Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

179 <strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009<br />

Notes to the financial statements (continued)<br />

As at 30 June 2009<br />

recorded in the Statement of Assets and Liabilities and the<br />

Statement of Operations and Changes in Net Assets of the<br />

Indian Equity Fund. All investments held by the Subsidiary<br />

are individually disclosed in the statement of investments<br />

of the Indian Equity Fund.<br />

The Subsidiary incurs and pays certain fees and expenses<br />

relating to its investment activity in India. These fees and<br />

expenses may include brokerage costs and commissions,<br />

transaction costs associated with converting currency to and<br />

from Indian Rupee to US Dollars, fees incurred by its standing<br />

proxy, corporate and registration fees and taxes associated<br />

with the establishment and operation of the Subsidiary.<br />

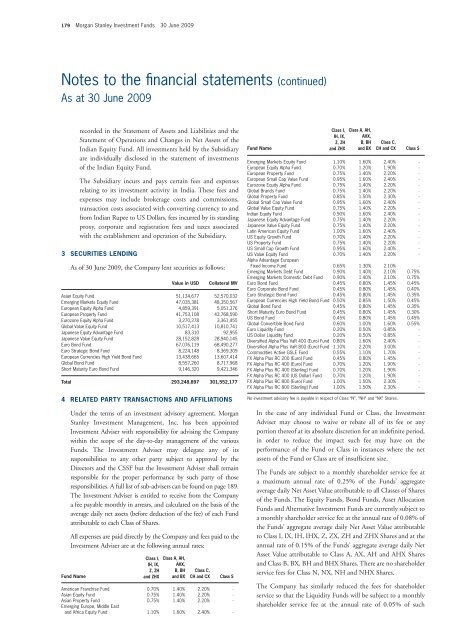

3 SECURITIES LENDING<br />

As of 30 June 2009, the Company lent securities as follows:<br />

Value in USD Collateral MV<br />

Asian Equity Fund 51,134,677 52,570,032<br />

Emerging Markets Equity Fund 47,035,381 48,350,567<br />

European Equity Alpha Fund 4,859,391 5,051,376<br />

European Property Fund 41,753,108 43,768,590<br />

Eurozone Equity Alpha Fund 3,270,278 3,361,455<br />

Global Value Equity Fund 10,517,413 10,810,741<br />

Japanese Equity Advantage Fund 83,310 92,955<br />

Japanese Value Equity Fund 28,152,828 28,940,145<br />

Euro Bond Fund 67,076,119 68,490,277<br />

Euro Strategic Bond Fund 8,224,148 8,369,309<br />

European Currencies High Yield Bond Fund 13,438,665 13,607,414<br />

Global Bond Fund 8,557,260 8,717,968<br />

Short Maturity Euro Bond Fund 9,146,320 9,421,346<br />

Total 293,248,897 301,552,177<br />

4 RELATED PARTY TRANSACTIONS AND AFFILIATIONS<br />

Under the terms of an investment advisory agreement, <strong>Morgan</strong><br />

<strong>Stanley</strong> <strong>Investment</strong> Management, Inc. has been appointed<br />

<strong>Investment</strong> Adviser with responsibility for advising the Company<br />

within the scope of the day-to-day management of the various<br />

<strong>Funds</strong>. The <strong>Investment</strong> Adviser may delegate any of its<br />

responsibilities to any other party subject to approval by the<br />

Directors and the CSSF but the <strong>Investment</strong> Adviser shall remain<br />

responsible for the proper performance by such party of those<br />

responsibilities. A full list of sub-advisers can be found on page 189.<br />

The <strong>Investment</strong> Adviser is entitled to receive from the Company<br />

a fee payable monthly in arrears, and calculated on the basis of the<br />

average daily net assets (before deduction of the fee) of each Fund<br />

attributable to each Class of Shares.<br />

All expenses are paid directly by the Company and fees paid to the<br />

<strong>Investment</strong> Adviser are at the following annual rates:<br />

Fund Name<br />

Class I,<br />

IH, IX,<br />

Z, ZH<br />

and ZHX<br />

Class A, AH,<br />

AHX,<br />

B, BH<br />

and BX<br />

Class C,<br />

CH and CX<br />

Class S<br />

American Franchise Fund 0.70% 1.40% 2.20% -<br />

Asian Equity Fund 0.75% 1.40% 2.20% -<br />

Asian Property Fund 0.75% 1.40% 2.20% -<br />

Emerging Europe, Middle East<br />

and Africa Equity Fund 1.10% 1.60% 2.40% -<br />

Class I, Class A, AH,<br />

IH, IX, AHX,<br />

Z, ZH B, BH Class C,<br />

Fund Name and ZHX<br />

and BX CH and CX Class S<br />

Emerging Markets Equity Fund 1.10% 1.60% 2.40% -<br />

European Equity Alpha Fund 0.70% 1.20% 1.90% -<br />

European Property Fund 0.75% 1.40% 2.20% -<br />

European Small Cap Value Fund 0.95% 1.60% 2.40% -<br />

Eurozone Equity Alpha Fund 0.75% 1.40% 2.20% -<br />

Global Brands Fund 0.75% 1.40% 2.20% -<br />

Global Property Fund 0.85% 1.50% 2.30% -<br />

Global Small Cap Value Fund 0.95% 1.60% 2.40% -<br />

Global Value Equity Fund 0.75% 1.40% 2.20% -<br />

Indian Equity Fund 0.90% 1.60% 2.40% -<br />

Japanese Equity Advantage Fund 0.75% 1.40% 2.20% -<br />

Japanese Value Equity Fund 0.75% 1.40% 2.20% -<br />

Latin American Equity Fund 1.00% 1.60% 2.40% -<br />

US Equity Growth Fund 0.70% 1.40% 2.20% -<br />

US Property Fund 0.75% 1.40% 2.20% -<br />

US Small Cap Growth Fund 0.95% 1.60% 2.40% -<br />

US Value Equity Fund 0.70% 1.40% 2.20% -<br />

Alpha Advantage European<br />

Fixed Income Fund 0.65% 1.30% 2.10% -<br />

Emerging Markets Debt Fund 0.90% 1.40% 2.10% 0.75%<br />

Emerging Markets Domestic Debt Fund 0.90% 1.40% 2.10% 0.75%<br />

Euro Bond Fund 0.45% 0.80% 1.45% 0.45%<br />

Euro Corporate Bond Fund 0.45% 0.80% 1.45% 0.40%<br />

Euro Strategic Bond Fund 0.45% 0.80% 1.45% 0.35%<br />

European Currencies High Yield Bond Fund 0.50% 0.85% 1.50% 0.45%<br />

Global Bond Fund 0.45% 0.80% 1.45% 0.35%<br />

Short Maturity Euro Bond Fund 0.45% 0.80% 1.45% 0.30%<br />

US Bond Fund 0.45% 0.80% 1.45% 0.45%<br />

Global Convertible Bond Fund 0.60% 1.00% 1.60% 0.55%<br />

Euro Liquidity Fund 0.20% 0.50% 0.85% -<br />

US Dollar Liquidity Fund 0.20% 0.50% 0.85% -<br />

Diversified Alpha Plus VaR 400 (Euro) Fund 0.80% 1.60% 2.40% -<br />

Diversified Alpha Plus VaR 800 (Euro) Fund 1.10% 2.20% 3.00% -<br />

Commodities Active GSLE Fund 0.55% 1.10% 1.70% -<br />

FX Alpha Plus RC 200 (Euro) Fund 0.45% 0.80% 1.45% -<br />

FX Alpha Plus RC 400 (Euro) Fund 0.70% 1.20% 1.90% -<br />

FX Alpha Plus RC 400 (Sterling) Fund 0.70% 1.20% 1.90% -<br />

FX Alpha Plus RC 400 (US Dollar) Fund 0.70% 1.20% 1.90% -<br />

FX Alpha Plus RC 800 (Euro) Fund 1.00% 1.50% 2.30% -<br />

FX Alpha Plus RC 800 (Sterling) Fund 1.00% 1.50% 2.30% -<br />

No investment advisory fee is payable in respect of Class “N”, “NH” and “NX” Shares.<br />

In the case of any individual Fund or Class, the <strong>Investment</strong><br />

Adviser may choose to waive or rebate all of its fee or any<br />

portion thereof at its absolute discretion for an indefinite period,<br />

in order to reduce the impact such fee may have on the<br />

performance of the Fund or Class in instances where the net<br />

assets of the Fund or Class are of insufficient size.<br />

The <strong>Funds</strong> are subject to a monthly shareholder service fee at<br />

a maximum annual rate of 0.25% of the <strong>Funds</strong>’ aggregate<br />

average daily Net Asset Value attributable to all Classes of Shares<br />

of the <strong>Funds</strong>. The Equity <strong>Funds</strong>, Bond <strong>Funds</strong>, Asset Allocation<br />

<strong>Funds</strong> and Alternative <strong>Investment</strong> <strong>Funds</strong> are currently subject to<br />

a monthly shareholder service fee at the annual rate of 0.08% of<br />

the <strong>Funds</strong>’ aggregate average daily Net Asset Value attributable<br />

to Class I, IX, IH, IHX, Z, ZX, ZH and ZHX Shares and at the<br />

annual rate of 0.15% of the <strong>Funds</strong>’ aggregate average daily Net<br />

Asset Value attributable to Class A, AX, AH and AHX Shares<br />

and Class B, BX, BH and BHX Shares. There are no shareholder<br />

service fees for Class N, NX, NH and NHX Shares.<br />

The Company has similarly reduced the fees for shareholder<br />

service so that the Liquidity <strong>Funds</strong> will be subject to a monthly<br />

shareholder service fee at the annual rate of 0.05% of such