Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

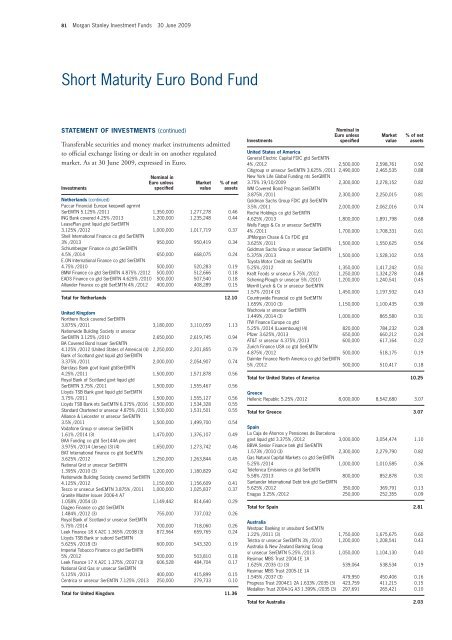

81 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

Short Maturity Euro Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

Netherlands (continued)<br />

Paccar Financial Europe keepwell agrmnt<br />

SerEMTN 5.125% /2011 1,350,000 1,277,278 0.46<br />

ING Bank covered 4.25% /2013 1,200,000 1,235,248 0.44<br />

LeasePlan govt liquid gtd SerEMTN<br />

3.125% /2012 1,000,000 1,017,719 0.37<br />

Shell International Finance co gtd SerEMTN<br />

3% /2013 950,000 950,419 0.34<br />

Schlumberger Finance co gtd SerEMTN<br />

4.5% /2014 650,000 668,075 0.24<br />

E.ON International Finance co gtd SerEMTN<br />

4.75% /2010 500,000 520,283 0.19<br />

BMW Finance co gtd SerEMTN 4.875% /2012 500,000 512,666 0.18<br />

EADS Finance co gtd SerEMTN 4.625% /2010 500,000 507,540 0.18<br />

Alliander Finance co gtd SerEMTN 4% /2012 400,000 408,289 0.15<br />

Total for Netherlands 12.10<br />

United Kingdom<br />

Northern Rock covered SerEMTN<br />

3.875% /2011 3,180,000 3,110,059 1.13<br />

Nationwide Building Society sr unsecur<br />

SerEMTN 3.125% /2010 2,650,000 2,619,745 0.94<br />

BA Covered Bond Issuer SerEMTN<br />

4.125% /2012 (United States of America) (4) 2,250,000 2,201,855 0.79<br />

Bank of Scotland govt liquid gtd SerEMTN<br />

3.375% /2011 2,000,000 2,054,907 0.74<br />

Barclays Bank govt liquid gtdSerEMTN<br />

4.25% /2011 1,500,000 1,571,878 0.56<br />

Royal Bank of Scotland govt liquid gtd<br />

SerEMTN 3.75% /2011 1,500,000 1,555,467 0.56<br />

Lloyds TSB Bank govt liquid gtd SerEMTN<br />

3.75% /2011 1,500,000 1,555,127 0.56<br />

Lloyds TSB Bank nts SerEMTN 6.375% /2016 1,500,000 1,534,328 0.55<br />

Standard Chartered sr unsecur 4.875% /2011 1,500,000 1,531,501 0.55<br />

Alliance & Leicester sr unsecur SerEMTN<br />

3.5% /2011 1,500,000 1,499,700 0.54<br />

Vodafone Group sr unsecur SerEMTN<br />

1.61% /2014 (3) 1,470,000 1,376,107 0.49<br />

BAA Funding co gtd Ser144A priv plmt<br />

3.975% /2014 (Jersey) (3) (4) 1,650,000 1,273,742 0.46<br />

BAT International Finance co gtd SerEMTN<br />

3.625% /2012 1,250,000 1,263,844 0.45<br />

National Grid sr unsecur SerEMTN<br />

1.395% /2010 (3) 1,200,000 1,180,829 0.42<br />

Nationwide Building Society covered SerEMTN<br />

4.125% /2012 1,150,000 1,156,609 0.41<br />

Tesco sr unsecur SerEMTN 3.875% /2011 1,000,000 1,025,837 0.37<br />

Granite Master Issuer 2006-4 A7<br />

1.058% /2054 (3) 1,149,442 814,640 0.29<br />

Diageo Finance co gtd SerEMTN<br />

1.484% /2012 (3) 755,000 737,032 0.26<br />

Royal Bank of Scotland sr unsecur SerEMTN<br />

5.75% /2014 700,000 718,060 0.26<br />

Leek Finance 18 X A2C 1.365% /2038 (3) 872,964 659,765 0.24<br />

Lloyds TSB Bank sr subord SerEMTN<br />

5.625% /2018 (3) 600,000 543,320 0.19<br />

Imperial Tobacco Finance co gtd SerEMTN<br />

5% /2012 500,000 503,810 0.18<br />

Leek Finance 17 X A2C 1.375% /2037 (3) 606,528 484,704 0.17<br />

National Grid Gas sr unsecur SerEMTN<br />

5.125% /2013 400,000 415,899 0.15<br />

Centrica sr unsecur SerEMTN 7.125% /2013 250,000 279,733 0.10<br />

Total for United Kingdom 11.36<br />

<strong>Investment</strong>s<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America<br />

General Electric Capital FDIC gtd SerEMTN<br />

4% /2012 2,500,000 2,598,761 0.92<br />

Citigroup sr unsecur SerEMTN 3.625% /2011 2,490,000 2,465,535 0.88<br />

New York Life Global Funding nts SerGMTN<br />

3.75% 19/10/2009 2,300,000 2,278,152 0.82<br />

WM Covered Bond Program SerEMTN<br />

3.875% /2011 2,300,000 2,250,015 0.81<br />

Goldman Sachs Group FDIC gtd SerEMTN<br />

3.5% /2011 2,000,000 2,062,016 0.74<br />

Roche Holdings co gtd SerEMTN<br />

4.625% /2013 1,800,000 1,891,798 0.68<br />

Wells Fargo & Co sr unsecur SerEMTN<br />

4% /2011 1,700,000 1,708,331 0.61<br />

JP<strong>Morgan</strong> Chase & Co FDIC gtd<br />

3.625% /2011 1,500,000 1,550,625 0.56<br />

Goldman Sachs Group sr unsecur SerEMTN<br />

5.375% /2013 1,500,000 1,528,102 0.55<br />

Toyota Motor Credit nts SerEMTN<br />

5.25% /2012 1,350,000 1,417,242 0.51<br />

Kraft Foods sr unsecur 5.75% /2012 1,250,000 1,324,278 0.48<br />

Schering-Plough sr unsecur 5% /2010 1,200,000 1,240,541 0.45<br />

Merrill Lynch & Co sr unsecur SerEMTN<br />

1.57% /2014 (3) 1,450,000 1,197,932 0.43<br />

Countrywide Financial co gtd SerEMTN<br />

1.659% /2010 (3) 1,150,000 1,100,435 0.39<br />

Wachovia sr unsecur SerEMTN<br />

1.449% /2014 (3) 1,000,000 865,580 0.31<br />

ITW Finance Europe co gtd<br />

5.25% /2014 (Luxembourg) (4) 820,000 784,232 0.28<br />

Pfizer 3.625% /2013 650,000 660,212 0.24<br />

AT&T sr unsecur 4.375% /2013 600,000 617,164 0.22<br />

Zurich Finance USA co gtd SerEMTN<br />

4.875% /2012 500,000 518,175 0.19<br />

Daimler Finance North America co gtd SerEMTN<br />

5% /2012 500,000 510,417 0.18<br />

Total for United States of America 10.25<br />

Greece<br />

Hellenic Republic 5.25% /2012 8,000,000 8,542,680 3.07<br />

Total for Greece 3.07<br />

Spain<br />

La Caja de Ahorros y Pensiones de Barcelona<br />

govt liquid gtd 3.375% /2012 3,000,000 3,054,474 1.10<br />

BBVA Senior Finance bnk gtd SerEMTN<br />

1.573% /2010 (3) 2,300,000 2,279,790 0.82<br />

Gas Natural Capital Markets co gtd SerEMTN<br />

5.25% /2014 1,000,000 1,010,585 0.36<br />

Telefonica Emisiones co gtd SerEMTN<br />

5.58% /2013 800,000 852,878 0.31<br />

Santander International Debt bnk gtd SerEMTN<br />

5.625% /2012 350,000 369,791 0.13<br />

Enagas 3.25% /2012 250,000 252,355 0.09<br />

Total for Spain 2.81<br />

Australia<br />

Westpac Banking sr unsubord SerEMTN<br />

1.22% /2011 (3) 1,750,000 1,675,675 0.60<br />

Telstra sr unsecur SerEMTN 3% /2010 1,200,000 1,208,541 0.43<br />

Australia & New Zealand Banking Group<br />

sr unsecur SerEMTN 5.25% /2013 1,050,000 1,104,130 0.40<br />

Resimac MBS Trust 2004-1E 1A<br />

1.625% /2035 (1) (3) 539,064 538,534 0.19<br />

Resimac MBS Trust 2005-1E 1A<br />

1.545% /2037 (3) 479,950 450,406 0.16<br />

Progress Trust 2004-E1 2A 1.633% /2035 (3) 423,759 411,215 0.15<br />

Medallion Trust 2004-1G A3 1.399% /2035 (3) 297,691 265,421 0.10<br />

Total for Australia 2.03