Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

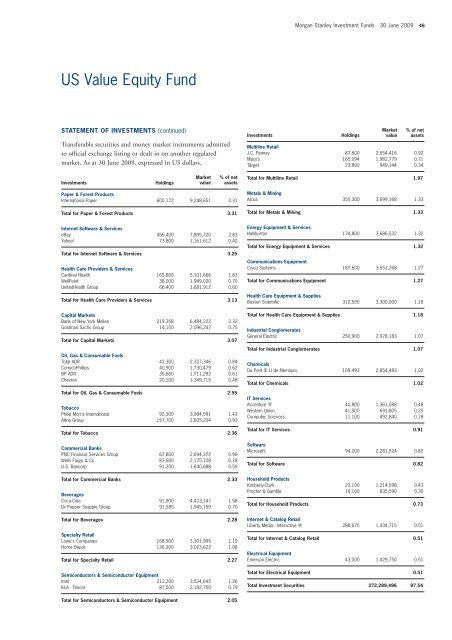

US Value Equity Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s Holdings<br />

Market<br />

value<br />

% of net<br />

assets<br />

Paper & Forest Products<br />

International Paper 600,172 9,248,651 3.31<br />

Total for Paper & Forest Products 3.31<br />

Internet Software & Services<br />

eBay 456,400 7,895,720 2.83<br />

Yahoo! 73,800 1,161,612 0.42<br />

Total for Internet Software & Services 3.25<br />

Health Care Providers & Services<br />

Cardinal Health 165,800 5,101,666 1.83<br />

WellPoint 38,000 1,949,020 0.70<br />

UnitedHealth Group 66,400 1,681,912 0.60<br />

Total for Health Care Providers & Services 3.13<br />

Capital Markets<br />

Bank of New York Mellon 219,358 6,484,222 2.32<br />

Goldman Sachs Group 14,100 2,096,247 0.75<br />

Total for Capital Markets 3.07<br />

Oil, Gas & Consumable Fuels<br />

Total ADR 42,300 2,327,346 0.84<br />

ConocoPhillips 40,900 1,730,479 0.62<br />

BP ADR 35,600 1,711,292 0.61<br />

Chevron 20,100 1,349,715 0.48<br />

Total for Oil, Gas & Consumable Fuels 2.55<br />

Tobacco<br />

Philip Morris International 92,300 3,984,591 1.43<br />

Altria Group 157,700 2,605,204 0.93<br />

Total for Tobacco 2.36<br />

Commercial Banks<br />

PNC Financial Services Group 67,800 2,694,372 0.96<br />

Wells Fargo & Co 87,600 2,175,108 0.78<br />

U.S. Bancorp 91,200 1,640,688 0.59<br />

Total for Commercial Banks 2.33<br />

Beverages<br />

Coca-Cola 91,900 4,423,147 1.58<br />

Dr Pepper Snapple Group 91,580 1,945,159 0.70<br />

Total for Beverages 2.28<br />

Specialty Retail<br />

Lowe's Companies 168,900 3,301,995 1.19<br />

Home Depot 126,300 3,023,622 1.08<br />

Total for Specialty Retail 2.27<br />

Semiconductors & Semiconductor Equipment<br />

Intel 212,200 3,524,642 1.26<br />

KLA - Tencor 87,500 2,192,750 0.79<br />

Total for Semiconductors & Semiconductor Equipment 2.05<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 46<br />

<strong>Investment</strong>s Holdings<br />

Market<br />

value<br />

% of net<br />

assets<br />

Multiline Retail<br />

J.C. Penney 87,600 2,554,416 0.92<br />

Macy’s 165,094 1,982,779 0.71<br />

Target 23,800 949,144 0.34<br />

Total for Multiline Retail 1.97<br />

Metals & Mining<br />

Alcoa 350,300 3,699,168 1.33<br />

Total for Metals & Mining 1.33<br />

Energy Equipment & Services<br />

Halliburton 174,800 3,686,532 1.32<br />

Total for Energy Equipment & Services 1.32<br />

Communications Equipment<br />

Cisco Systems 187,600 3,551,268 1.27<br />

Total for Communications Equipment 1.27<br />

Health Care Equipment & Supplies<br />

Boston Scientific 312,500 3,300,000 1.18<br />

Total for Health Care Equipment & Supplies 1.18<br />

Industrial Conglomerates<br />

General Electric 250,900 2,978,183 1.07<br />

Total for Industrial Conglomerates 1.07<br />

Chemicals<br />

Du Pont (E.I.) de Nemours 109,493 2,854,483 1.02<br />

Total for Chemicals 1.02<br />

IT Services<br />

Accenture ‘A’ 40,800 1,361,088 0.48<br />

Western Union 41,500 691,805 0.25<br />

Computer Sciences 11,100 492,840 0.18<br />

Total for IT Services 0.91<br />

Software<br />

Microsoft 94,200 2,281,524 0.82<br />

Total for Software 0.82<br />

Household Products<br />

Kimberly-Clark 23,100 1,214,598 0.43<br />

Procter & Gamble 16,100 835,590 0.30<br />

Total for Household Products 0.73<br />

Internet & Catalog Retail<br />

Liberty Media - Interactive ‘A’ 288,675 1,434,715 0.51<br />

Total for Internet & Catalog Retail 0.51<br />

Electrical Equipment<br />

Emerson Electric 43,000 1,429,750 0.51<br />

Total for Electrical Equipment 0.51<br />

Total <strong>Investment</strong> Securities 272,289,496 97.54