Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

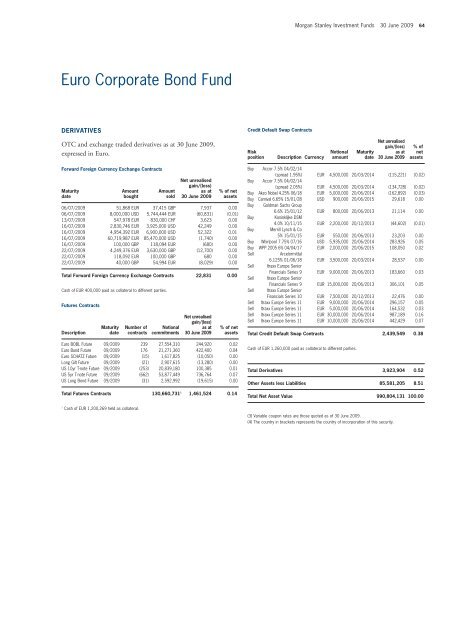

Euro Corporate Bond Fund<br />

DERIVATIVES<br />

OTC and exchange traded derivatives as at 30 June 2009,<br />

expressed in Euro.<br />

Forward Foreign Currency Exchange Contracts<br />

Maturity<br />

date<br />

06/07/2009 51,868 EUR 37,415 GBP 7,937 0.00<br />

06/07/2009 8,000,000 USD 5,744,444 EUR (60,831) (0.01)<br />

13/07/2009 547,978 EUR 830,000 CHF 3,623 0.00<br />

16/07/2009 2,830,746 EUR 3,925,000 USD 42,249 0.00<br />

16/07/2009 4,954,392 EUR 6,900,000 USD 52,322 0.01<br />

16/07/2009 60,719,987 EUR 85,470,000 USD (1,740) 0.00<br />

16/07/2009 100,000 GBP 118,094 EUR (680) 0.00<br />

22/07/2009 4,249,376 EUR 3,630,000 GBP (12,700) 0.00<br />

22/07/2009 118,092 EUR 100,000 GBP 680 0.00<br />

22/07/2009 40,000 GBP 54,994 EUR (8,029) 0.00<br />

Total Forward Foreign Currency Exchange Contracts 22,831 0.00<br />

Cash of EUR 400,000 paid as collateral to different parties.<br />

Futures Contracts<br />

Description<br />

Maturity<br />

date<br />

Amount<br />

bought<br />

Number of<br />

contracts<br />

Euro BOBL Future 09/2009 239 27,554,310 244,920 0.02<br />

Euro Bund Future 09/2009 176 21,271,360 422,400 0.04<br />

Euro SCHATZ Future 09/2009 (15) 1,617,825 (10,050) 0.00<br />

Long Gilt Future 09/2009 (21) 2,907,615 (13,280) 0.00<br />

US 10yr T-note Future 09/2009 (253) 20,839,180 100,385 0.01<br />

US 5yr T-note Future 09/2009 (662) 53,877,449 736,764 0.07<br />

US Long Bond Future 09/2009 (31) 2,592,992 (19,615) 0.00<br />

Total Futures Contracts 130,660,731 1 1,461,524 0.14<br />

1 Cash of EUR 1,200,269 held as collateral.<br />

Amount<br />

sold<br />

Notional<br />

commitments<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of net<br />

assets<br />

% of net<br />

assets<br />

Credit Default Swap Contracts<br />

Risk<br />

position<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 64<br />

Description Currency<br />

Notional<br />

amount<br />

Buy Accor 7.5% 04/02/14<br />

(spread 1.95%) EUR 4,500,000 20/03/2014 (115,221) (0.02)<br />

Buy Accor 7.5% 04/02/14<br />

(spread 2.05%) EUR 4,500,000 20/03/2014 (134,728) (0.02)<br />

Buy Akzo Nobel 4.25% 06/18 EUR 5,000,000 20/06/2014 (162,892) (0.03)<br />

Buy Carnival 6.65% 15/01/28 USD 900,000 20/06/2015 29,618 0.00<br />

Buy Goldman Sachs Group<br />

6.6% 15/01/12 EUR 800,000 20/06/2013 21,114 0.00<br />

Buy Koninklijke DSM<br />

4.0% 10/11/15 EUR 2,200,000 20/12/2013 (44,602) (0.01)<br />

Buy Merrill Lynch & Co<br />

5% 15/01/15 EUR 550,000 20/06/2013 23,203 0.00<br />

Buy Whirlpool 7.75% 07/16 USD 5,935,000 20/06/2014 283,926 0.05<br />

Buy WPP 2005 6% 04/04/17 EUR 2,000,000 20/06/2015 108,050 0.02<br />

Sell Arcelormittal<br />

6.125% 01/06/18 EUR 3,500,000 20/03/2014 28,537 0.00<br />

Sell Itraxx Europe Senior<br />

Financials Series 9 EUR 9,000,000 20/06/2013 183,660 0.03<br />

Sell Itraxx Europe Senior<br />

Financials Series 9 EUR 15,000,000 20/06/2013 306,101 0.05<br />

Sell Itraxx Europe Senior<br />

Financials Series 10 EUR 7,500,000 20/12/2013 22,476 0.00<br />

Sell Itraxx Europe Series 11 EUR 9,000,000 20/06/2014 296,157 0.05<br />

Sell Itraxx Europe Series 11 EUR 5,000,000 20/06/2014 164,532 0.03<br />

Sell Itraxx Europe Series 11 EUR 30,000,000 20/06/2014 987,189 0.16<br />

Sell Itraxx Europe Series 11 EUR 10,000,000 20/06/2014 442,429 0.07<br />

Total Credit Default Swap Contracts 2,439,549 0.38<br />

Cash of EUR 1,260,000 paid as collateral to different parties.<br />

Maturity<br />

date<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

Total Derivatives 3,923,904 0.52<br />

Other Assets less Liabilities 85,581,205 8.51<br />

Total Net Asset Value 990,804,131 100.00<br />

(3) Variable coupon rates are those quoted as of 30 June 2009.<br />

(4) The country in brackets represents the country of incorporation of this security.<br />

% of<br />

net<br />

assets