81 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 Short Maturity Euro Bond Fund STATEMENT OF INVESTMENTS (continued) Transferable securities and money market instruments admitted to official exchange listing or dealt in on another regulated market. As at 30 June 2009, expressed in Euro. <strong>Investment</strong>s Nominal in Euro unless specified Market value % of net assets Netherlands (continued) Paccar Financial Europe keepwell agrmnt SerEMTN 5.125% /2011 1,350,000 1,277,278 0.46 ING Bank covered 4.25% /2013 1,200,000 1,235,248 0.44 LeasePlan govt liquid gtd SerEMTN 3.125% /2012 1,000,000 1,017,719 0.37 Shell International Finance co gtd SerEMTN 3% /2013 950,000 950,419 0.34 Schlumberger Finance co gtd SerEMTN 4.5% /2014 650,000 668,075 0.24 E.ON International Finance co gtd SerEMTN 4.75% /2010 500,000 520,283 0.19 BMW Finance co gtd SerEMTN 4.875% /2012 500,000 512,666 0.18 EADS Finance co gtd SerEMTN 4.625% /2010 500,000 507,540 0.18 Alliander Finance co gtd SerEMTN 4% /2012 400,000 408,289 0.15 Total for Netherlands 12.10 United Kingdom Northern Rock covered SerEMTN 3.875% /2011 3,180,000 3,110,059 1.13 Nationwide Building Society sr unsecur SerEMTN 3.125% /2010 2,650,000 2,619,745 0.94 BA Covered Bond Issuer SerEMTN 4.125% /2012 (United States of America) (4) 2,250,000 2,201,855 0.79 Bank of Scotland govt liquid gtd SerEMTN 3.375% /2011 2,000,000 2,054,907 0.74 Barclays Bank govt liquid gtdSerEMTN 4.25% /2011 1,500,000 1,571,878 0.56 Royal Bank of Scotland govt liquid gtd SerEMTN 3.75% /2011 1,500,000 1,555,467 0.56 Lloyds TSB Bank govt liquid gtd SerEMTN 3.75% /2011 1,500,000 1,555,127 0.56 Lloyds TSB Bank nts SerEMTN 6.375% /2016 1,500,000 1,534,328 0.55 Standard Chartered sr unsecur 4.875% /2011 1,500,000 1,531,501 0.55 Alliance & Leicester sr unsecur SerEMTN 3.5% /2011 1,500,000 1,499,700 0.54 Vodafone Group sr unsecur SerEMTN 1.61% /2014 (3) 1,470,000 1,376,107 0.49 BAA Funding co gtd Ser144A priv plmt 3.975% /2014 (Jersey) (3) (4) 1,650,000 1,273,742 0.46 BAT International Finance co gtd SerEMTN 3.625% /2012 1,250,000 1,263,844 0.45 National Grid sr unsecur SerEMTN 1.395% /2010 (3) 1,200,000 1,180,829 0.42 Nationwide Building Society covered SerEMTN 4.125% /2012 1,150,000 1,156,609 0.41 Tesco sr unsecur SerEMTN 3.875% /2011 1,000,000 1,025,837 0.37 Granite Master Issuer 2006-4 A7 1.058% /2054 (3) 1,149,442 814,640 0.29 Diageo Finance co gtd SerEMTN 1.484% /2012 (3) 755,000 737,032 0.26 Royal Bank of Scotland sr unsecur SerEMTN 5.75% /2014 700,000 718,060 0.26 Leek Finance 18 X A2C 1.365% /2038 (3) 872,964 659,765 0.24 Lloyds TSB Bank sr subord SerEMTN 5.625% /2018 (3) 600,000 543,320 0.19 Imperial Tobacco Finance co gtd SerEMTN 5% /2012 500,000 503,810 0.18 Leek Finance 17 X A2C 1.375% /2037 (3) 606,528 484,704 0.17 National Grid Gas sr unsecur SerEMTN 5.125% /2013 400,000 415,899 0.15 Centrica sr unsecur SerEMTN 7.125% /2013 250,000 279,733 0.10 Total for United Kingdom 11.36 <strong>Investment</strong>s Nominal in Euro unless specified Market value % of net assets United States of America General Electric Capital FDIC gtd SerEMTN 4% /2012 2,500,000 2,598,761 0.92 Citigroup sr unsecur SerEMTN 3.625% /2011 2,490,000 2,465,535 0.88 New York Life Global Funding nts SerGMTN 3.75% 19/10/2009 2,300,000 2,278,152 0.82 WM Covered Bond Program SerEMTN 3.875% /2011 2,300,000 2,250,015 0.81 Goldman Sachs Group FDIC gtd SerEMTN 3.5% /2011 2,000,000 2,062,016 0.74 Roche Holdings co gtd SerEMTN 4.625% /2013 1,800,000 1,891,798 0.68 Wells Fargo & Co sr unsecur SerEMTN 4% /2011 1,700,000 1,708,331 0.61 JP<strong>Morgan</strong> Chase & Co FDIC gtd 3.625% /2011 1,500,000 1,550,625 0.56 Goldman Sachs Group sr unsecur SerEMTN 5.375% /2013 1,500,000 1,528,102 0.55 Toyota Motor Credit nts SerEMTN 5.25% /2012 1,350,000 1,417,242 0.51 Kraft Foods sr unsecur 5.75% /2012 1,250,000 1,324,278 0.48 Schering-Plough sr unsecur 5% /2010 1,200,000 1,240,541 0.45 Merrill Lynch & Co sr unsecur SerEMTN 1.57% /2014 (3) 1,450,000 1,197,932 0.43 Countrywide Financial co gtd SerEMTN 1.659% /2010 (3) 1,150,000 1,100,435 0.39 Wachovia sr unsecur SerEMTN 1.449% /2014 (3) 1,000,000 865,580 0.31 ITW Finance Europe co gtd 5.25% /2014 (Luxembourg) (4) 820,000 784,232 0.28 Pfizer 3.625% /2013 650,000 660,212 0.24 AT&T sr unsecur 4.375% /2013 600,000 617,164 0.22 Zurich Finance USA co gtd SerEMTN 4.875% /2012 500,000 518,175 0.19 Daimler Finance North America co gtd SerEMTN 5% /2012 500,000 510,417 0.18 Total for United States of America 10.25 Greece Hellenic Republic 5.25% /2012 8,000,000 8,542,680 3.07 Total for Greece 3.07 Spain La Caja de Ahorros y Pensiones de Barcelona govt liquid gtd 3.375% /2012 3,000,000 3,054,474 1.10 BBVA Senior Finance bnk gtd SerEMTN 1.573% /2010 (3) 2,300,000 2,279,790 0.82 Gas Natural Capital Markets co gtd SerEMTN 5.25% /2014 1,000,000 1,010,585 0.36 Telefonica Emisiones co gtd SerEMTN 5.58% /2013 800,000 852,878 0.31 Santander International Debt bnk gtd SerEMTN 5.625% /2012 350,000 369,791 0.13 Enagas 3.25% /2012 250,000 252,355 0.09 Total for Spain 2.81 Australia Westpac Banking sr unsubord SerEMTN 1.22% /2011 (3) 1,750,000 1,675,675 0.60 Telstra sr unsecur SerEMTN 3% /2010 1,200,000 1,208,541 0.43 Australia & New Zealand Banking Group sr unsecur SerEMTN 5.25% /2013 1,050,000 1,104,130 0.40 Resimac MBS Trust 2004-1E 1A 1.625% /2035 (1) (3) 539,064 538,534 0.19 Resimac MBS Trust 2005-1E 1A 1.545% /2037 (3) 479,950 450,406 0.16 Progress Trust 2004-E1 2A 1.633% /2035 (3) 423,759 411,215 0.15 Medallion Trust 2004-1G A3 1.399% /2035 (3) 297,691 265,421 0.10 Total for Australia 2.03

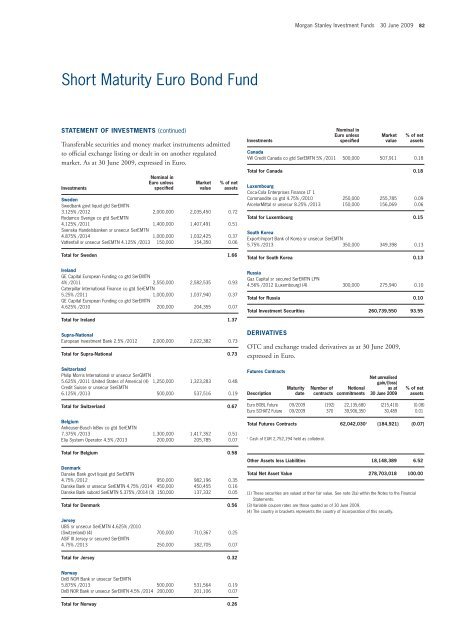

Short Maturity Euro Bond Fund STATEMENT OF INVESTMENTS (continued) Transferable securities and money market instruments admitted to official exchange listing or dealt in on another regulated market. As at 30 June 2009, expressed in Euro. <strong>Investment</strong>s Nominal in Euro unless specified Market value % of net assets Sweden Swedbank govt liquid gtd SerEMTN 3.125% /2012 2,000,000 2,035,450 0.72 Rodamco Sverige co gtd SerEMTN 4.125% /2011 1,400,000 1,407,491 0.51 Svenska Handelsbanken sr unsecur SerEMTN 4.875% /2014 1,000,000 1,032,425 0.37 Vattenfall sr unsecur SerEMTN 4.125% /2013 150,000 154,350 0.06 Total for Sweden 1.66 Ireland GE Capital European Funding co gtd SerEMTN 4% /2011 2,550,000 2,582,535 0.93 Caterpillar International Finance co gtd SerEMTN 5.25% /2011 1,000,000 1,037,940 0.37 GE Capital European Funding co gtd SerEMTN 4.625% /2010 200,000 204,355 0.07 Total for Ireland 1.37 Supra-National European <strong>Investment</strong> Bank 2.5% /2012 2,000,000 2,022,382 0.73 Total for Supra-National 0.73 Switzerland Philip Morris International sr unsecur SerGMTN 5.625% /2011 (United States of America) (4) 1,250,000 1,323,283 0.48 Credit Suisse sr unsecur SerEMTN 6.125% /2013 500,000 537,516 0.19 Total for Switzerland 0.67 Belgium Anheuser-Busch InBev co gtd SerEMTN 7.375% /2013 1,300,000 1,417,352 0.51 Elia System Operator 4.5% /2013 200,000 205,785 0.07 Total for Belgium 0.58 Denmark Danske Bank govt liquid gtd SerEMTN 4.75% /2012 950,000 982,196 0.35 Danske Bank sr unsecur SerEMTN 4.75% /2014 450,000 450,455 0.16 Danske Bank subord SerEMTN 5.375% /2014 (3) 150,000 137,332 0.05 Total for Denmark 0.56 Jersey UBS sr unsecur SerEMTN 4.625% /2010 (Switzerland) (4) 700,000 710,367 0.25 ASIF III Jersey sr secured SerEMTN 4.75% /2013 250,000 182,705 0.07 Total for Jersey 0.32 Norway DnB NOR Bank sr unsecur SerEMTN 5.875% /2013 500,000 531,564 0.19 DnB NOR Bank sr unsecur SerEMTN 4.5% /2014 200,000 201,106 0.07 Total for Norway 0.26 <strong>Investment</strong>s <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 82 Canada VW Credit Canada co gtd SerEMTN 5% /2011 500,000 507,911 0.18 Total for Canada 0.18 Luxembourg Coca-Cola Enterprises Finance LT 1 Commandite co gtd 4.75% /2010 250,000 255,785 0.09 ArcelorMittal sr unsecur 8.25% /2013 150,000 156,069 0.06 Total for Luxembourg 0.15 South Korea Export-Import Bank of Korea sr unsecur SerEMTN 5.75% /2013 350,000 349,398 0.13 Total for South Korea 0.13 Russia Gaz Capital sr secured SerEMTN LPN 4.56% /2012 (Luxembourg) (4) 300,000 275,940 0.10 Total for Russia 0.10 Total <strong>Investment</strong> Securities 260,739,550 93.55 DERIVATIVES OTC and exchange traded derivatives as at 30 June 2009, expressed in Euro. Futures Contracts Description Maturity date Number of contracts Euro BOBL Future 09/2009 (192) 22,135,680 (215,410) (0.08) Euro SCHATZ Future 09/2009 370 39,906,350 30,489 0.01 Total Futures Contracts 62,042,030 1 (184,921) (0.07) 1 Cash of EUR 2,752,194 held as collateral. Nominal in Euro unless specified Notional commitments Market value Net unrealised gain/(loss) as at 30 June 2009 % of net assets % of net assets Other Assets less Liabilities 18,148,389 6.52 Total Net Asset Value 278,703,018 100.00 (1) These securities are valued at their fair value. See note 2(a) within the Notes to the Financial Statements. (3) Variable coupon rates are those quoted as of 30 June 2009. (4) The country in brackets represents the country of incorporation of this security.