Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

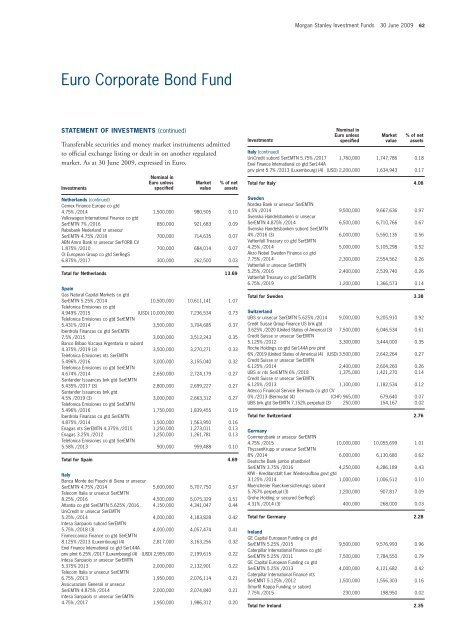

Euro Corporate Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

Netherlands (continued)<br />

Cemex Finance Europe co gtd<br />

4.75% /2014 1,500,000 980,505 0.10<br />

Volkswagen International Finance co gtd<br />

SerEMTN 7% /2016 850,000 921,683 0.09<br />

Rabobank Nederland sr unsecur<br />

SerEMTN 4.75% /2018 700,000 714,635 0.07<br />

ABN Amro Bank sr unsecur SerFORB CV<br />

1.875% /2010 700,000 684,014 0.07<br />

OI European Group co gtd SerRegS<br />

6.875% /2017 300,000 262,500 0.03<br />

Total for Netherlands 13.69<br />

Spain<br />

Gas Natural Capital Markets co gtd<br />

SerEMTN 5.25% /2014 10,500,000 10,611,141 1.07<br />

Telefonica Emisiones co gtd<br />

4.949% /2015 (USD) 10,000,000 7,236,534 0.73<br />

Telefonica Emisiones co gtd SerEMTN<br />

5.431% /2014 3,500,000 3,704,685 0.37<br />

Iberdrola Finanzas co gtd SerEMTN<br />

7.5% /2015 3,000,000 3,512,243 0.35<br />

Banco Bilbao Vizcaya Argentaria sr subord<br />

4.375% /2019 (3) 3,500,000 3,270,271 0.33<br />

Telefonica Emisiones nts SerEMTN<br />

5.496% /2016 3,000,000 3,155,040 0.32<br />

Telefonica Emisiones co gtd SerEMTN<br />

4.674% /2014 2,650,000 2,724,179 0.27<br />

Santander Issuances bnk gtd SerEMTN<br />

5.435% /2017 (3) 2,800,000 2,699,227 0.27<br />

Santander Issuances bnk gtd<br />

4.5% /2019 (3) 3,000,000 2,663,312 0.27<br />

Telefonica Emisiones co gtd SerEMTN<br />

5.496% /2016 1,750,000 1,839,455 0.19<br />

Iberdrola Finanzas co gtd SerEMTN<br />

4.875% /2014 1,500,000 1,563,950 0.16<br />

Enagas nts SerEMTN 4.375% /2015 1,250,000 1,273,011 0.13<br />

Enagas 3.25% /2012 1,250,000 1,261,781 0.13<br />

Telefonica Emisiones co gtd SerEMTN<br />

5.58% /2013 900,000 959,488 0.10<br />

Total for Spain 4.69<br />

Italy<br />

Banca Monte dei Paschi di Siena sr unsecur<br />

SerEMTN 4.75% /2014 5,600,000 5,707,750 0.57<br />

Telecom Italia sr unsecur SerEMTN<br />

8.25% /2016 4,500,000 5,075,329 0.51<br />

Atlantia co gtd SerEMTN 5.625% /2016 4,150,000 4,341,047 0.44<br />

UniCredit sr unsecur SerEMTN<br />

5.25% /2014 4,000,000 4,183,828 0.42<br />

Intesa Sanpaolo subord SerEMTN<br />

5.75% /2018 (3) 4,000,000 4,057,474 0.41<br />

Finmeccanica Finance co gtd SerEMTN<br />

8.125% /2013 (Luxembourg) (4) 2,817,000 3,163,256 0.32<br />

Enel Finance International co gtd Ser144A<br />

priv plmt 6.25% /2017 (Luxembourg) (4) (USD) 2,955,000 2,199,615 0.22<br />

Intesa Sanpaolo sr unsecur SerEMTN<br />

5.375% 2013 2,000,000 2,132,901 0.22<br />

Telecom Italia sr unsecur SerEMTN<br />

6.75% /2013 1,950,000 2,076,114 0.21<br />

Assicurazioni Generali sr unsecur<br />

SerEMTN 4.875% /2014 2,000,000 2,074,840 0.21<br />

Intesa Sanpaolo sr unsecur SerGMTN<br />

4.75% /2017 1,950,000 1,986,312 0.20<br />

<strong>Investment</strong>s<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 62<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

Italy (continued)<br />

UniCredit subord SerEMTN 5.75% /2017 1,760,000 1,747,786 0.18<br />

Enel Finance International co gtd Ser144A<br />

priv plmt 5.7% /2013 (Luxembourg) (4) (USD) 2,200,000 1,634,943 0.17<br />

Total for Italy 4.08<br />

Sweden<br />

Nordea Bank sr unsecur SerEMTN<br />

4.5% /2014 9,500,000 9,667,636 0.97<br />

Svenska Handelsbanken sr unsecur<br />

SerEMTN 4.875% /2014 6,500,000 6,710,766 0.67<br />

Svenska Handelsbanken subord SerEMTN<br />

4% /2016 (3) 6,000,000 5,550,135 0.56<br />

Vattenfall Treasury co gtd SerEMTN<br />

4.25% /2014 5,000,000 5,105,298 0.52<br />

Akzo Nobel Sweden Finance co gtd<br />

7.75% /2014 2,300,000 2,554,562 0.26<br />

Vattenfall sr unsecur SerEMTN<br />

5.25% /2016 2,400,000 2,539,740 0.26<br />

Vattenfall Treasury co gtd SerEMTN<br />

6.75% /2019 1,200,000 1,366,573 0.14<br />

Total for Sweden 3.38<br />

Switzerland<br />

UBS sr unsecur SerEMTN 5.625% /2014 9,000,000 9,205,910 0.92<br />

Credit Suisse Group Finance US bnk gtd<br />

3.625% /2020 (United States of America) (3) 7,500,000 6,046,534 0.61<br />

Credit Suisse sr unsecur SerEMTN<br />

5.125% /2012 3,300,000 3,444,000 0.35<br />

Roche Holdings co gtd Ser144A priv plmt<br />

6% /2019 (United States of America) (4) (USD) 3,500,000 2,642,264 0.27<br />

Credit Suisse sr unsecur SerEMTN<br />

6.125% /2014 2,400,000 2,604,260 0.26<br />

UBS sr nts SerEMTN 6% /2018 1,375,000 1,421,270 0.14<br />

Credit Suisse sr unsecur SerEMTN<br />

6.125% /2013 1,100,000 1,182,534 0.12<br />

Adecco Financial Service Bermuda co gtd CV<br />

0% /2013 (Bermuda) (4) (CHF) 965,000 679,640 0.07<br />

UBS bnk gtd SerEMTN 7.152% perpetual (3) 250,000 154,167 0.02<br />

Total for Switzerland 2.76<br />

Germany<br />

Commerzbank sr unsecur SerEMTN<br />

4.75% /2015 10,000,000 10,055,699 1.01<br />

ThyssenKrupp sr unsecur SerEMTN<br />

8% /2014 6,000,000 6,130,680 0.62<br />

Deutsche Bank jumbo pfandbrief<br />

SerEMTN 3.75% /2016 4,250,000 4,286,189 0.43<br />

KfW - Kreditanstalt fuer Wiederaufbau govt gtd<br />

3.125% /2014 1,000,000 1,006,512 0.10<br />

Muenchener Rueckversicherungs subord<br />

5.767% perpetual (3) 1,200,000 907,817 0.09<br />

Grohe Holding sr secured SerRegS<br />

4.31% /2014 (3) 400,000 268,000 0.03<br />

Total for Germany 2.28<br />

Ireland<br />

GE Capital European Funding co gtd<br />

SerEMTN 5.25% /2015 9,500,000 9,576,993 0.96<br />

Caterpillar International Finance co gtd<br />

SerEMTN 5.25% /2011 7,500,000 7,784,550 0.79<br />

GE Capital European Funding co gtd<br />

SerEMTN 5.25% /2013 4,000,000 4,121,682 0.42<br />

Caterpillar International Finance nts<br />

SerEMNT 5.125% /2012 1,500,000 1,556,303 0.16<br />

Smurfit Kappa Funding sr subord<br />

7.75% /2015 230,000 198,950 0.02<br />

Total for Ireland 2.35