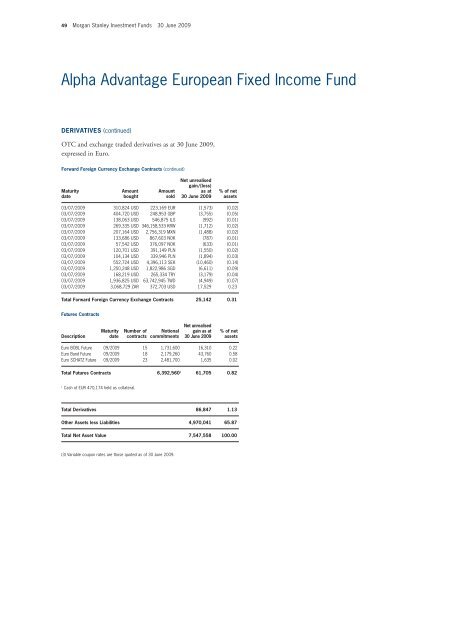

49 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 Alpha Advantage European Fixed Income Fund DERIVATIVES (continued) OTC and exchange traded derivatives as at 30 June 2009, expressed in Euro. Forward Foreign Currency Exchange Contracts (continued) Maturity date 03/07/2009 310,824 USD 223,169 EUR (1,573) (0.02) 03/07/2009 404,720 USD 248,953 GBP (3,755) (0.05) 03/07/2009 138,063 USD 546,875 ILS (992) (0.01) 03/07/2009 269,335 USD 346,158,533 KRW (1,712) (0.02) 03/07/2009 207,164 USD 2,756,319 MXN (1,488) (0.02) 03/07/2009 133,686 USD 867,603 NOK (787) (0.01) 03/07/2009 57,542 USD 376,097 NOK (633) (0.01) 03/07/2009 120,701 USD 391,149 PLN (1,550) (0.02) 03/07/2009 104,134 USD 339,946 PLN (1,894) (0.03) 03/07/2009 552,724 USD 4,396,113 SEK (10,460) (0.14) 03/07/2009 1,250,248 USD 1,822,986 SGD (6,611) (0.09) 03/07/2009 168,219 USD 265,334 TRY (3,179) (0.04) 03/07/2009 1,936,825 USD 63,742,945 TWD (4,949) (0.07) 03/07/2009 3,068,729 ZAR 372,703 USD 17,529 0.23 Total Forward Foreign Currency Exchange Contracts 25,142 0.31 Futures Contracts Description Maturity date Amount bought Euro BOBL Future 09/2009 15 1,731,600 16,310 0.22 Euro Bund Future 09/2009 18 2,179,260 43,760 0.58 Euro SCHATZ Future 09/2009 23 2,481,700 1,635 0.02 Total Futures Contracts 6,392,560 1 61,705 0.82 1 Cash of EUR 470,174 held as collateral. Amount sold Number of Notional contracts commitments Total Derivatives 86,847 1.13 Other Assets less Liabilities 4,970,041 65.87 Total Net Asset Value 7,547,558 100.00 (3) Variable coupon rates are those quoted as of 30 June 2009. Net unrealised gain/(loss) as at 30 June 2009 Net unrealised gain as at 30 June 2009 % of net assets % of net assets

Emerging Markets Debt Fund INVESTMENT AIMS To seek to maximise total return, measured in US Dollars, through investment in the debt securities of government and governmentrelated issuers located in emerging countries. Please refer to the full prospectus for the Fund’s investment objective and policy. <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 50 STATEMENT OF INVESTMENTS Transferable securities and money market instruments admitted to official exchange listing or dealt in on another regulated market. As at 30 June 2009, expressed in US dollars. <strong>Investment</strong>s Nominal in US dollars unless specified Market value % of net assets Brazil Republic of Brazil unsubord 11% /2040 6,410,000 8,373,062 4.25 Republic of Brazil unsubord SerA 8% /2018 7,322,000 8,273,860 4.20 Republic of Brazil sr unsecur 8.875% /2019 3,730,000 4,567,385 2.32 Republic of Brazil sr nts 5.875% /2019 3,250,000 3,315,000 1.68 Banco Nacional de Desenvolvimento Economico e Social sr unsecur SerRegS 6.369% /2018 2,100,000 2,073,750 1.05 Republic of Brazil sr unsecur 10.5% /2014 1,300,000 1,625,000 0.82 Republic of Brazil unsubord SerB 8.875% /2024 1,165,000 1,450,425 0.74 Republic of Brazil unsubord 7.125% /2037 430,000 471,925 0.24 Total for Brazil 15.30 Russia Russia Foreign Bonds sr unsecured SerRegS step cpn 7.5% /2030 14,235,027 14,154,883 7.18 Russia Foreign Bonds unsubord SerRegS 12.75% /2028 2,940,000 4,218,900 2.14 TNK-BP Finance co gtd SerRegS 7.875% /2018 (Luxembourg) (4) 3,294,000 2,750,490 1.40 RSHB Capital for OJSC (Russian Agricultural Bank) sr secured SerRegS LPN 7.175% /2013 (Luxembourg) (4) 2,340,000 2,258,100 1.15 RSHB Capital for OJSC (Russian Agricultural Bank) sr secured SerRegS LPN 6.299% /2017 (Luxembourg) (4) 1,462,000 1,279,250 0.65 Russia Foreign Bonds unsubord SerRegS 8.25% /2010 27,641 28,478 0.01 Russian Federation unsubord Ser144A priv plmt step cpn 7.5% /2030 9,600 9,504 0.00 Total for Russia 12.53 Mexico United Mexican States nts SerEMTN 5.95% /2019 10,756,000 10,863,560 5.51 United Mexican States sr unsecur SerMTNA 6.75% /2034 3,453,000 3,530,692 1.79 Pemex Project Funding Master Trust co gtd 9.125% /2010 (United States of America) (4) 2,444,000 2,642,697 1.34 United Mexican States sr unsecur 5.625% /2017 2,500,000 2,538,750 1.29 Pemex Project Funding Master Trust co gtd SerRegS 1.929% /2010 (United States of America) (3) (4) 1,390,000 1,375,622 0.70 Pemex Project Funding Master Trust co gtd 8.625% /2023 (United States of America) (4) 1,000,000 1,085,000 0.55 Total for Mexico 11.18 Turkey Republic of Turkey nts 11% /2013 7,210,000 8,453,725 4.29 Republic of Turkey unsecur 6.75% /2018 6,171,000 6,171,000 3.13 Republic of Turkey unsecur 6.875% /2036 2,901,000 2,696,189 1.37 Republic of Turkey sr unsecur 7.5% /2019 2,010,000 2,088,893 1.06 Republic of Turkey unsecur 8% /2034 755,000 794,638 0.40 Republic of Turkey unsecur 11.5% /2012 200,000 231,000 0.12 Total for Turkey 10.37