Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

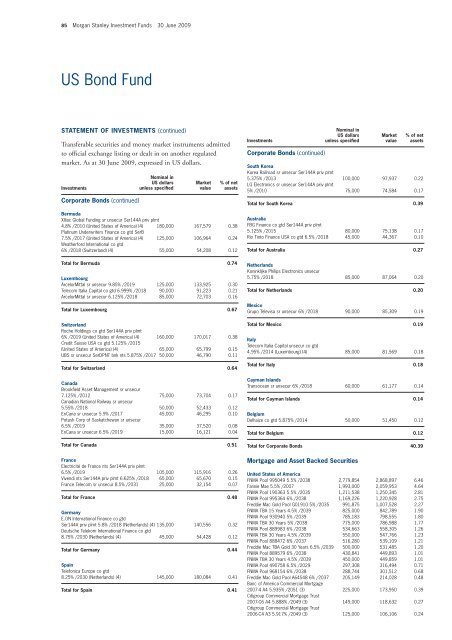

85 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

US Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

Nominal in<br />

US dollars<br />

unless specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

Bermuda<br />

Xlliac Global Funding sr unsecur Ser144A priv plmt<br />

4.8% /2010 (United States of America) (4) 180,000 167,579 0.38<br />

Platinum Underwriters Finance co gtd SerB<br />

7.5% /2017 (United States of America) (4) 125,000 106,964 0.24<br />

Weatherford International co gtd<br />

6% /2018 (Switzerland) (4) 55,000 54,208 0.12<br />

Total for Bermuda 0.74<br />

Luxembourg<br />

ArcelorMittal sr unsecur 9.85% /2019 125,000 133,925 0.30<br />

Telecom Italia Capital co gtd 6.999% /2018 90,000 91,223 0.21<br />

ArcelorMittal sr unsecur 6.125% /2018 85,000 72,703 0.16<br />

Total for Luxembourg 0.67<br />

Switzerland<br />

Roche Holdings co gtd Ser144A priv plmt<br />

6% /2019 (United States of America) (4) 160,000 170,017 0.38<br />

Credit Suisse USA co gtd 5.125% /2015<br />

(United States of America) (4) 65,000 65,799 0.15<br />

UBS sr unsecur SerDPNT bnk nts 5.875% /2017 50,000 46,790 0.11<br />

Total for Switzerland 0.64<br />

Canada<br />

Brookfield Asset Management sr unsecur<br />

7.125% /2012 75,000 73,704 0.17<br />

Canadian National Railway sr unsecur<br />

5.55% /2018 50,000 52,433 0.12<br />

EnCana sr unsecur 5.9% /2017 45,000 46,295 0.10<br />

Potash Corp of Saskatchewan sr unsecur<br />

6.5% /2019 35,000 37,520 0.08<br />

EnCana sr unsecur 6.5% /2019 15,000 16,121 0.04<br />

Total for Canada 0.51<br />

France<br />

Electricité de France nts Ser144A priv plmt<br />

6.5% /2019 105,000 115,916 0.26<br />

Vivendi nts Ser144A priv plmt 6.625% /2018 65,000 65,670 0.15<br />

France Telecom sr unsecur 8.5% /2031 25,000 32,154 0.07<br />

Total for France 0.48<br />

Germany<br />

E.ON International Finance co gtd<br />

Ser144A priv plmt 5.8% /2018 (Netherlands) (4) 135,000 140,556 0.32<br />

Deutsche Telekom International Finance co gtd<br />

8.75% /2030 (Netherlands) (4) 45,000 54,428 0.12<br />

Total for Germany 0.44<br />

Spain<br />

Telefonica Europe co gtd<br />

8.25% /2030 (Netherlands) (4) 145,000 180,084 0.41<br />

Total for Spain 0.41<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

Nominal in<br />

US dollars<br />

unless specified<br />

South Korea<br />

Korea Railroad sr unsecur Ser144A priv plmt<br />

5.375% /2013 100,000 97,937 0.22<br />

LG Electronics sr unsecur Ser144A priv plmt<br />

5% /2010 75,000 74,584 0.17<br />

Total for South Korea 0.39<br />

Australia<br />

FBG Finance co gtd Ser144A priv plmt<br />

5.125% /2015 80,000 75,138 0.17<br />

Rio Tinto Finance USA co gtd 6.5% /2018 45,000 44,367 0.10<br />

Total for Australia 0.27<br />

Netherlands<br />

Koninklijke Philips Electronics unsecur<br />

5.75% /2018 85,000 87,064 0.20<br />

Total for Netherlands 0.20<br />

Mexico<br />

Grupo Televisa sr unsecur 6% /2018 90,000 85,309 0.19<br />

Total for Mexico 0.19<br />

Italy<br />

Telecom Italia Capital unsecur co gtd<br />

4.95% /2014 (Luxembourg) (4) 85,000 81,569 0.18<br />

Total for Italy 0.18<br />

Cayman Islands<br />

Transocean sr unsecur 6% /2018 60,000 61,177 0.14<br />

Total for Cayman Islands 0.14<br />

Belgium<br />

Delhaize co gtd 5.875% /2014 50,000 51,450 0.12<br />

Total for Belgium 0.12<br />

Total for Corporate Bonds 40.39<br />

Mortgage and Asset Backed Securities<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America<br />

FNMA Pool 995049 5.5% /2038 2,779,854 2,868,897 6.46<br />

Fannie Mae 5.5% /2007 1,993,000 2,059,953 4.64<br />

FNMA Pool 190363 5.5% /2035 1,211,538 1,250,345 2.81<br />

FNMA Pool 995364 6% /2038 1,169,226 1,220,928 2.75<br />

Freddie Mac Gold Pool G01910 5% /2035 991,875 1,007,528 2.27<br />

FNMA TBA 15 Years 4.5% /2039 825,000 842,789 1.90<br />

FNMA Pool 930940 5% /2039 785,183 798,555 1.80<br />

FNMA TBA 30 Years 5% /2038 775,000 786,988 1.77<br />

FNMA Pool 889983 6% /2038 534,663 558,305 1.26<br />

FNMA TBA 30 Years 4.5% /2039 550,000 547,766 1.23<br />

FNMA Pool 888472 6% /2037 516,280 539,109 1.21<br />

Freddie Mac TBA Gold 30 Years 6.5% /2039 500,000 531,485 1.20<br />

FNMA Pool 889579 6% /2038 430,841 449,893 1.01<br />

FNMA TBA 30 Years 4.5% /2039 450,000 449,859 1.01<br />

FNMA Pool 490758 6.5% /2029 297,308 316,494 0.71<br />

FNMA Pool 968154 6% /2038 288,744 301,512 0.68<br />

Freddie Mac Gold Pool A64548 6% /2037 205,149 214,028 0.48<br />

Banc of America Commercial Mortgage<br />

2007-4 A4 5.935% /2051 (3) 225,000 173,950 0.39<br />

Citigroup Commercial Mortgage Trust<br />

2007-C6 A4 5.888% /2049 (3) 149,000 118,632 0.27<br />

Citigroup Commercial Mortgage Trust<br />

2006-C4 A3 5.917% /2049 (3) 125,000 106,106 0.24