Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

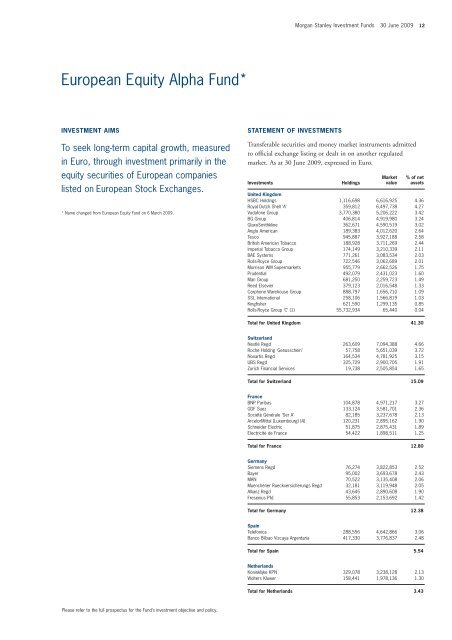

European Equity Alpha Fund*<br />

INVESTMENT AIMS<br />

To seek long-term capital growth, measured<br />

in Euro, through investment primarily in the<br />

equity securities of European companies<br />

listed on European Stock Exchanges.<br />

* Name changed from European Equity Fund on 6 March 2009.<br />

Please refer to the full prospectus for the Fund’s investment objective and policy.<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 12<br />

STATEMENT OF INVESTMENTS<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s Holdings<br />

Market<br />

value<br />

% of net<br />

assets<br />

United Kingdom<br />

HSBC Holdings 1,116,698 6,616,925 4.36<br />

Royal Dutch Shell ‘A’ 359,812 6,497,738 4.27<br />

Vodafone Group 3,770,380 5,206,222 3.42<br />

BG Group 406,814 4,919,980 3.24<br />

GlaxoSmithkline 362,671 4,590,519 3.02<br />

Anglo American 189,383 4,012,620 2.64<br />

Tesco 945,887 3,927,188 2.58<br />

British American Tobacco 188,928 3,711,269 2.44<br />

Imperial Tobacco Group 174,149 3,210,339 2.11<br />

BAE Systems 771,261 3,083,534 2.03<br />

Rolls-Royce Group 722,546 3,062,689 2.01<br />

Morrison WM Supermarkets 955,779 2,662,526 1.75<br />

Prudential 492,079 2,431,023 1.60<br />

Man Group 681,250 2,259,723 1.49<br />

Reed Elsevier 379,123 2,016,548 1.33<br />

Carphone Warehouse Group 888,797 1,656,710 1.09<br />

SSL International 258,106 1,566,819 1.03<br />

Kingfisher 621,590 1,299,135 0.85<br />

Rolls-Royce Group ‘C’ (1) 55,732,934 65,440 0.04<br />

Total for United Kingdom 41.30<br />

Switzerland<br />

Nestlé Regd 263,609 7,094,388 4.66<br />

Roche Holding ‘Genusschein’ 57,758 5,651,039 3.72<br />

Novartis Regd 164,534 4,781,925 3.15<br />

UBS Regd 325,729 2,900,705 1.91<br />

Zurich Financial Services 19,738 2,505,854 1.65<br />

Total for Switzerland 15.09<br />

France<br />

BNP Paribas 104,878 4,971,217 3.27<br />

GDF Suez 133,124 3,581,701 2.36<br />

Société Générale ‘Ser A’ 82,185 3,237,678 2.13<br />

ArcelorMittal (Luxembourg) (4) 120,231 2,895,162 1.90<br />

Schneider Electric 51,875 2,875,431 1.89<br />

Electricité de France 54,422 1,898,511 1.25<br />

Total for France 12.80<br />

Germany<br />

Siemens Regd 76,274 3,822,853 2.52<br />

Bayer 95,002 3,693,678 2.43<br />

MAN 70,522 3,135,408 2.06<br />

Muenchener Rueckversicherungs Regd 32,181 3,119,948 2.05<br />

Allianz Regd 43,645 2,890,608 1.90<br />

Fresenius Pfd 55,853 2,153,692 1.42<br />

Total for Germany 12.38<br />

Spain<br />

Telefonica 288,556 4,642,866 3.06<br />

Banco Bilbao Vizcaya Argentaria 417,330 3,776,837 2.48<br />

Total for Spain 5.54<br />

Netherlands<br />

Koninklijke KPN 329,078 3,238,128 2.13<br />

Wolters Kluwer 158,441 1,978,136 1.30<br />

Total for Netherlands 3.43