Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

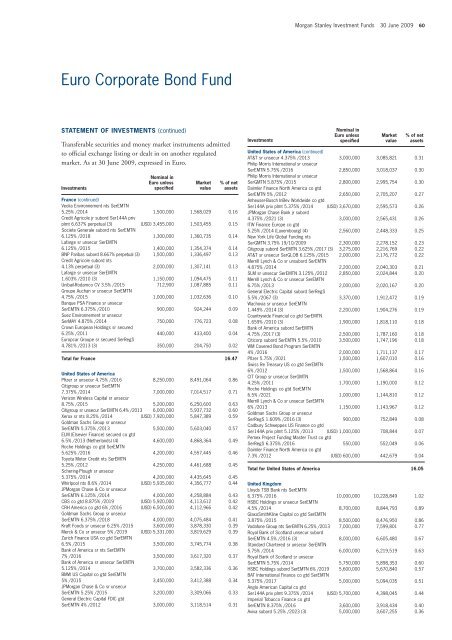

Euro Corporate Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

France (continued)<br />

Veolia Environnement nts SerEMTN<br />

5.25% /2014 1,500,000 1,568,029 0.16<br />

Credit Agricole jr subord Ser144A priv<br />

plmt 6.637% perpetual (3) (USD) 3,455,000 1,503,455 0.15<br />

Societe Generale subord nts SerEMTN<br />

6.125% /2018 1,300,000 1,360,735 0.14<br />

Lafarge sr unsecur SerEMTN<br />

6.125% /2015 1,400,000 1,354,374 0.14<br />

BNP Paribas subord 8.667% perpetual (3) 1,500,000 1,336,497 0.13<br />

Credit Agricole subord nts<br />

4.13% perpetual (3) 2,000,000 1,307,141 0.13<br />

Lafarge sr unsecur SerEMTN<br />

1.603% /2010 (3) 1,150,000 1,094,475 0.11<br />

Unibail-Rodamco CV 3.5% /2015 712,900 1,087,885 0.11<br />

Groupe Auchan sr unsecur SerEMTN<br />

4.75% /2015 1,000,000 1,032,636 0.10<br />

Banque PSA Finance sr unsecur<br />

SerEMTN 6.375% /2010 900,000 924,244 0.09<br />

Suez Environnement sr unsecur<br />

SerMAY 4.875% /2014 750,000 776,723 0.08<br />

Crown European Holdings sr secured<br />

6.25% /2011 440,000 433,400 0.04<br />

Europcar Groupe sr secured SerRegS<br />

4.781% /2013 (3) 350,000 204,750 0.02<br />

Total for France 16.47<br />

United States of America<br />

Pfizer sr unsecur 4.75% /2016 8,250,000 8,491,064 0.86<br />

Citigroup sr unsecur SerEMTN<br />

7.375% /2014 7,000,000 7,014,517 0.71<br />

Verizon Wireless Capital sr unsecur<br />

8.75% /2015 5,200,000 6,250,600 0.63<br />

Citigroup sr unsecur SerEMTN 6.4% /2013 6,000,000 5,937,732 0.60<br />

Xerox sr nts 8.25% /2014 (USD) 7,920,000 5,847,389 0.59<br />

Goldman Sachs Group sr unsecur<br />

SerEMTN 5.375% /2013 5,500,000 5,603,040 0.57<br />

ELM (Elsevier Finance) secured co gtd<br />

6.5% /2013 (Netherlands) (4) 4,600,000 4,868,364 0.49<br />

Roche Holdings co gtd SerEMTN<br />

5.625% /2016 4,200,000 4,557,445 0.46<br />

Toyota Motor Credit nts SerEMTN<br />

5.25% /2012 4,250,000 4,461,688 0.45<br />

Schering-Plough sr unsecur<br />

5.375% /2014 4,200,000 4,435,645 0.45<br />

Whirlpool nts 8.6% /2014 (USD) 5,935,000 4,356,777 0.44<br />

JP<strong>Morgan</strong> Chase & Co sr unsecur<br />

SerEMTN 6.125% /2014 4,000,000 4,258,884 0.43<br />

CBS co gtd 8.875% /2019 (USD) 5,920,000 4,113,612 0.42<br />

CRH America co gtd 6% /2016 (USD) 6,500,000 4,112,966 0.42<br />

Goldman Sachs Group sr unsecur<br />

SerEMTN 6.375% /2018 4,000,000 4,075,484 0.41<br />

Kraft Foods sr unsecur 6.25% /2015 3,600,000 3,878,330 0.39<br />

Merck & Co sr unsecur 5% /2019 (USD) 5,331,000 3,819,629 0.39<br />

Zurich Finance USA co gtd SerEMTN<br />

6.5% /2015 3,500,000 3,745,774 0.38<br />

Bank of America sr nts SerEMTN<br />

7% /2016 3,500,000 3,617,320 0.37<br />

Bank of America sr unsecur SerEMTN<br />

5.125% /2014 3,700,000 3,582,336 0.36<br />

BMW US Capital co gtd SerEMTN<br />

5% /2015 3,450,000 3,412,388 0.34<br />

JP<strong>Morgan</strong> Chase & Co sr unsecur<br />

SerEMTN 5.25% /2015 3,200,000 3,309,066 0.33<br />

General Electric Capital FDIC gtd<br />

SerEMTN 4% /2012 3,000,000 3,118,514 0.31<br />

<strong>Investment</strong>s<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 60<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America (continued)<br />

AT&T sr unsecur 4.375% /2013 3,000,000 3,085,821 0.31<br />

Philip Morris International sr unsecur<br />

SerEMTN 5.75% /2016 2,850,000 3,018,037 0.30<br />

Philip Morris International sr unsecur<br />

SerGMTN 5.875% /2015 2,800,000 2,995,754 0.30<br />

Daimler Finance North America co gtd<br />

SerEMTN 5% /2012 2,650,000 2,705,207 0.27<br />

Anheuser-Busch InBev Worldwide co gtd<br />

Ser144A priv plmt 5.375% /2014 (USD) 3,670,000 2,595,573 0.26<br />

JP<strong>Morgan</strong> Chase Bank jr subord<br />

4.375% /2021 (3) 3,000,000 2,565,431 0.26<br />

ITW Finance Europe co gtd<br />

5.25% /2014 (Luxembourg) (4) 2,560,000 2,448,333 0.25<br />

New York Life Global Funding nts<br />

SerGMTN 3.75% 19/10/2009 2,300,000 2,278,152 0.23<br />

Citigroup subord SerEMTN 3.625% /2017 (3) 3,275,000 2,216,769 0.22<br />

AT&T sr unsecur SerGLOB 6.125% /2015 2,000,000 2,176,772 0.22<br />

Merrill Lynch & Co sr unsubord SerEMTN<br />

4.875% /2014 2,200,000 2,040,303 0.21<br />

SLM sr unsecur SerEMTN 3.125% /2012 2,850,000 2,024,844 0.20<br />

Merrill Lynch & Co sr unsecur SerEMTN<br />

6.75% /2013 2,000,000 2,020,167 0.20<br />

General Electric Capital subord SerRegS<br />

5.5% /2067 (3) 3,370,000 1,912,472 0.19<br />

Wachovia sr unsecur SerEMTN<br />

1.449% /2014 (3) 2,200,000 1,904,276 0.19<br />

Countrywide Financial co gtd SerEMTN<br />

1.659% /2010 (3) 1,900,000 1,818,110 0.18<br />

Bank of America subord SerEMTN<br />

4.75% /2017 (3) 2,500,000 1,787,160 0.18<br />

Citicorp subord SerEMTN 5.5% /2010 3,500,000 1,747,196 0.18<br />

WM Covered Bond Program SerEMTN<br />

4% /2016 2,000,000 1,711,137 0.17<br />

Pfizer 5.75% /2021 1,500,000 1,607,010 0.16<br />

Swiss Re Treasury US co gtd SerEMTN<br />

6% /2012 1,500,000 1,568,864 0.16<br />

CIT Group sr unsecur SerGMTN<br />

4.25% /2011 1,700,000 1,190,000 0.12<br />

Roche Holdings co gtd SerEMTN<br />

6.5% /2021 1,000,000 1,144,810 0.12<br />

Merrill Lynch & Co sr unsecur SerEMTN<br />

6% /2013 1,150,000 1,143,967 0.12<br />

Goldman Sachs Group sr unsecur<br />

SerRegS 1.609% /2016 (3) 900,000 752,849 0.08<br />

Cadbury Schweppes US Finance co gtd<br />

Ser144A priv plmt 5.125% /2013 (USD) 1,000,000 708,844 0.07<br />

Pemex Project Funding Master Trust co gtd<br />

SerRegS 6.375% /2016 550,000 552,049 0.06<br />

Daimler Finance North America co gtd<br />

7.3% /2012 (USD) 600,000 442,679 0.04<br />

Total for United States of America 16.05<br />

United Kingdom<br />

Lloyds TSB Bank nts SerEMTN<br />

6.375% /2016 10,000,000 10,228,849 1.02<br />

HSBC Holdings sr unsecur SerEMTN<br />

4.5% /2014 8,700,000 8,844,793 0.89<br />

GlaxoSmithKline Capital co gtd SerEMTN<br />

3.875% /2015 8,500,000 8,476,950 0.86<br />

Vodafone Group nts SerEMTN 6.25% /2013 7,000,000 7,599,801 0.77<br />

Royal Bank of Scotland unsecur subord<br />

SerEMTN 4.5% /2016 (3) 8,000,000 6,605,480 0.67<br />

Standard Chartered sr unsecur SerEMTN<br />

5.75% /2014 6,000,000 6,219,519 0.63<br />

Royal Bank of Scotland sr unsecur<br />

SerEMTN 5.75% /2014 5,750,000 5,898,353 0.60<br />

HSBC Holdings subord SerEMTN 6% /2019 5,600,000 5,670,840 0.57<br />

BAT International Finance co gtd SerEMTN<br />

5.375% /2017 5,000,000 5,094,035 0.51<br />

Anglo American Capital co gtd<br />

Ser144A priv plmt 9.375% /2014 (USD) 5,700,000 4,398,045 0.44<br />

Imperial Tobacco Finance co gtd<br />

SerEMTN 8.375% /2016 3,600,000 3,918,434 0.40<br />

Aviva subord 5.25% /2023 (3) 5,000,000 3,607,255 0.36