Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Morgan Stanley Investment Funds - stockselection

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

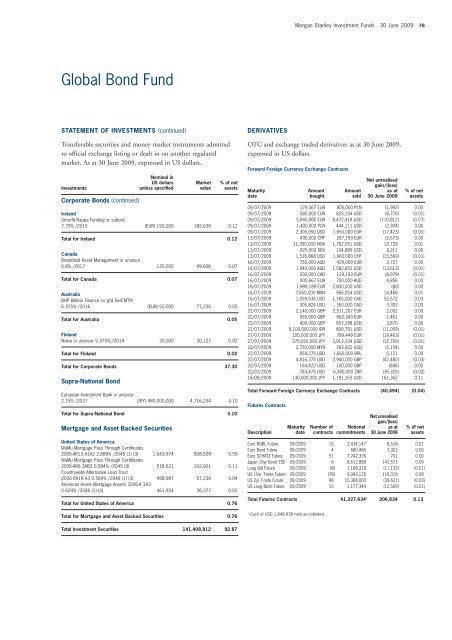

Global Bond Fund<br />

STATEMENT OF INVESTMENTS (continued)<br />

Transferable securities and money market instruments admitted<br />

to official exchange listing or dealt in on another regulated<br />

market. As at 30 June 2009, expressed in US dollars.<br />

<strong>Investment</strong>s<br />

Corporate Bonds (continued)<br />

Ireland<br />

Smurfit Kappa Funding sr subord<br />

7.75% /2015 (EUR) 150,000 182,630 0.12<br />

Total for Ireland 0.12<br />

Canada<br />

Brookfield Asset Management sr unsecur<br />

5.8% /2017 120,000 99,606 0.07<br />

Total for Canada 0.07<br />

Australia<br />

BHP Billiton Finance co gtd SerEMTN<br />

6.375% /2016 (EUR) 50,000 77,236 0.05<br />

Total for Australia 0.05<br />

Finland<br />

Nokia sr unsecur 5.375% /2019 30,000 30,127 0.02<br />

Total for Finland 0.02<br />

Total for Corporate Bonds 37.30<br />

Supra-National Bond<br />

Nominal in<br />

US dollars<br />

unless specified<br />

European <strong>Investment</strong> Bank sr unsecur<br />

2.15% /2027 (JPY) 480,000,000 4,716,234 3.10<br />

Total for Supra-National Bond 3.10<br />

Mortgage and Asset Backed Securities<br />

Market<br />

value<br />

% of net<br />

assets<br />

United States of America<br />

WaMu Mortgage Pass Through Certificates<br />

2005-AR13 A1A2 2.889% /2045 (1) (3) 1,643,974 908,509 0.59<br />

WaMu Mortgage Pass Through Certificates<br />

2005-AR6 2AB3 0.584% /2045 (3) 518,521 162,001 0.11<br />

Countrywide Alternative Loan Trust<br />

2006-OA18 A3 0.584% /2046 (1) (3) 458,987 57,230 0.04<br />

American Home Mortgage Assets 2006-4 1A3<br />

0.624% /2046 (1) (3) 461,924 36,377 0.02<br />

Total for United States of America 0.76<br />

Total for Mortgage and Asset Backed Securities 0.76<br />

Total <strong>Investment</strong> Securities 141,408,812 92.87<br />

DERIVATIVES<br />

<strong>Morgan</strong> <strong>Stanley</strong> <strong>Investment</strong> <strong>Funds</strong> 30 June 2009 78<br />

OTC and exchange traded derivatives as at 30 June 2009,<br />

expressed in US dollars.<br />

Forward Foreign Currency Exchange Contracts<br />

Maturity<br />

date<br />

09/07/2009 179,067 EUR 805,000 PLN (1,992) 0.00<br />

09/07/2009 580,000 EUR 825,154 USD (8,770) (0.01)<br />

09/07/2009 5,940,500 EUR 8,472,418 USD (110,812) (0.07)<br />

09/07/2009 1,400,000 PLN 444,111 USD (2,304) 0.00<br />

09/07/2009 2,305,050 USD 1,650,000 EUR (17,423) (0.01)<br />

13/07/2009 435,000 CHF 287,193 EUR (2,673) 0.00<br />

13/07/2009 11,350,000 NOK 1,752,051 USD 12,739 0.01<br />

13/07/2009 825,000 SEK 104,889 USD 2,211 0.00<br />

13/07/2009 1,516,868 USD 1,660,000 CHF (15,560) (0.01)<br />

16/07/2009 750,000 AUD 429,009 EUR 2,727 0.00<br />

16/07/2009 1,940,000 AUD 1,582,652 USD (13,613) (0.01)<br />

16/07/2009 200,000 CAD 129,193 EUR (8,979) (0.01)<br />

16/07/2009 405,667 EUR 700,000 AUD 4,856 0.00<br />

16/07/2009 1,989,189 EUR 2,800,000 USD (80) 0.00<br />

16/07/2009 7,650,000 MXN 566,054 USD 14,466 0.01<br />

16/07/2009 1,059,536 USD 1,165,000 CAD 52,572 0.03<br />

16/07/2009 305,824 USD 350,000 CAD 3,302 0.00<br />

22/07/2009 2,140,000 GBP 2,511,207 EUR 2,002 0.00<br />

22/07/2009 565,000 GBP 662,343 EUR 1,461 0.00<br />

22/07/2009 400,000 GBP 657,198 USD 3,870 0.00<br />

22/07/2009 8,100,000,000 IDR 800,791 USD (11,009) (0.01)<br />

27/07/2009 105,000,000 JPY 789,449 EUR (19,463) (0.01)<br />

27/07/2009 375,050,000 JPY 3,912,334 USD (12,700) (0.01)<br />

22/07/2009 2,750,000 MYR 783,922 USD (2,154) 0.00<br />

22/07/2009 854,275 USD 1,660,000 BRL 5,121 0.00<br />

22/07/2009 4,816,375 USD 2,940,000 GBP (42,480) (0.03)<br />

22/07/2009 164,422 USD 100,000 GBP (846) 0.00<br />

22/07/2009 783,475 USD 6,350,000 ZAR (36,325) (0.02)<br />

16/09/2009 130,000,000 JPY 1,191,163 USD 161,362 0.11<br />

Total Forward Foreign Currency Exchange Contracts (40,494) (0.04)<br />

Futures Contracts<br />

Description<br />

Maturity<br />

date<br />

Amount<br />

bought<br />

Euro BOBL Future 09/2009 15 2,434,147 8,516 0.01<br />

Euro Bund Future 09/2009 4 680,466 3,322 0.00<br />

Euro SCHATZ Future 09/2009 51 7,742,376 701 0.00<br />

Japan 10yr Bond TSE 09/2009 6 8,612,858 141,573 0.09<br />

Long Gilt Future 09/2009 (6) 1,169,318 (11,172) (0.01)<br />

US 10yr T-note Future 09/2009 (78) 9,043,125 116,015 0.08<br />

US 2yr T-note Future 09/2009 48 10,368,000 (39,621) (0.03)<br />

US Long Bond Future 09/2009 10 1,177,344 (12,500) (0.01)<br />

Total Futures Contracts 41,227,634 1 206,834 0.13<br />

1 Cash of USD 1,848,936 held as collateral.<br />

Amount<br />

sold<br />

Number of Notional<br />

contracts commitments<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

Net unrealised<br />

gain/(loss)<br />

as at<br />

30 June 2009<br />

% of net<br />

assets<br />

% of net<br />

assets