Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

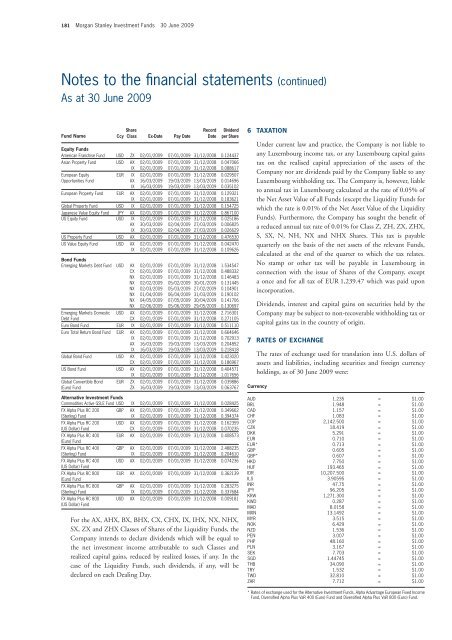

181 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

Notes to the financial statements (continued)<br />

As at 30 June 2009<br />

Fund Name<br />

Share<br />

Ccy<br />

Class<br />

Ex-Date<br />

Pay Date<br />

Record<br />

Date<br />

Dividend<br />

per Share<br />

Equity <strong>Funds</strong><br />

American Franchise Fund USD ZX 02/01/2009 07/01/2009 31/12/2008 0.124437<br />

Asian Property Fund USD AX 02/01/2009 07/01/2009 31/12/2008 0.047066<br />

IX 02/01/2009 07/01/2009 31/12/2008 0.088617<br />

European Equity EUR IX 02/01/2009 07/01/2009 31/12/2008 0.029507<br />

Opportunities Fund AX 16/03/2009 19/03/2009 13/03/2009 0.014696<br />

IX 16/03/2009 19/03/2009 13/03/2009 0.035102<br />

European Property Fund EUR AX 02/01/2009 07/01/2009 31/12/2008 0.129321<br />

IX 02/01/2009 07/01/2009 31/12/2008 0.183621<br />

Global Property Fund USD IX 02/01/2009 07/01/2009 31/12/2008 0.154725<br />

Japanese Value Equity Fund JPY AX 02/01/2009 07/01/2009 31/12/2008 0.867100<br />

US Equity Fund USD IX 02/01/2009 07/01/2009 31/12/2008 0.025186<br />

AX 30/03/2009 02/04/2009 27/03/2009 0.006825<br />

IX 30/03/2009 02/04/2009 27/03/2009 0.026629<br />

US Property Fund USD AX 02/01/2009 07/01/2009 31/12/2008 0.476530<br />

US Value Equity Fund USD AX 02/01/2009 07/01/2009 31/12/2008 0.042470<br />

IX 02/01/2009 07/01/2009 31/12/2008 0.109626<br />

Bond <strong>Funds</strong><br />

Emerging Markets Debt Fund USD AX 02/01/2009 07/01/2009 31/12/2008 1.534547<br />

CX 02/01/2009 07/01/2009 31/12/2008 0.488332<br />

NX 02/01/2009 07/01/2009 31/12/2008 0.146483<br />

NX 02/02/2009 05/02/2009 30/01/2009 0.131445<br />

NX 02/03/2009 05/03/2009 27/02/2009 0.104901<br />

NX 01/04/2009 06/04/2009 31/03/2009 0.190102<br />

NX 04/05/2009 07/05/2009 30/04/2009 0.141706<br />

NX 02/06/2009 05/06/2009 29/05/2009 0.130697<br />

Emerging Markets Domestic USD AX 02/01/2009 07/01/2009 31/12/2008 2.716301<br />

Debt Fund CX 02/01/2009 07/01/2009 31/12/2008 0.271105<br />

Euro Bond Fund EUR IX 02/01/2009 07/01/2009 31/12/2008 0.511110<br />

Euro Total Return Bond Fund EUR AX 02/01/2009 07/01/2009 31/12/2008 0.664646<br />

IX 02/01/2009 07/01/2009 31/12/2008 0.702913<br />

AX 16/03/2009 19/03/2009 13/03/2009 0.204852<br />

IX 16/03/2009 19/03/2009 13/03/2009 0.218418<br />

Global Bond Fund USD AX 02/01/2009 07/01/2009 31/12/2008 0.423020<br />

CX 02/01/2009 07/01/2009 31/12/2008 0.186967<br />

US Bond Fund USD AX 02/01/2009 07/01/2009 31/12/2008 0.404571<br />

IX 02/01/2009 07/01/2009 31/12/2008 1.017656<br />

Global Convertible Bond EUR ZX 02/01/2009 07/01/2009 31/12/2008 0.039886<br />

(Euro) Fund ZX 16/03/2009 19/03/2009 13/03/2009 0.063767<br />

Alternative <strong>Investment</strong> <strong>Funds</strong><br />

Commodities Active GSLE Fund USD IX 02/01/2009 07/01/2009 31/12/2008 0.028425<br />

FX Alpha Plus RC 200 GBP AX 02/01/2009 07/01/2009 31/12/2008 0.349662<br />

(Sterling) Fund IX 02/01/2009 07/01/2009 31/12/2008 0.394374<br />

FX Alpha Plus RC 200 USD AX 02/01/2009 07/01/2009 31/12/2008 0.162359<br />

(US Dollar) Fund CX 02/01/2009 07/01/2009 31/12/2008 0.070235<br />

FX Alpha Plus RC 400<br />

(Euro) Fund<br />

EUR AX 02/01/2009 07/01/2009 31/12/2008 0.408573<br />

FX Alpha Plus RC 400 GBP AX 02/01/2009 07/01/2009 31/12/2008 2.488235<br />

(Sterling) Fund IX 02/01/2009 07/01/2009 31/12/2008 0.204610<br />

FX Alpha Plus RC 400<br />

(US Dollar) Fund<br />

USD AX 02/01/2009 07/01/2009 31/12/2008 0.074236<br />

FX Alpha Plus RC 800<br />

(Euro) Fund<br />

EUR AX 02/01/2009 07/01/2009 31/12/2008 0.362139<br />

FX Alpha Plus RC 800 GBP AX 02/01/2009 07/01/2009 31/12/2008 0.283275<br />

(Sterling) Fund IX 02/01/2009 07/01/2009 31/12/2008 0.337684<br />

FX Alpha Plus RC 800<br />

(US Dollar) Fund<br />

USD AX 02/01/2009 07/01/2009 31/12/2008 0.009181<br />

For the AX, AHX, BX, BHX, CX, CHX, IX, IHX, NX, NHX,<br />

SX, ZX and ZHX Classes of Shares of the Liquidity <strong>Funds</strong>, the<br />

Company intends to declare dividends which will be equal to<br />

the net investment income attributable to such Classes and<br />

realized capital gains, reduced by realized losses, if any. In the<br />

case of the Liquidity <strong>Funds</strong>, such dividends, if any, will be<br />

declared on each Dealing Day.<br />

6 TAXATION<br />

Under current law and practice, the Company is not liable to<br />

any Luxembourg income tax, or any Luxembourg capital gains<br />

tax on the realised capital appreciation of the assets of the<br />

Company nor are dividends paid by the Company liable to any<br />

Luxembourg withholding tax. The Company is, however, liable<br />

to annual tax in Luxembourg calculated at the rate of 0.05% of<br />

the Net Asset Value of all <strong>Funds</strong> (except the Liquidity <strong>Funds</strong> for<br />

which the rate is 0.01% of the Net Asset Value of the Liquidity<br />

<strong>Funds</strong>). Furthermore, the Company has sought the benefit of<br />

a reduced annual tax rate of 0.01% for Class Z, ZH, ZX, ZHX,<br />

S, SX, N, NH, NX and NHX Shares. This tax is payable<br />

quarterly on the basis of the net assets of the relevant <strong>Funds</strong>,<br />

calculated at the end of the quarter to which the tax relates.<br />

No stamp or other tax will be payable in Luxembourg in<br />

connection with the issue of Shares of the Company, except<br />

a once and for all tax of EUR 1,239.47 which was paid upon<br />

incorporation.<br />

Dividends, interest and capital gains on securities held by the<br />

Company may be subject to non-recoverable withholding tax or<br />

capital gains tax in the country of origin.<br />

7 RATES OF EXCHANGE<br />

The rates of exchange used for translation into U.S. dollars of<br />

assets and liabilities, including securities and foreign currency<br />

holdings, as of 30 June 2009 were:<br />

Currency<br />

AUD 1.235 = $1.00<br />

BRL 1.948 = $1.00<br />

CAD 1.157 = $1.00<br />

CHF 1.083 = $1.00<br />

COP 2,142.500 = $1.00<br />

CZK 18.419 = $1.00<br />

DKK 5.291 = $1.00<br />

EUR 0.710 = $1.00<br />

EUR* 0.713 = $1.00<br />

GBP 0.605 = $1.00<br />

GBP* 0.607 = $1.00<br />

HKD 7.750 = $1.00<br />

HUF 193.465 = $1.00<br />

IDR 10,207.500 = $1.00<br />

ILS 3.90595 = $1.00<br />

INR 47.75 = $1.00<br />

JPY 96.205 = $1.00<br />

KRW 1,271.300 = $1.00<br />

KWD 0.287 = $1.00<br />

MAD 8.0158 = $1.00<br />

MXN 13.1492 = $1.00<br />

MYR 3.515 = $1.00<br />

NOK 6.429 = $1.00<br />

NZD 1.536 = $1.00<br />

PEN 3.007 = $1.00<br />

PHP 48.160 = $1.00<br />

PLN 3.167 = $1.00<br />

SEK 7.703 = $1.00<br />

SGD 1.44745 = $1.00<br />

THB 34.090 = $1.00<br />

TRY 1.532 = $1.00<br />

TWD 32.810 = $1.00<br />

ZAR 7.712 = $1.00<br />

* Rates of exchange used for the Alternative <strong>Investment</strong> <strong>Funds</strong>, Alpha Advantage European Fixed Income<br />

Fund, Diversified Alpha Plus VaR 400 (Euro) Fund and Diversified Alpha Plus VaR 800 (Euro) Fund.