Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

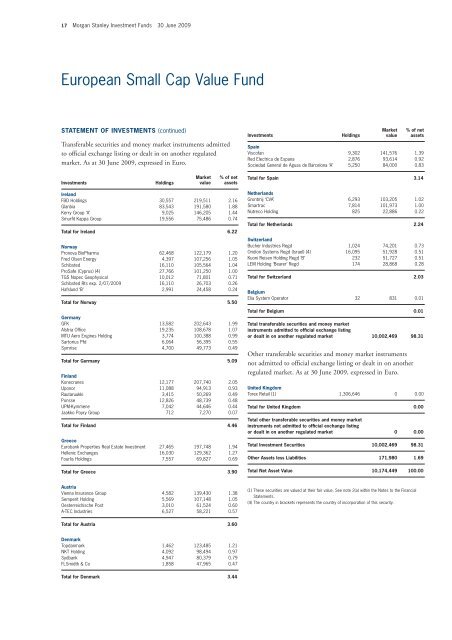

17 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

European Small Cap Value Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s Holdings<br />

Market<br />

value<br />

% of net<br />

assets<br />

Ireland<br />

FBD Holdings 30,557 219,511 2.16<br />

Glanbia 83,543 191,580 1.88<br />

Kerry Group ‘A’ 9,025 146,205 1.44<br />

Smurfit Kappa Group 19,556 75,486 0.74<br />

Total for Ireland 6.22<br />

Norway<br />

Pronova BioPharma 62,468 122,179 1.20<br />

Fred Olsen Energy 4,397 107,256 1.05<br />

Schibsted 16,110 105,564 1.04<br />

ProSafe (Cyprus) (4) 27,766 101,250 1.00<br />

TGS Nopec Geophysical 10,012 71,801 0.71<br />

Schibsted Rts exp. 2/07/2009 16,110 26,703 0.26<br />

Hafslund ‘B’ 2,991 24,458 0.24<br />

Total for Norway 5.50<br />

Germany<br />

GFK 13,582 202,643 1.99<br />

Alstria Office 19,235 108,678 1.07<br />

MTU Aero Engines Holding 3,774 100,388 0.99<br />

Sartorius Pfd 6,064 56,395 0.55<br />

Symrise 4,700 49,773 0.49<br />

Total for Germany 5.09<br />

Finland<br />

Konecranes 12,177 207,740 2.05<br />

Uponor 11,088 94,913 0.93<br />

Rautaruukki 3,415 50,269 0.49<br />

Ponsse 12,826 48,739 0.48<br />

UPM-Kymmene 7,042 44,646 0.44<br />

Jaakko Poyry Group 712 7,270 0.07<br />

Total for Finland 4.46<br />

Greece<br />

Eurobank Properties Real Estate <strong>Investment</strong> 27,465 197,748 1.94<br />

Hellenic Exchanges 16,030 129,362 1.27<br />

Fourlis Holdings 7,557 69,827 0.69<br />

Total for Greece 3.90<br />

Austria<br />

Vienna Insurance Group 4,582 139,430 1.38<br />

Semperit Holding 5,569 107,148 1.05<br />

Oesterreichische Post 3,010 61,524 0.60<br />

A-TEC Industries 6,527 58,221 0.57<br />

Total for Austria 3.60<br />

Denmark<br />

Topdanmark 1,462 123,485 1.21<br />

NKT Holding 4,092 98,494 0.97<br />

Sydbank 4,947 80,379 0.79<br />

FLSmidth & Co 1,858 47,965 0.47<br />

Total for Denmark 3.44<br />

<strong>Investment</strong>s Holdings<br />

Market<br />

value<br />

Spain<br />

Viscofan 9,302 141,576 1.39<br />

Red Electrica de Espana 2,876 93,614 0.92<br />

Sociedad General de Aguas de Barcelona ‘A’ 5,250 84,000 0.83<br />

Total for Spain 3.14<br />

Netherlands<br />

Grontmij ‘CVA’ 6,293 103,205 1.02<br />

Smartrac 7,814 101,973 1.00<br />

Nutreco Holding 825 22,886 0.22<br />

Total for Netherlands 2.24<br />

Switzerland<br />

Bucher Industries Regd 1,024 74,201 0.73<br />

Oridion Systems Regd (Israel) (4) 16,095 51,928 0.51<br />

Kuoni Reisen Holding Regd ‘B’ 232 51,727 0.51<br />

LEM Holding ‘Bearer’ Regd 174 28,868 0.28<br />

Total for Switzerland 2.03<br />

Belgium<br />

Elia System Operator 32 831 0.01<br />

Total for Belgium 0.01<br />

Total transferable securities and money market<br />

instruments admitted to official exchange listing<br />

or dealt in on another regulated market 10,002,469 98.31<br />

Other transferable securities and money market instruments<br />

not admitted to official exchange listing or dealt in on another<br />

regulated market. As at 30 June 2009, expressed in Euro.<br />

% of net<br />

assets<br />

United Kingdom<br />

Torex Retail (1) 1,306,646 0 0.00<br />

Total for United Kingdom 0.00<br />

Total other transferable securities and money market<br />

instruments not admitted to official exchange listing<br />

or dealt in on another regulated market 0 0.00<br />

Total <strong>Investment</strong> Securities 10,002,469 98.31<br />

Other Assets less Liabilities 171,980 1.69<br />

Total Net Asset Value 10,174,449 100.00<br />

(1) These securities are valued at their fair value. See note 2(a) within the Notes to the Financial<br />

Statements.<br />

(4) The country in brackets represents the country of incorporation of this security.