99 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 Diversified Alpha Plus VaR 800 (Euro) Fund STATEMENT OF INVESTMENTS (continued) Transferable securities and money market instruments admitted to official exchange listing or dealt in on another regulated market. As at 30 June 2009, expressed in Euro. <strong>Investment</strong>s Certificate of Deposit Nominal in Euro unless specified Market value % of net assets Rabobank Nederland 0% 15/07/2009 (Netherlands) (4) 1,000,000 999,638 4.26 Total for Certificate of Deposit 4.26 Total <strong>Investment</strong> Securities 15,955,531 68.05 DERIVATIVES OTC and exchange traded derivatives as at 30 June 2009, expressed in Euro. Forward Foreign Currency Exchange Contracts Maturity date Amount bought Amount sold Net unrealised gain/(loss) as at 30 June 2009 % of net assets 02/07/2009 50,724 AUD 40,819 USD 135 0.00 02/07/2009 962,724 CAD 847,584 USD (13,271) (0.06) 02/07/2009 1,166,110 CHF 1,080,021 USD (5,551) (0.02) 02/07/2009 3,721,206 CZK 200,492 USD 116 0.00 02/07/2009 735,306 EUR 1,035,164 USD (2,700) (0.01) 02/07/2009 596,006 GBP 971,564 USD 7,107 0.03 02/07/2009 114,315,962 HUF 560,433 USD 19,994 0.09 02/07/2009 568,227 ILS 144,738 USD 114 0.00 02/07/2009 14,465,889 JPY 150,525 USD (425) 0.00 02/07/2009 3,490,567 MXN 258,844 USD 4,413 0.02 02/07/2009 4,943,303 NOK 771,632 USD (2,585) (0.01) 02/07/2009 130,466 NZD 82,038 USD 1,767 0.01 02/07/2009 1,167,824 PLN 362,605 USD 3,054 0.01 02/07/2009 2,329,668 SEK 297,221 USD 2,470 0.01 02/07/2009 1,352,797 SGD 931,101 USD 2,545 0.01 02/07/2009 1,785,565 TRY 1,144,724 USD 12,549 0.05 02/07/2009 40,196 USD 50,724 AUD (579) 0.00 02/07/2009 841,984 USD 962,724 CAD 9,278 0.04 02/07/2009 1,072,507 USD 1,166,110 CHF 193 0.00 02/07/2009 193,723 USD 3,721,206 CZK (4,942) (0.02) 02/07/2009 1,020,862 USD 735,306 EUR (7,496) (0.03) 02/07/2009 988,685 USD 596,006 GBP 5,099 0.02 02/07/2009 578,537 USD 114,315,962 HUF (7,087) (0.03) 02/07/2009 144,261 USD 568,227 ILS (454) 0.00 02/07/2009 151,782 USD 14,465,889 JPY 1,321 0.01 02/07/2009 262,624 USD 3,490,567 MXN (1,718) (0.01) 02/07/2009 772,605 USD 4,943,303 NOK 3,279 0.01 02/07/2009 84,597 USD 130,466 NZD 58 0.00 02/07/2009 358,470 USD 1,167,824 PLN (6,002) (0.03) 02/07/2009 298,005 USD 2,329,668 SEK (1,911) (0.01) 02/07/2009 927,701 USD 1,352,797 SGD (4,970) (0.02) 02/07/2009 1,148,606 USD 1,785,565 TRY (9,782) (0.04) 02/07/2009 407,667 USD 3,286,654 ZAR (12,781) (0.05) 02/07/2009 3,286,654 ZAR 407,663 USD 12,784 0.05 08/07/2009 153,788 AUD 123,703 USD 408 0.00 08/07/2009 1,065,523 BRL 545,774 USD (1,918) (0.01) 08/07/2009 555,987 CAD 486,266 USD (5,354) (0.02) 08/07/2009 65,343,098 CLP 149,873 USD (19,136) (0.08) 08/07/2009 1,656,692,986 COP 798,005 USD (19,623) (0.08) 08/07/2009 2,431,276 CZK 130,965 USD 80 0.00 08/07/2009 2,966,590 EUR 4,213,669 USD (37,377) (0.16) 08/07/2009 202,578 GBP 336,043 USD (1,733) (0.01) 08/07/2009 150,129,765 HUF 758,748 USD 9,345 0.04 08/07/2009 61,225,141 JPY 642,446 USD (5,594) (0.02) 08/07/2009 388,104,998 KRW 307,045 USD (1,629) (0.01) 08/07/2009 2,190,576 NZD 1,419,909 USD (930) 0.00 08/07/2009 140,754,276 PHP 3,000,849 USD (55,392) (0.24) Forward Foreign Currency Exchange Contracts (continued) Maturity date 08/07/2009 51,379,914 RUB 1,656,966 USD (6,754) (0.03) 08/07/2009 1,306,602 RUB 41,612 USD 203 0.00 08/07/2009 872,913 TRY 560,692 USD 4,775 0.02 08/07/2009 3,558,822 TWD 108,336 USD 327 0.00 08/07/2009 239,606 USD 474,659 BRL (1,655) (0.01) 08/07/2009 417,952 USD 451,233 CHF 2,151 0.01 08/07/2009 306,617 USD 169,712,319 CLP (9,214) (0.04) 08/07/2009 233,228 USD 479,983,269 COP 7,130 0.03 08/07/2009 165,895 USD 651,272 ILS (129) 0.00 08/07/2009 779,456 USD 991,911,598 KRW 396 0.00 08/07/2009 108,682 USD 1,445,853 MXN (713) 0.00 08/07/2009 835,567 USD 5,353,810 NOK 2,793 0.01 08/07/2009 383,022 USD 18,679,994 PHP (3,507) (0.01) 08/07/2009 555,283 USD 1,789,177 PLN (4,662) (0.02) 08/07/2009 320,318 USD 2,504,132 SEK (2,053) (0.01) 08/07/2009 1,531,521 USD 2,225,300 SGD (4,197) (0.02) 08/07/2009 4,672,857 USD 151,361,719 TWD 32,558 0.14 08/07/2009 3,275,090 ZAR 405,760 USD 12,686 0.05 Total Forward Foreign Currency Exchange Contracts (104,696) (0.45) Futures Contracts Description Maturity date Amount bought Amsterdam Index Future 07/2009 (33) 1,676,070 35,656 0.15 CAC40 10 Euro Future 07/2009 (5) 156,300 (617) 0.00 Hang Seng Index Future 07/2009 8 677,791 8,022 0.03 H-Shares Index Future 07/2009 1 50,641 1,320 0.01 IBEX 35 Index Future 07/2009 3 290,040 5,580 0.02 KL Composite Index Future 07/2009 8 86,648 306 0.00 MSCI Singapore Index 07/2009 6 164,916 1,537 0.01 MSCI Taiwan Index Future 07/2009 (21) 344,947 (1,497) (0.01) OBX Index Future 07/2009 342 964,834 (2,520) (0.01) OMX Index Future 07/2009 31 227,062 7,747 0.03 SGX CNX Nifty Index Future 07/2009 113 693,234 11,093 0.05 Bovespa Index Future 08/2009 13 245,679 (5,730) (0.02) DJ Euro Stoxx 50 Index Future 09/2009 (1) 23,910 (355) 0.00 DJ Euro Stoxx Construction Index Future 09/2009 (37) 416,990 13,640 0.06 ASE-20 Index Future 09/2009 265 1,452,200 21,074 0.09 DAX Index Future 09/2009 (1) 120,138 (2,175) (0.01) FTSE 100 Index Future 09/2009 (13) 642,317 5,542 0.02 FTSE/JSE Top 40 Index Future 09/2009 13 239,910 (2,675) (0.01) FTSE/MIB Index Future 09/2009 2 189,875 4,550 0.02 KOSPI2 Index Future 09/2009 5 249,873 951 0.00 Mexico Bolsa Index Future 09/2009 16 212,632 (5,785) (0.02) S&P 500 EMINI Future 09/2009 (23) 748,138 7,644 0.03 S&P/TSE 60 Index Future 09/2009 (3) 229,949 6,271 0.03 SGX Nikkei 225 Index Future 09/2009 7 257,196 2,276 0.01 SPI 200 Future 09/2009 (8) 449,686 9,915 0.04 Swiss Market Index Future 09/2009 (24) 847,067 5,347 0.02 Total Futures Contracts 11,658,043 1 127,117 0.54 1 Cash of EUR 2,321,880 held as collateral. Amount sold Number of Notional contracts commitments Net unrealised gain/(loss) as at 30 June 2009 Net unrealised gain/(loss) as at 30 June 2009 % of net assets % of net assets

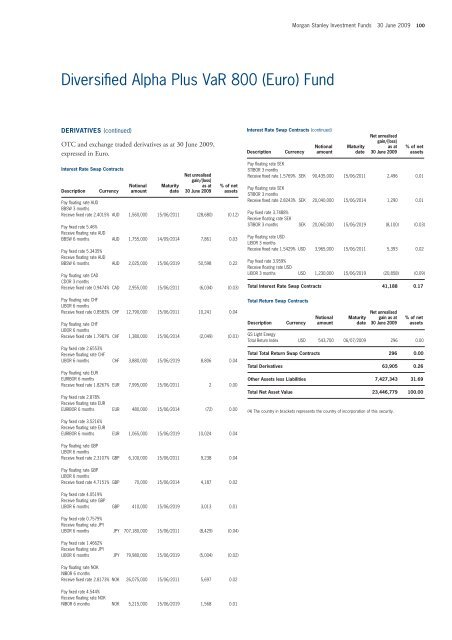

Diversified Alpha Plus VaR 800 (Euro) Fund DERIVATIVES (continued) OTC and exchange traded derivatives as at 30 June 2009, expressed in Euro. Interest Rate Swap Contracts Description Currency Notional amount Maturity date Net unrealised gain/(loss) as at 30 June 2009 % of net assets Pay floating rate AUD BBSW 3 months Receive fixed rate 2.4015% AUD 1,560,000 15/06/2011 (28,680) (0.12) Pay fixed rate 5.46% Receive floating rate AUD BBSW 6 months AUD 1,755,000 14/09/2014 7,861 0.03 Pay fixed rate 5.3435% Receive floating rate AUD BBSW 6 months AUD 2,025,000 15/06/2019 50,598 0.22 Pay floating rate CAD CDOR 3 months Receive fixed rate 0.9474% CAD 2,955,000 15/06/2011 (6,034) (0.03) Pay floating rate CHF LIBOR 6 months Receive fixed rate 0.8583% CHF 12,790,000 15/06/2011 10,241 0.04 Pay floating rate CHF LIBOR 6 months Receive fixed rate 1.7987% CHF 1,380,000 15/06/2014 (2,049) (0.01) Pay fixed rate 2.6553% Receive floating rate CHF LIBOR 6 months CHF 3,880,000 15/06/2019 8,806 0.04 Pay floating rate EUR EURIBOR 6 months Receive fixed rate 1.8267% EUR 7,995,000 15/06/2011 2 0.00 Pay fixed rate 2.878% Receive floating rate EUR EURIBOR 6 months EUR 480,000 15/06/2014 (72) 0.00 Pay fixed rate 3.5216% Receive floating rate EUR EURIBOR 6 months EUR 1,065,000 15/06/2019 10,024 0.04 Pay floating rate GBP LIBOR 6 months Receive fixed rate 2.3107% GBP 6,100,000 15/06/2011 9,238 0.04 Pay floating rate GBP LIBOR 6 months Receive fixed rate 4.7151% GBP 70,000 15/06/2014 4,187 0.02 Pay fixed rate 4.0519% Receive floating rate GBP LIBOR 6 months GBP 410,000 15/06/2019 3,013 0.01 Pay fixed rate 0.7579% Receive floating rate JPY LIBOR 6 months JPY 707,180,000 15/06/2011 (8,429) (0.04) Pay fixed rate 1.4662% Receive floating rate JPY LIBOR 6 months JPY 79,980,000 15/06/2019 (5,004) (0.02) Pay floating rate NOK NIBOR 6 months Receive fixed rate 2.8173% NOK 26,075,000 15/06/2011 5,697 0.02 Pay fixed rate 4.544% Receive floating rate NOK NIBOR 6 months NOK 5,215,000 15/06/2019 1,568 0.01 Interest Rate Swap Contracts (continued) Description <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 100 Pay floating rate SEK STIBOR 3 months Receive fixed rate 1.5769% SEK 90,435,000 15/06/2011 2,496 0.01 Pay floating rate SEK STIBOR 3 months Receive fixed rate 2.8243% SEK 20,040,000 15/06/2014 1,290 0.01 Pay fixed rate 3.7488% Receive floating rate SEK STIBOR 3 months SEK 20,060,000 15/06/2019 (8,100) (0.03) Pay floating rate USD LIBOR 3 months Receive fixed rate 1.5429% USD 3,965,000 15/06/2011 5,393 0.02 Pay fixed rate 3.959% Receive floating rate USD LIBOR 3 months USD 1,230,000 15/06/2019 (20,858) (0.09) Total Interest Rate Swap Contracts 41,188 0.17 Total Return Swap Contracts Description Currency Currency Notional amount Notional amount Maturity date Maturity date Net unrealised gain/(loss) as at 30 June 2009 Net unrealised gain as at 30 June 2009 GS Light Energy Total Return Index USD 543,700 06/07/2009 296 0.00 Total Total Return Swap Contracts 296 0.00 Total Derivatives 63,905 0.26 Other Assets less Liabilities 7,427,343 31.69 Total Net Asset Value 23,446,779 100.00 (4) The country in brackets represents the country of incorporation of this security. % of net assets % of net assets