total for Norway 0.41<br />

Jersey<br />

ASIF III Jersey sr secured SerEMTN 4.75% /2013 3,000,000 2,192,454 0.36<br />

Total for Jersey 0.36<br />

Luxembourg<br />

Gaz Capital secured SerEMTN LPN 6.605% /2018 2,200,000 1,801,250 0.29<br />

Total for Luxembourg 0.29<br />

Cayman Islands<br />

Norinchukin Finance bnk gtd SerEMTN<br />

4.25% /2016 (3) 1,450,000 1,349,390 0.22<br />

Total for Cayman Islands 0.22<br />

Singapore<br />

Singapore Telecommunications sr unsecur<br />

Ser144A priv plmt 6% /2011 700,000 751,424 0.12<br />

Total for Singapore 0.12<br />

Total for Corporate Bonds 57.13