Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

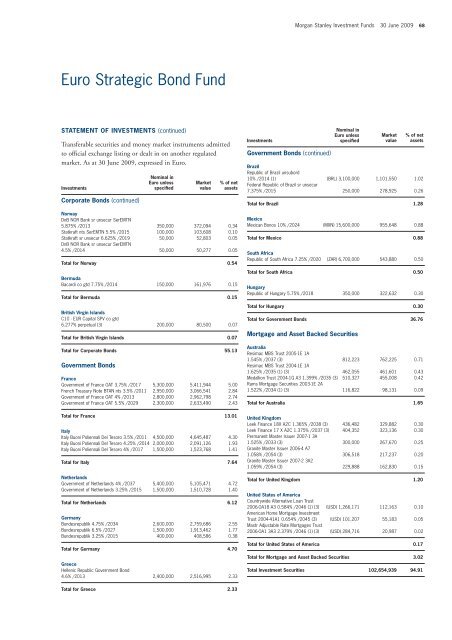

Euro Strategic Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in Euro.<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

Norway<br />

DnB NOR Bank sr unsecur SerEMTN<br />

5.875% /2013 350,000 372,094 0.34<br />

Statkraft nts SerEMTN 5.5% /2015 100,000 103,608 0.10<br />

Statkraft sr unsecur 6.625% /2019 50,000 52,803 0.05<br />

DnB NOR Bank sr unsecur SerEMTN<br />

4.5% /2014 50,000 50,277 0.05<br />

Total for Norway 0.54<br />

Bermuda<br />

Bacardi co gtd 7.75% /2014 150,000 161,976 0.15<br />

Total for Bermuda 0.15<br />

British Virgin Islands<br />

C10 - EUR Capital SPV co gtd<br />

6.277% perpetual (3) 200,000 80,500 0.07<br />

Total for British Virgin Islands 0.07<br />

Total for Corporate Bonds 55.13<br />

Government Bonds<br />

Nominal in<br />

Euro unless<br />

specified<br />

Market<br />

value<br />

% of net<br />

assets<br />

France<br />

Government of France OAT 3.75% /2017 5,300,000 5,411,944 5.00<br />

French Treasury Note BTAN nts 3.5% /2011 2,950,000 3,066,541 2.84<br />

Government of France OAT 4% /2013 2,800,000 2,962,798 2.74<br />

Government of France OAT 5.5% /2029 2,300,000 2,633,490 2.43<br />

Total for France 13.01<br />

Italy<br />

Italy Buoni Poliennali Del Tesoro 3.5% /2011 4,500,000 4,645,487 4.30<br />

Italy Buoni Poliennali Del Tesoro 4.25% /2014 2,000,000 2,091,126 1.93<br />

Italy Buoni Poliennali Del Tesoro 4% /2017 1,500,000 1,523,768 1.41<br />

Total for Italy 7.64<br />

Netherlands<br />

Government of Netherlands 4% /2037 5,400,000 5,105,471 4.72<br />

Government of Netherlands 3.25% /2015 1,500,000 1,510,728 1.40<br />

Total for Netherlands 6.12<br />

Germany<br />

Bundesrepublik 4.75% /2034 2,600,000 2,759,686 2.55<br />

Bundesrepublik 6.5% /2027 1,500,000 1,913,462 1.77<br />

Bundesrepublik 3.25% /2015 400,000 408,586 0.38<br />

Total for Germany 4.70<br />

Greece<br />

Hellenic Republic Government Bond<br />

4.6% /2013 2,400,000 2,516,995 2.33<br />

Total for Greece 2.33<br />

<strong>Investment</strong>s<br />

Government Bonds (continued)<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 68<br />

Nominal in<br />

Euro unless<br />

specified<br />

Brazil<br />

Republic of Brazil unsubord<br />

10% /2014 (1) (BRL) 3,100,000 1,101,550 1.02<br />

Federal Republic of Brazil sr unsecur<br />

7.375% /2015 250,000 278,925 0.26<br />

Total for Brazil 1.28<br />

Mexico<br />

Mexican Bonos 10% /2024 (MXN) 15,600,000 955,648 0.88<br />

Total for Mexico 0.88<br />

South Africa<br />

Republic of South Africa 7.25% /2020 (ZAR) 6,700,000 543,880 0.50<br />

Total for South Africa 0.50<br />

Hungary<br />

Republic of Hungary 5.75% /2018 350,000 322,632 0.30<br />

Total for Hungary 0.30<br />

Total for Government Bonds 36.76<br />

Mortgage and Asset Backed Securities<br />

Market<br />

value<br />

% of net<br />

assets<br />

Australia<br />

Resimac MBS Trust 2005-1E 1A<br />

1.545% /2037 (3) 812,223 762,225 0.71<br />

Resimac MBS Trust 2004-1E 1A<br />

1.625% /2035 (1) (3) 462,055 461,601 0.43<br />

Medallion Trust 2004-1G A3 1.399% /2035 (3) 510,327 455,008 0.42<br />

Rams Mortgage Securities 2003-1E 2A<br />

1.522% /2034 (1) (3) 116,822 98,131 0.09<br />

Total for Australia 1.65<br />

United Kingdom<br />

Leek Finance 18X A2C 1.365% /2038 (3) 436,482 329,882 0.30<br />

Leek Finance 17 X A2C 1.375% /2037 (3) 404,352 323,136 0.30<br />

Permanent Master Issuer 2007-1 3A<br />

1.525% /2033 (3) 300,000 267,670 0.25<br />

Granite Master Issuer 2006-4 A7<br />

1.058% /2054 (3) 306,518 217,237 0.20<br />

Granite Master Issuer 2007-2 3A2<br />

1.059% /2054 (3) 229,888 162,830 0.15<br />

Total for United Kingdom 1.20<br />

United States of America<br />

Countrywide Alternative Loan Trust<br />

2006-OA18 A3 0.584% /2046 (1) (3) (USD) 1,266,171 112,163 0.10<br />

American Home Mortgage <strong>Investment</strong><br />

Trust 2004-41A1 0.654% /2045 (3) (USD) 101,207 55,183 0.05<br />

Mastr Adjustable Rate Mortgages Trust<br />

2006-OA1 3A3 2.379% /2046 (1) (3) (USD) 284,716 20,987 0.02<br />

Total for United States of America 0.17<br />

Total for Mortgage and Asset Backed Securities 3.02<br />

Total <strong>Investment</strong> Securities 102,654,939 94.91