Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

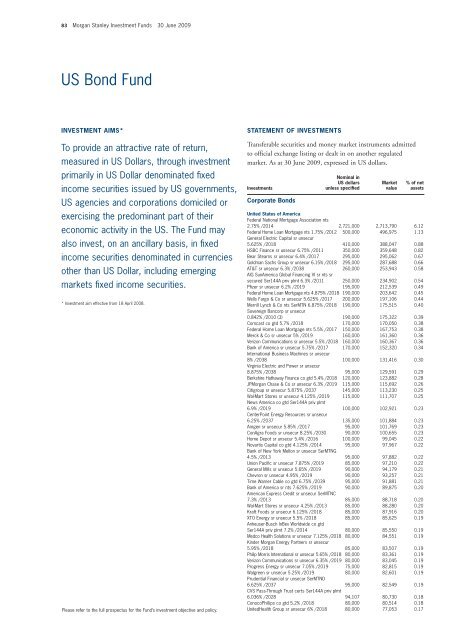

83 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

US Bond Fund<br />

INVESTMENT AIMS*<br />

To provide an attractive rate of return,<br />

measured in US Dollars, through investment<br />

primarily in US Dollar denominated fixed<br />

income securities issued by US governments,<br />

US agencies and corporations domiciled or<br />

exercising the predominant part of their<br />

economic activity in the US. The Fund may<br />

also invest, on an ancillary basis, in fixed<br />

income securities denominated in currencies<br />

other than US Dollar, including emerging<br />

markets fixed income securities.<br />

* <strong>Investment</strong> aim effective from 18 April 2008.<br />

Please refer to the full prospectus for the Fund’s investment objective and policy.<br />

STATEMENT OF INVESTMENTS<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s<br />

Corporate Bonds<br />

Nominal in<br />

US dollars<br />

unless specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America<br />

Federal National Mortgage Association nts<br />

2.75% /2014 2,721,000 2,713,790 6.12<br />

Federal Home Loan Mortgage nts 1.75% /2012 500,000 496,975 1.13<br />

General Electric Capital sr unsecur<br />

5.625% /2018 410,000 388,047 0.88<br />

HSBC Finance sr unsecur 6.75% /2011 350,000 359,648 0.82<br />

Bear Stearns sr unsecur 6.4% /2017 295,000 295,062 0.67<br />

Goldman Sachs Group sr unsecur 6.15% /2018 295,000 287,688 0.66<br />

AT&T sr unsecur 6.3% /2038 260,000 253,943 0.58<br />

AIG SunAmerica Global Financing VI sr nts sr<br />

secured Ser144A priv plmt 6.3% /2011 250,000 234,902 0.54<br />

Pfizer sr unsecur 6.2% /2019 195,000 212,539 0.49<br />

Federal Home Loan Mortgage nts 4.875% /2018 190,000 203,642 0.45<br />

Wells Fargo & Co sr unsecur 5.625% /2017 200,000 197,106 0.44<br />

Merrill Lynch & Co nts SerMTN 6.875% /2018 190,000 175,515 0.40<br />

Sovereign Bancorp sr unsecur<br />

0.842% /2010 (3) 190,000 175,322 0.39<br />

Comcast co gtd 5.7% /2018 170,000 170,050 0.38<br />

Federal Home Loan Mortgage nts 5.5% /2017 150,000 167,753 0.38<br />

Merck & Co sr unsecur 5% /2019 160,000 161,360 0.36<br />

Verizon Communications sr unsecur 5.5% /2018 160,000 160,367 0.36<br />

Bank of America sr unsecur 5.75% /2017 170,000 152,320 0.34<br />

International Business Machines sr unsecur<br />

8% /2038 100,000 131,416 0.30<br />

Virginia Electric and Power sr unsecur<br />

8.875% /2038 95,000 129,591 0.29<br />

Berkshire Hathaway Finance co gtd 5.4% /2018 120,000 123,882 0.28<br />

JP<strong>Morgan</strong> Chase & Co sr unsecur 6.3% /2019 115,000 115,692 0.26<br />

Citigroup sr unsecur 5.875% /2037 145,000 113,230 0.25<br />

Wal-Mart Stores sr unsecur 4.125% /2019 115,000 111,707 0.25<br />

News America co gtd Ser144A priv plmt<br />

6.9% /2019 100,000 102,921 0.23<br />

CenterPoint Energy Resources sr unsecur<br />

6.25% /2037 135,000 101,884 0.23<br />

Amgen sr unsecur 5.85% /2017 95,000 101,769 0.23<br />

ConAgra Foods sr unsecur 8.25% /2030 90,000 100,655 0.23<br />

Home Depot sr unsecur 5.4% /2016 100,000 99,045 0.22<br />

Novartis Capital co gtd 4.125% /2014 95,000 97,967 0.22<br />

Bank of New York Mellon sr unsecur SerMTNG<br />

4.5% /2013 95,000 97,882 0.22<br />

Union Pacific sr unsecur 7.875% /2019 85,000 97,210 0.22<br />

General Mills sr unsecur 5.65% /2019 90,000 94,179 0.21<br />

Chevron sr unsecur 4.95% /2019 90,000 93,257 0.21<br />

Time Warner Cable co gtd 6.75% /2039 95,000 91,881 0.21<br />

Bank of America sr nts 7.625% /2019 90,000 89,875 0.20<br />

American Express Credit sr unsecur SerMTNC<br />

7.3% /2013 85,000 88,718 0.20<br />

Wal-Mart Stores sr unsecur 4.25% /2013 85,000 88,280 0.20<br />

Kraft Foods sr unsecur 6.125% /2018 85,000 87,916 0.20<br />

XTO Energy sr unsecur 5.5% /2018 85,000 85,625 0.19<br />

Anheuser-Busch InBev Worldwide co gtd<br />

Ser144A priv plmt 7.2% /2014 80,000 85,550 0.19<br />

Medco Health Solutions sr unsecur 7.125% /2018 80,000 84,551 0.19<br />

Kinder <strong>Morgan</strong> Energy Partners sr unsecur<br />

5.95% /2018 85,000 83,507 0.19<br />

Philip Morris International sr unsecur 5.65% /2018 80,000 83,361 0.19<br />

Verizon Communications sr unsecur 6.35% /2019 80,000 83,045 0.19<br />

Progress Energy sr unsecur 7.05% /2019 75,000 82,815 0.19<br />

Walgreen sr unsecur 5.25% /2019 80,000 82,601 0.19<br />

Prudential Financial sr unsecur SerMTND<br />

6.625% /2037 95,000 82,549 0.19<br />

CVS Pass-Through Trust certs Ser144A priv plmt<br />

6.036% /2028 94,107 80,730 0.18<br />

ConocoPhillips co gtd 5.2% /2018 80,000 80,514 0.18<br />

UnitedHealth Group sr unsecur 6% /2018 80,000 77,053 0.17