Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

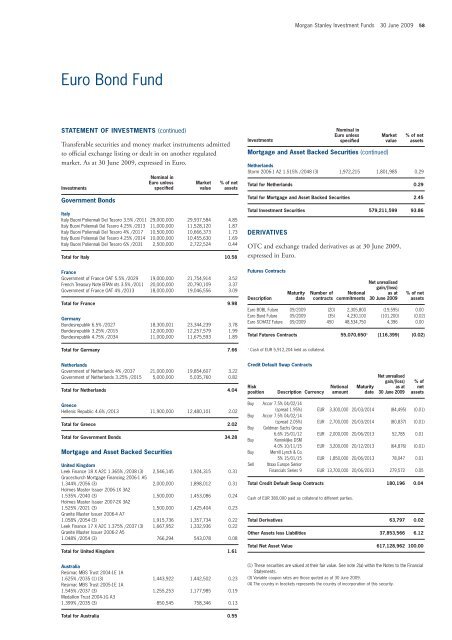

Euro Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s<br />

Government Bonds<br />

Nominal in<br />

Euro unless<br />

specified<br />

Italy<br />

Italy Buoni Poliennali Del Tesoro 3.5% /2011 29,000,000 29,937,584 4.85<br />

Italy Buoni Poliennali Del Tesoro 4.25% /2013 11,000,000 11,528,120 1.87<br />

Italy Buoni Poliennali Del Tesoro 4% /2017 10,500,000 10,666,373 1.73<br />

Italy Buoni Poliennali Del Tesoro 4.25% /2014 10,000,000 10,455,630 1.69<br />

Italy Buoni Poliennali Del Tesoro 6% /2031 2,500,000 2,722,524 0.44<br />

Total for Italy 10.58<br />

France<br />

Government of France OAT 5.5% /2029 19,000,000 21,754,914 3.52<br />

French Treasury Note BTAN nts 3.5% /2011 20,000,000 20,790,109 3.37<br />

Government of France OAT 4% /2013 18,000,000 19,046,556 3.09<br />

Total for France 9.98<br />

Germany<br />

Bundesrepublik 6.5% /2027 18,300,001 23,344,239 3.78<br />

Bundesrepublik 3.25% /2015 12,000,000 12,257,579 1.99<br />

Bundesrepublik 4.75% /2034 11,000,000 11,675,593 1.89<br />

Total for Germany 7.66<br />

Netherlands<br />

Government of Netherlands 4% /2037 21,000,000 19,854,607 3.22<br />

Government of Netherlands 3.25% /2015 5,000,000 5,035,760 0.82<br />

Total for Netherlands 4.04<br />

Greece<br />

Hellenic Republic 4.6% /2013 11,900,000 12,480,101 2.02<br />

Total for Greece 2.02<br />

Total for Government Bonds 34.28<br />

Mortgage and Asset Backed Securities<br />

Market<br />

value<br />

% of net<br />

assets<br />

United Kingdom<br />

Leek Finance 18 X A2C 1.365% /2038 (3) 2,546,145 1,924,315 0.31<br />

Gracechurch Mortgage Financing 2006-1 A5<br />

1.344% /2056 (3) 2,000,000 1,898,012 0.31<br />

Holmes Master Issuer 2006-1X 3A2<br />

1.535% /2040 (3) 1,500,000 1,453,086 0.24<br />

Holmes Master Issuer 2007-2X 3A2<br />

1.525% /2021 (3) 1,500,000 1,425,404 0.23<br />

Granite Master Issuer 2006-4 A7<br />

1.058% /2054 (3) 1,915,736 1,357,734 0.22<br />

Leek Finance 17 X A2C 1.375% /2037 (3) 1,667,952 1,332,936 0.22<br />

Granite Master Issuer 2006-2 A5<br />

1.048% /2054 (3) 766,294 543,078 0.08<br />

Total for United Kingdom 1.61<br />

Australia<br />

Resimac MBS Trust 2004-1E 1A<br />

1.625% /2035 (1) (3) 1,443,922 1,442,502 0.23<br />

Resimac MBS Trust 2005-1E 1A<br />

1.545% /2037 (3) 1,255,253 1,177,985 0.19<br />

Medallion Trust 2004-1G A3<br />

1.399% /2035 (3) 850,545 758,346 0.13<br />

Total for Australia 0.55<br />

<strong>Investment</strong>s<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 58<br />

Mortgage and Asset Backed Securities (continued)<br />

Netherlands<br />

Storm 2006-1 A2 1.515% /2048 (3) 1,972,215 1,801,985 0.29<br />

Total for Netherlands 0.29<br />

Total for Mortgage and Asset Backed Securities 2.45<br />

Total <strong>Investment</strong> Securities 579,211,599 93.86<br />

DERIVATIVES<br />

OTC and exchange traded derivatives as at 30 June 2009,<br />

expressed in Euro.<br />

Futures Contracts<br />

Description<br />

Euro BOBL Future 09/2009 (20) 2,305,800 (19,595) 0.00<br />

Euro Bund Future 09/2009 (35) 4,230,100 (101,200) (0.02)<br />

Euro SCHATZ Future 09/2009 450 48,534,750 4,396 0.00<br />

Total Futures Contracts 55,070,650 1 (116,399) (0.02)<br />

1 Cash of EUR 5,912,204 held as collateral.<br />

Credit Default Swap Contracts<br />

Risk<br />

position<br />

Maturity<br />

date<br />

Description Currency<br />

Nominal in<br />

Euro unless<br />

specified<br />

Number of Notional<br />

contracts commitments<br />

Notional<br />

amount<br />

Buy Accor 7.5% 04/02/14<br />

(spread 1.95%) EUR 3,300,000 20/03/2014 (84,495) (0.01)<br />

Buy Accor 7.5% 04/02/14<br />

(spread 2.05%) EUR 2,700,000 20/03/2014 (80,837) (0.01)<br />

Buy Goldman Sachs Group<br />

6.6% 15/01/12 EUR 2,000,000 20/06/2013 52,785 0.01<br />

Buy Koninklijke DSM<br />

4.0% 10/11/15 EUR 3,200,000 20/12/2013 (64,876) (0.01)<br />

Buy Merrill Lynch & Co<br />

5% 15/01/15 EUR 1,850,000 20/06/2013 78,047 0.01<br />

Sell Itraxx Europe Senior<br />

Financials Series 9 EUR 13,700,000 20/06/2013 279,572 0.05<br />

Total Credit Default Swap Contracts 180,196 0.04<br />

Cash of EUR 380,000 paid as collateral to different parties.<br />

Maturity<br />

date<br />

Market<br />

value<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of net<br />

assets<br />

% of net<br />

assets<br />

% of<br />

net<br />

assets<br />

Total Derivatives 63,797 0.02<br />

Other Assets less Liabilities 37,853,566 6.12<br />

Total Net Asset Value 617,128,962 100.00<br />

(1) These securities are valued at their fair value. See note 2(a) within the Notes to the Financial<br />

Statements.<br />

(3) Variable coupon rates are those quoted as of 30 June 2009.<br />

(4) The country in brackets represents the country of incorporation of this security.