Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

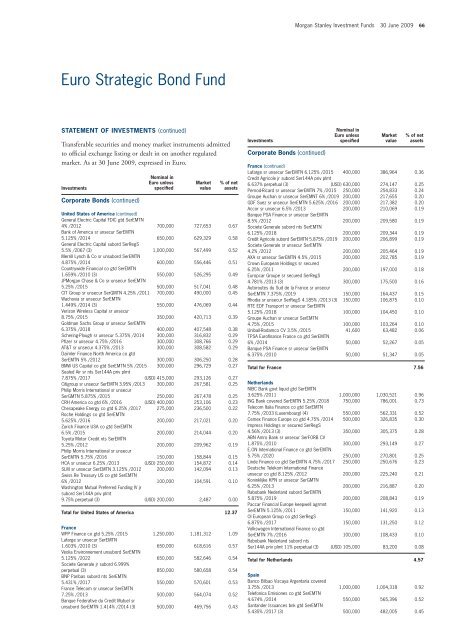

Euro Strategic Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America (continued)<br />

General Electric Capital FDIC gtd SerEMTN<br />

4% /2012 700,000 727,653 0.67<br />

Bank of America sr unsecur SerEMTN<br />

5.125% /2014 650,000 629,329 0.58<br />

General Electric Capital subord SerRegS<br />

5.5% /2067 (3) 1,000,000 567,499 0.52<br />

Merrill Lynch & Co sr unsubord SerEMTN<br />

4.875% /2014 600,000 556,446 0.51<br />

Countrywide Financial co gtd SerEMTN<br />

1.659% /2010 (3) 550,000 526,295 0.49<br />

JP<strong>Morgan</strong> Chase & Co sr unsecur SerEMTN<br />

5.25% /2015 500,000 517,041 0.48<br />

CIT Group sr unsecur SerGMTN 4.25% /2011 700,000 490,000 0.45<br />

Wachovia sr unsecur SerEMTN<br />

1.449% /2014 (3) 550,000 476,069 0.44<br />

Verizon Wireless Capital sr unsecur<br />

8.75% /2015 350,000 420,713 0.39<br />

Goldman Sachs Group sr unsecur SerEMTN<br />

6.375% /2018 400,000 407,548 0.38<br />

Schering-Plough sr unsecur 5.375% /2014 300,000 316,832 0.29<br />

Pfizer sr unsecur 4.75% /2016 300,000 308,766 0.29<br />

AT&T sr unsecur 4.375% /2013 300,000 308,582 0.29<br />

Daimler Finance North America co gtd<br />

SerEMTN 5% /2012 300,000 306,250 0.28<br />

BMW US Capital co gtd SerEMTN 5% /2015 300,000 296,729 0.27<br />

Sealed Air sr nts Ser144A priv plmt<br />

7.875% /2017 (USD) 415,000 293,126 0.27<br />

Citigroup sr unsecur SerEMTN 3.95% /2013 300,000 267,581 0.25<br />

Philip Morris International sr unsecur<br />

SerGMTN 5.875% /2015 250,000 267,478 0.25<br />

CRH America co gtd 6% /2016 (USD) 400,000 253,106 0.23<br />

Chesapeake Energy co gtd 6.25% /2017 275,000 236,500 0.22<br />

Roche Holdings co gtd SerEMTN<br />

5.625% /2016 200,000 217,021 0.20<br />

Zurich Finance USA co gtd SerEMTN<br />

6.5% /2015 200,000 214,044 0.20<br />

Toyota Motor Credit nts SerEMTN<br />

5.25% /2012 200,000 209,962 0.19<br />

Philip Morris International sr unsecur<br />

SerEMTN 5.75% /2016 150,000 158,844 0.15<br />

HCA sr unsecur 6.25% /2013 (USD) 250,000 154,872 0.14<br />

SLM sr unsecur SerEMTN 3.125% /2012 200,000 142,094 0.13<br />

Swiss Re Treasury US co gtd SerEMTN<br />

6% /2012 100,000 104,591 0.10<br />

Washington Mutual Preferred Funding IV jr<br />

subord Ser144A priv plmt<br />

9.75% perpetual (3) (USD) 200,000 2,487 0.00<br />

Total for United States of America 12.37<br />

France<br />

WPP Finance co gtd 5.25% /2015 1,250,000 1,181,312 1.09<br />

Lafarge sr unsecur SerEMTN<br />

1.603% /2010 (3) 650,000 618,616 0.57<br />

Veolia Environnement unsubord SerEMTN<br />

5.125% /2022 650,000 582,646 0.54<br />

Societe Generale jr subord 6.999%<br />

perpetual (3) 850,000 580,658 0.54<br />

BNP Paribas subord nts SerEMTN<br />

5.431% /2017 550,000 570,601 0.53<br />

France Telecom sr unsecur SerEMTN<br />

7.25% /2013 500,000 564,074 0.52<br />

Banque Federative du Credit Mutuel sr<br />

unsubord SerEMTN 1.414% /2014 (3) 500,000 469,756 0.43<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 66<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

France (continued)<br />

Lafarge sr unsecur SerEMTN 6.125% /2015 400,000 386,964 0.36<br />

Credit Agricole jr subord Ser144A priv plmt<br />

6.637% perpetual (3) (USD) 630,000 274,147 0.25<br />

Pernod-Ricard sr unsecur SerEMTN 7% /2015 250,000 254,833 0.24<br />

Groupe Auchan sr unsecur SerEMNT 6% /2019 200,000 217,655 0.20<br />

GDF Suez sr unsecur SerEMTN 5.625% /2016 200,000 217,382 0.20<br />

Accor sr unsecur 6.5% /2013 200,000 210,069 0.19<br />

Banque PSA Finance sr unsecur SerEMTN<br />

8.5% /2012 200,000 209,580 0.19<br />

Societe Generale subord nts SerEMTN<br />

6.125% /2018 200,000 209,344 0.19<br />

Credit Agricole subord SerEMTN 5.875% /2019 200,000 206,899 0.19<br />

Societe Generale sr unsecur SerEMTN<br />

4.2% /2012 200,000 205,464 0.19<br />

AXA sr unsecur SerEMTN 4.5% /2015 200,000 202,785 0.19<br />

Crown European Holdings sr secured<br />

6.25% /2011 200,000 197,000 0.18<br />

Europcar Groupe sr secured SerRegS<br />

4.781% /2013 (3) 300,000 175,500 0.16<br />

Autoroutes du Sud de la France sr unsecur<br />

SerEMTN 7.375% /2019 150,000 164,437 0.15<br />

Rhodia sr unsecur SerRegS 4.185% /2013 (3) 150,000 106,875 0.10<br />

RTE EDF Transport sr unsecur SerEMTN<br />

5.125% /2018 100,000 104,450 0.10<br />

Groupe Auchan sr unsecur SerEMTN<br />

4.75% /2015 100,000 103,264 0.10<br />

Unibail-Rodamco CV 3.5% /2015 41,600 63,482 0.06<br />

TPSA Eurofinance France co gtd SerEMTN<br />

6% /2014 50,000 52,267 0.05<br />

Banque PSA Finance sr unsecur SerEMTN<br />

6.375% /2010 50,000 51,347 0.05<br />

Total for France 7.56<br />

Netherlands<br />

NIBC Bank govt liquid gtd SerEMTN<br />

3.625% /2011 1,000,000 1,030,521 0.96<br />

ING Bank covered SerEMTN 5.25% /2018 750,000 786,001 0.73<br />

Telecom Italia Finance co gtd SerEMTN<br />

7.75% /2033 (Luxembourg) (4) 550,000 562,331 0.52<br />

Cemex Finance Europe co gtd 4.75% /2014 500,000 326,835 0.30<br />

Impress Holdings sr secured SerRegS<br />

4.56% /2013 (3) 350,000 305,375 0.28<br />

ABN Amro Bank sr unsecur SerFORB CV<br />

1.875% /2010 300,000 293,149 0.27<br />

E.ON International Finance co gtd SerEMTN<br />

5.75% /2020 250,000 270,801 0.25<br />

Linde Finance co gtd SerEMTN 4.75% /2017 250,000 250,676 0.23<br />

Deutsche Telekom International Finance<br />

unsecur co gtd 8.125% /2012 200,000 225,240 0.21<br />

Koninklijke KPN sr unsecur SerGMTN<br />

6.25% /2013 200,000 216,887 0.20<br />

Rabobank Nederland subord SerEMTN<br />

5.875% /2019 200,000 208,843 0.19<br />

Paccar Financial Europe keepwell agrmnt<br />

SerEMTN 5.125% /2011 150,000 141,920 0.13<br />

OI European Group co gtd SerRegS<br />

6.875% /2017 150,000 131,250 0.12<br />

Volkswagen International Finance co gtd<br />

SerEMTN 7% /2016 100,000 108,433 0.10<br />

Rabobank Nederland subord nts<br />

Ser144A priv plmt 11% perpetual (3) (USD) 105,000 83,200 0.08<br />

Total for Netherlands 4.57<br />

Spain<br />

Banco Bilbao Vizcaya Argentaria covered<br />

3.75% /2013 1,000,000 1,004,318 0.92<br />

Telefonica Emisiones co gtd SerEMTN<br />

4.674% /2014 550,000 565,396 0.52<br />

Santander Issuances bnk gtd SerEMTN<br />

5.435% /2017 (3) 500,000 482,005 0.45