Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

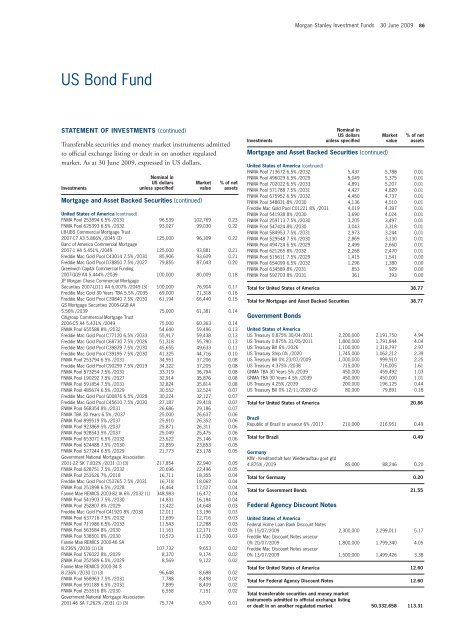

US Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s<br />

Nominal in<br />

US dollars<br />

unless specified<br />

Mortgage and Asset Backed Securities (continued)<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America (continued)<br />

FNMA Pool 253894 6.5% /2031 96,539 102,769 0.23<br />

FNMA Pool 625393 6.5% /2032 93,027 99,030 0.22<br />

LB-UBS Commercial Mortgage Trust<br />

2007-C7 A3 5.866% /2045 (3) 125,000 96,309 0.22<br />

Banc of America Commercial Mortgage<br />

2007-1 A4 5.451% /2049 125,000 93,881 0.21<br />

Freddie Mac Gold Pool C43014 7.5% /2030 85,906 93,609 0.21<br />

Freddie Mac Gold Pool D78850 7.5% /2027 79,855 87,043 0.20<br />

Greenwich Capital Commercial Funding<br />

2007-GG9 A4 5.444% /2039 100,000 80,009 0.18<br />

JP <strong>Morgan</strong> Chase Commercial Mortgage<br />

Securities 2007-LD11 A4 6.007% /2049 (3) 100,000 76,904 0.17<br />

Freddie Mac Gold 30 Years TBA 5.5% /2035 69,000 71,318 0.16<br />

Freddie Mac Gold Pool C39840 7.5% /2030 61,194 66,440 0.15<br />

GS Mortgage Securities 2006-GG8 A4<br />

5.56% /2039 75,000 61,381 0.14<br />

Citigroup Commercial Mortgage Trust<br />

2006-C5 A4 5.431% /2049 75,000 60,363 0.14<br />

FNMA Pool 655588 8% /2032 54,640 59,496 0.13<br />

Freddie Mac Gold Pool C77120 6.5% /2033 55,917 59,438 0.13<br />

Freddie Mac Gold Pool C68730 7.5% /2026 51,318 55,790 0.13<br />

Freddie Mac Gold Pool C39839 7.5% /2030 45,655 49,633 0.11<br />

Freddie Mac Gold Pool C39195 7.5% /2030 41,325 44,716 0.10<br />

FNMA Pool 253794 6.5% /2031 34,951 37,206 0.08<br />

Freddie Mac Gold Pool C90299 7.5% /2019 34,322 37,205 0.08<br />

FNMA Pool 573254 7.5% /2031 33,719 36,794 0.08<br />

FNMA Pool 190292 7.5% /2027 32,914 35,876 0.08<br />

FNMA Pool 591854 7.5% /2031 32,824 35,814 0.08<br />

FNMA Pool 485674 6.5% /2029 30,552 32,524 0.07<br />

Freddie Mac Gold Pool G00876 6.5% /2028 30,224 32,127 0.07<br />

Freddie Mac Gold Pool C45610 7.5% /2030 27,187 29,418 0.07<br />

FNMA Pool 568354 8% /2031 26,686 29,186 0.07<br />

FNMA TBA 30 Years 6.5% /2037 25,000 26,637 0.06<br />

FNMA Pool 899519 5% /2037 25,910 26,352 0.06<br />

FNMA Pool 923869 5% /2037 25,871 26,311 0.06<br />

FNMA Pool 928543 5% /2037 25,049 25,475 0.06<br />

FNMA Pool 653071 6.5% /2032 23,622 25,146 0.06<br />

FNMA Pool 524488 7.5% /2030 21,859 23,853 0.05<br />

FNMA Pool 527244 6.5% /2029 21,773 23,178 0.05<br />

Government National Mortgage Association<br />

2001-22 SK 7.832% /2031 (1) (3) 217,854 22,940 0.05<br />

FNMA Pool 628751 7.5% /2032 20,696 22,496 0.05<br />

FNMA Pool 251626 7% /2018 16,711 18,355 0.04<br />

Freddie Mac Gold Pool C53765 7.5% /2031 16,718 18,062 0.04<br />

FNMA Pool 251898 6.5% /2028 16,464 17,527 0.04<br />

Fannie Mae REMICS 2003-82 IA 6% /2032 (1) 348,983 16,472 0.04<br />

FNMA Pool 541903 7.5% /2030 14,831 16,184 0.04<br />

FNMA Pool 252807 8% /2029 13,422 14,648 0.03<br />

Freddie Mac Gold Pool C41920 8% /2030 12,011 13,196 0.03<br />

FNMA Pool 637716 7.5% /2032 11,699 12,716 0.03<br />

FNMA Pool 711986 6.5% /2033 11,543 12,288 0.03<br />

FNMA Pool 563584 8% /2030 11,161 12,171 0.03<br />

FNMA Pool 538501 8% /2030 10,573 11,530 0.03<br />

Fannie Mae REMICS 2000-46 SA<br />

8.236% /2030 (1) (3) 107,732 9,653 0.02<br />

FNMA Pool 576022 8% /2029 8,370 9,174 0.02<br />

FNMA Pool 252589 6.5% /2029 8,569 9,122 0.02<br />

Fannie Mae REMICS 2000-34 S<br />

8.236% /2030 (1) (3) 96,648 8,698 0.02<br />

FNMA Pool 568963 7.5% /2031 7,788 8,498 0.02<br />

FNMA Pool 591189 6.5% /2031 7,899 8,409 0.02<br />

FNMA Pool 253516 8% /2030 6,558 7,151 0.02<br />

Government National Mortgage Association<br />

2001-46 SA 7.262% /2031 (1) (3) 75,774 6,570 0.01<br />

<strong>Investment</strong>s<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 86<br />

Mortgage and Asset Backed Securities (continued)<br />

United States of America (continued)<br />

FNMA Pool 713672 6.5% /2032 5,437 5,788 0.01<br />

FNMA Pool 496029 6.5% /2029 5,049 5,375 0.01<br />

FNMA Pool 702022 6.5% /2033 4,891 5,207 0.01<br />

FNMA Pool 571788 7.5% /2031 4,427 4,820 0.01<br />

FNMA Pool 675952 6.5% /2032 4,450 4,737 0.01<br />

FNMA Pool 548831 8% /2030 4,136 4,510 0.01<br />

Freddie Mac Gold Pool C01221 8% /2031 4,019 4,397 0.01<br />

FNMA Pool 541938 8% /2030 3,690 4,024 0.01<br />

FNMA Pool 259113 7.5% /2030 3,205 3,497 0.01<br />

FNMA Pool 547424 8% /2030 3,043 3,318 0.01<br />

FNMA Pool 584953 7.5% /2031 2,973 3,244 0.01<br />

FNMA Pool 529548 7.5% /2030 2,869 3,130 0.01<br />

FNMA Pool 494724 6.5% /2029 2,499 2,660 0.01<br />

FNMA Pool 621265 8% /2032 2,268 2,470 0.01<br />

FNMA Pool 515611 7.5% /2029 1,415 1,541 0.00<br />

FNMA Pool 654099 6.5% /2032 1,296 1,380 0.00<br />

FNMA Pool 634589 8% /2031 853 929 0.00<br />

FNMA Pool 592703 8% /2031 361 393 0.00<br />

Total for United States of America 38.77<br />

Total for Mortgage and Asset Backed Securities 38.77<br />

Government Bonds<br />

United States of America<br />

US Treasury 0.875% 30/04/2011 2,200,000 2,191,750 4.94<br />

US Treasury 0.875% 31/05/2011 1,800,000 1,791,844 4.04<br />

US Treasury Bill 6% /2026 1,100,000 1,318,797 2.97<br />

US Treasury Strip 0% /2020 1,745,000 1,062,212 2.39<br />

US Treasury Bill 0% 23/07/2009 1,000,000 999,910 2.25<br />

US Treasury 4.375% /2038 715,000 716,005 1.61<br />

GNMA TBA 30 Years 5% /2039 450,000 459,492 1.03<br />

GNMA TBA 30 Years 4.5% /2039 450,000 450,000 1.01<br />

US Treasury 4.25% /2039 200,000 196,125 0.44<br />

US Treasury Bill 0% 12/11/2009 (2) 80,000 79,891 0.18<br />

Total for United States of America 20.86<br />

Brazil<br />

Republic of Brazil sr unsecur 6% /2017 210,000 216,951 0.49<br />

Total for Brazil 0.49<br />

Germany<br />

KfW - Kreditanstalt fuer Wiederaufbau govt gtd<br />

4.875% /2019 85,000 88,246 0.20<br />

Total for Germany 0.20<br />

Total for Government Bonds 21.55<br />

Federal Agency Discount Notes<br />

Nominal in<br />

US dollars<br />

unless specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America<br />

Federal Home Loan Bank Discount Notes<br />

0% 15/07/2009 2,300,000 2,299,011 5.17<br />

Freddie Mac Discount Notes unsecur<br />

0% 20/07/2009 1,800,000 1,799,340 4.05<br />

Freddie Mac Discount Notes unsecur<br />

0% 13/07/2009 1,500,000 1,499,426 3.38<br />

Total for United States of America 12.60<br />

Total for Federal Agency Discount Notes 12.60<br />

Total transferable securities and money market<br />

instruments admitted to official exchange listing<br />

or dealt in on another regulated market 50,332,658 113.31