Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

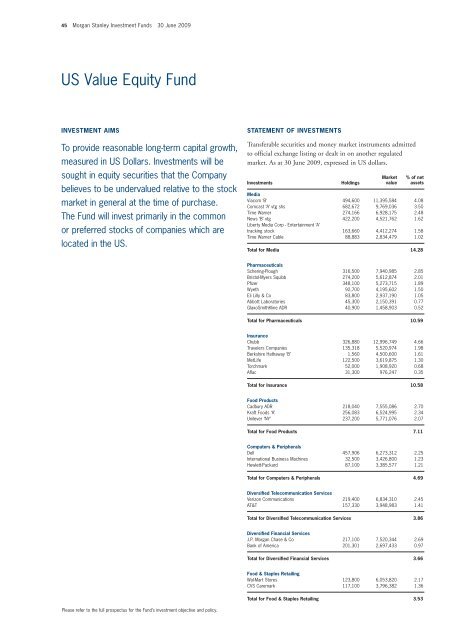

45 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

US Value Equity Fund<br />

INVESTMENT AIMS<br />

To provide reasonable long-term capital growth,<br />

measured in US Dollars. <strong>Investment</strong>s will be<br />

sought in equity securities that the Company<br />

believes to be undervalued relative to the stock<br />

market in general at the time of purchase.<br />

The Fund will invest primarily in the common<br />

or preferred stocks of companies which are<br />

located in the US.<br />

Please refer to the full prospectus for the Fund’s investment objective and policy.<br />

STATEMENT OF INVESTMENTS<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s Holdings<br />

Market<br />

value<br />

% of net<br />

assets<br />

Media<br />

Viacom ‘B’ 494,600 11,395,584 4.08<br />

Comcast ‘A’ vtg shs 682,672 9,769,036 3.50<br />

Time Warner 274,166 6,928,175 2.48<br />

News ‘B’ vtg 422,200 4,521,762 1.62<br />

Liberty Media Corp - Entertainment ‘A’<br />

tracking stock 163,660 4,412,274 1.58<br />

Time Warner Cable 88,883 2,834,479 1.02<br />

Total for Media 14.28<br />

Pharmaceuticals<br />

Schering-Plough 316,500 7,940,985 2.85<br />

Bristol-Myers Squibb 274,200 5,612,874 2.01<br />

Pfizer 348,100 5,273,715 1.89<br />

Wyeth 92,700 4,195,602 1.50<br />

Eli Lilly & Co 83,800 2,937,190 1.05<br />

Abbott Laboratories 45,300 2,150,391 0.77<br />

GlaxoSmithKline ADR 40,900 1,458,903 0.52<br />

Total for Pharmaceuticals 10.59<br />

Insurance<br />

Chubb 326,880 12,996,749 4.66<br />

Travelers Companies 135,318 5,520,974 1.98<br />

Berkshire Hathaway ‘B’ 1,560 4,500,600 1.61<br />

MetLife 122,500 3,619,875 1.30<br />

Torchmark 52,000 1,908,920 0.68<br />

Aflac 31,300 976,247 0.35<br />

Total for Insurance 10.58<br />

Food Products<br />

Cadbury ADR 218,040 7,555,086 2.70<br />

Kraft Foods ‘A’ 256,083 6,524,995 2.34<br />

Unilever ‘NY’ 237,200 5,771,076 2.07<br />

Total for Food Products 7.11<br />

Computers & Peripherals<br />

Dell 457,906 6,273,312 2.25<br />

International Business Machines 32,500 3,426,800 1.23<br />

Hewlett-Packard 87,100 3,385,577 1.21<br />

Total for Computers & Peripherals 4.69<br />

Diversified Telecommunication Services<br />

Verizon Communications 219,400 6,834,310 2.45<br />

AT&T 157,330 3,948,983 1.41<br />

Total for Diversified Telecommunication Services 3.86<br />

Diversified Financial Services<br />

J.P. <strong>Morgan</strong> Chase & Co 217,100 7,520,344 2.69<br />

Bank of America 201,301 2,697,433 0.97<br />

Total for Diversified Financial Services 3.66<br />

Food & Staples Retailing<br />

Wal-Mart Stores 123,800 6,053,820 2.17<br />

CVS Caremark 117,100 3,796,382 1.36<br />

Total for Food & Staples Retailing 3.53