Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

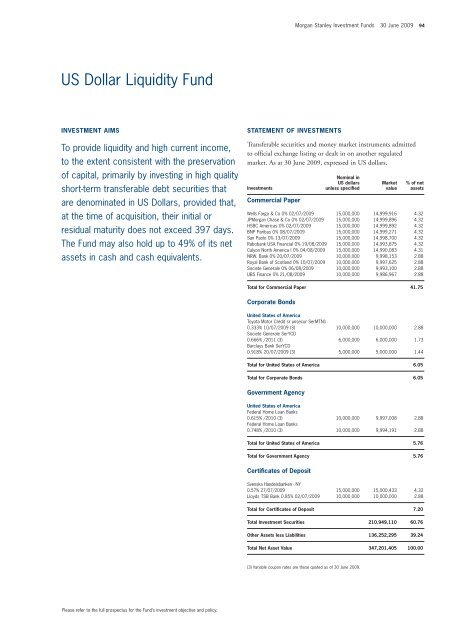

US Dollar Liquidity Fund<br />

INVESTMENT AIMS<br />

To provide liquidity and high current income,<br />

to the extent consistent with the preservation<br />

of capital, primarily by investing in high quality<br />

short-term transferable debt securities that<br />

are denominated in US Dollars, provided that,<br />

at the time of acquisition, their initial or<br />

residual maturity does not exceed 397 days.<br />

The Fund may also hold up to 49% of its net<br />

assets in cash and cash equivalents.<br />

Please refer to the full prospectus for the Fund’s investment objective and policy.<br />

Commercial Paper<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 94<br />

STATEMENT OF INVESTMENTS<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s<br />

Wells Fargo & Co 0% 02/07/2009 15,000,000 14,999,916 4.32<br />

JP<strong>Morgan</strong> Chase & Co 0% 02/07/2009 15,000,000 14,999,896 4.32<br />

HSBC Americas 0% 02/07/2009 15,000,000 14,999,892 4.32<br />

BNP Paribas 0% 08/07/2009 15,000,000 14,999,271 4.32<br />

San Paolo 0% 13/07/2009 15,000,000 14,998,700 4.32<br />

Rabobank USA Financial 0% 19/08/2009 15,000,000 14,993,875 4.32<br />

Calyon North America I 0% 04/08/2009 15,000,000 14,990,083 4.31<br />

NRW. Bank 0% 20/07/2009 10,000,000 9,998,153 2.88<br />

Royal Bank of Scotland 0% 10/07/2009 10,000,000 9,997,625 2.88<br />

Societe Generale 0% 06/08/2009 10,000,000 9,993,100 2.88<br />

UBS Finance 0% 21/08/2009 10,000,000 9,986,967 2.88<br />

Total for Commercial Paper 41.75<br />

Corporate Bonds<br />

United States of America<br />

Toyota Motor Credit sr unsecur SerMTN1<br />

0.333% 10/07/2009 (3) 10,000,000 10,000,000 2.88<br />

Societe Generale SerYCD<br />

0.666% /2011 (3) 6,000,000 6,000,000 1.73<br />

Barclays Bank SerYCD<br />

0.918% 20/07/2009 (3) 5,000,000 5,000,000 1.44<br />

Total for United States of America 6.05<br />

Total for Corporate Bonds 6.05<br />

Government Agency<br />

United States of America<br />

Federal Home Loan Banks<br />

0.615% /2010 (3) 10,000,000 9,997,008 2.88<br />

Federal Home Loan Banks<br />

0.748% /2010 (3) 10,000,000 9,994,191 2.88<br />

Total for United States of America 5.76<br />

Total for Government Agency 5.76<br />

Certificates of Deposit<br />

Nominal in<br />

US dollars<br />

unless specified<br />

Svenska Handelsbanken - NY<br />

0.57% 27/07/2009 15,000,000 15,000,433 4.32<br />

Lloyds TSB Bank 0.85% 02/07/2009 10,000,000 10,000,000 2.88<br />

Total for Certificates of Deposit 7.20<br />

Total <strong>Investment</strong> Securities 210,949,110 60.76<br />

Other Assets less Liabilities 136,252,295 39.24<br />

Total Net Asset Value 347,201,405 100.00<br />

(3) Variable coupon rates are those quoted as of 30 June 2009.<br />

Market<br />

value<br />

% of net<br />

assets