Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

53 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

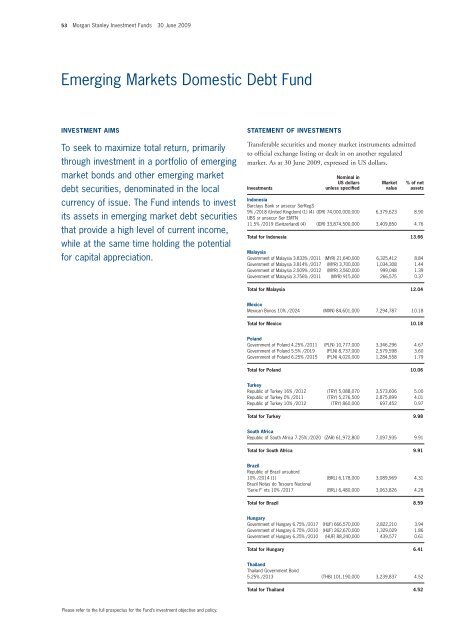

Emerging Markets Domestic Debt Fund<br />

INVESTMENT AIMS<br />

To seek to maximize total return, primarily<br />

through investment in a portfolio of emerging<br />

market bonds and other emerging market<br />

debt securities, denominated in the local<br />

currency of issue. The Fund intends to invest<br />

its assets in emerging market debt securities<br />

that provide a high level of current income,<br />

while at the same time holding the potential<br />

for capital appreciation.<br />

Please refer to the full prospectus for the Fund’s investment objective and policy.<br />

STATEMENT OF INVESTMENTS<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s<br />

Nominal in<br />

US dollars<br />

unless specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

Indonesia<br />

Barclays Bank sr unsecur SerRegS<br />

9% /2018 (United Kingdom) (1) (4) (IDR) 74,000,000,000 6,379,623 8.90<br />

UBS sr unsecur Ser EMTN<br />

11.5% /2019 (Switzerland) (4) (IDR) 33,874,500,000 3,409,850 4.76<br />

Total for Indonesia 13.66<br />

Malaysia<br />

Government of Malaysia 3.833% /2011 (MYR) 21,640,000 6,325,412 8.84<br />

Government of Malaysia 3.814% /2017 (MYR) 3,700,000 1,034,308 1.44<br />

Government of Malaysia 2.509% /2012 (MYR) 3,560,000 999,048 1.39<br />

Government of Malaysia 3.756% /2011 (MYR) 915,000 266,575 0.37<br />

Total for Malaysia 12.04<br />

Mexico<br />

Mexican Bonos 10% /2024 (MXN) 84,601,000 7,294,787 10.18<br />

Total for Mexico 10.18<br />

Poland<br />

Government of Poland 4.25% /2011 (PLN) 10,777,000 3,346,296 4.67<br />

Government of Poland 5.5% /2019 (PLN) 8,737,000 2,579,598 3.60<br />

Government of Poland 6.25% /2015 (PLN) 4,020,000 1,284,558 1.79<br />

Total for Poland 10.06<br />

Turkey<br />

Republic of Turkey 16% /2012 (TRY) 5,088,070 3,573,606 5.00<br />

Republic of Turkey 0% /2011 (TRY) 5,276,500 2,875,899 4.01<br />

Republic pf Turkey 10% /2012 (TRY) 860,000 697,452 0.97<br />

Total for Turkey 9.98<br />

South Africa<br />

Republic of South Africa 7.25% /2020 (ZAR) 61,972,800 7,097,935 9.91<br />

Total for South Africa 9.91<br />

Brazil<br />

Republic of Brazil unsubord<br />

10% /2014 (1) (BRL) 6,178,000 3,089,969 4.31<br />

Brazil Notas do Tesouro Nacional<br />

‘Serie F’ nts 10% /2017 (BRL) 6,480,000 3,063,826 4.28<br />

Total for Brazil 8.59<br />

Hungary<br />

Government of Hungary 6.75% /2017 (HUF) 666,570,000 2,822,210 3.94<br />

Government of Hungary 6.75% /2010 (HUF) 262,670,000 1,329,029 1.86<br />

Government of Hungary 6.25% /2010 (HUF) 88,240,000 439,577 0.61<br />

Total for Hungary 6.41<br />

Thailand<br />

Thailand Government Bond<br />

5.25% /2013 (THB) 101,190,000 3,239,837 4.52<br />

Total for Thailand 4.52