Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

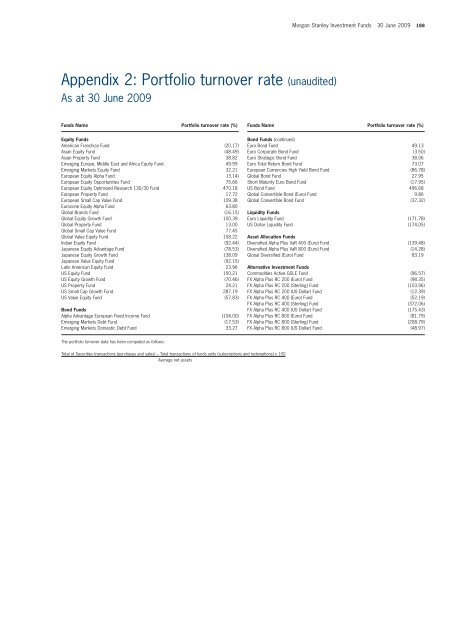

Appendix 2: Portfolio turnover rate (unaudited)<br />

As at 30 June 2009<br />

Equity <strong>Funds</strong><br />

American Franchise Fund (20.17)<br />

Asian Equity Fund (48.49)<br />

Asian Property Fund 38.82<br />

Emerging Europe, Middle East and Africa Equity Fund 49.99<br />

Emerging Markets Equity Fund 32.21<br />

European Equity Alpha Fund (3.14)<br />

European Equity Opportunities Fund 75.66<br />

European Equity Optimised Research 130/30 Fund 470.18<br />

European Property Fund 17.72<br />

European Small Cap Value Fund 109.38<br />

Eurozone Equity Alpha Fund 63.80<br />

Global Brands Fund (16.15)<br />

Global Equity Growth Fund 100.39<br />

Global Property Fund 13.00<br />

Global Small Cap Value Fund 77.45<br />

Global Value Equity Fund 158.22<br />

Indian Equity Fund (92.44)<br />

Japanese Equity Advantage Fund (78.53)<br />

Japanese Equity Growth Fund 138.09<br />

Japanese Value Equity Fund (92.15)<br />

Latin American Equity Fund 23.96<br />

US Equity Fund 150.21<br />

US Equity Growth Fund (70.46)<br />

US Property Fund 24.21<br />

US Small Cap Growth Fund 287.19<br />

US Value Equity Fund (57.83)<br />

Bond <strong>Funds</strong><br />

Alpha Advantage European Fixed Income Fund (104.00)<br />

Emerging Markets Debt Fund (17.53)<br />

Emerging Markets Domestic Debt Fund 33.27<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 188<br />

<strong>Funds</strong> Name Portfolio turnover rate (%) <strong>Funds</strong> Name Portfolio turnover rate (%)<br />

The portfolio turnover data has been computed as follows:<br />

Total of Securities transactions (purchases and sales) – Total transactions of funds units (subscriptions and redemptions) x 100<br />

Average net assets<br />

Bond <strong>Funds</strong> (continued)<br />

Euro Bond Fund 49.13<br />

Euro Corporate Bond Fund (3.50)<br />

Euro Strategic Bond Fund 38.06<br />

Euro Total Return Bond Fund 73.07<br />

European Currencies High Yield Bond Fund (86.78)<br />

Global Bond Fund 27.95<br />

Short Maturity Euro Bond Fund (17.95)<br />

US Bond Fund 496.68<br />

Global Convertible Bond (Euro) Fund 9.86<br />

Global Convertible Bond Fund (37.32)<br />

Liquidity <strong>Funds</strong><br />

Euro Liquidity Fund (171.78)<br />

US Dollar Liquidity Fund (174.05)<br />

Asset Allocation <strong>Funds</strong><br />

Diversified Alpha Plus VaR 400 (Euro) Fund (139.48)<br />

Diversified Alpha Plus VaR 800 (Euro) Fund (14.28)<br />

Global Diversified (Euro) Fund 83.19<br />

Alternative <strong>Investment</strong> <strong>Funds</strong><br />

Commodities Active GSLE Fund (96.57)<br />

FX Alpha Plus RC 200 (Euro) Fund (98.35)<br />

FX Alpha Plus RC 200 (Sterling) Fund (103.96)<br />

FX Alpha Plus RC 200 (US Dollar) Fund (12.39)<br />

FX Alpha Plus RC 400 (Euro) Fund (52.19)<br />

FX Alpha Plus RC 400 (Sterling) Fund (372.06)<br />

FX Alpha Plus RC 400 (US Dollar) Fund (175.43)<br />

FX Alpha Plus RC 800 (Euro) Fund (81.79)<br />

FX Alpha Plus RC 800 (Sterling) Fund (208.79)<br />

FX Alpha Plus RC 800 (US Dollar) Fund (48.97)