Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

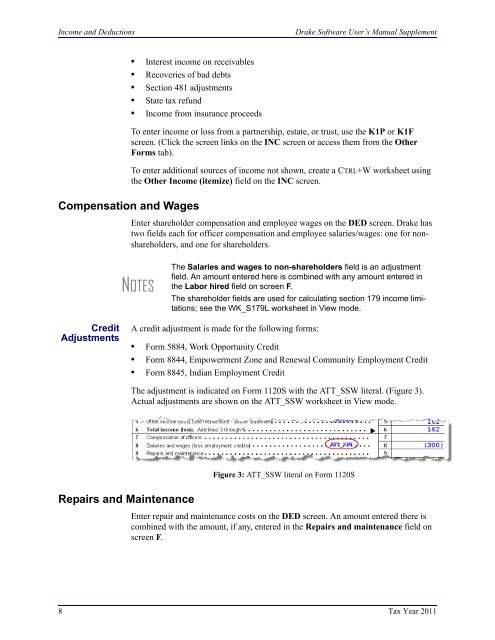

Income and Deductions<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>• Interest income on receivables• Recoveries of bad debts• Section 481 adjustments• State tax refund• Income from insurance proceedsCompensation and WagesTo enter income or loss from a partnership, estate, or trust, use the K1P or K1Fscreen. (Click the screen links on the INC screen or access them from the OtherForms tab).To enter additional sources of income not shown, create a CTRL+W worksheet usingthe Other Income (itemize) field on the INC screen.Enter shareholder compensation and employee wages on the DED screen. <strong>Drake</strong> hastwo fields each for officer compensation and employee salaries/wages: one for nonshareholders,and one for shareholders.NOTESThe Salaries and wages to non-shareholders field is an adjustmentfield. An amount entered here is combined with any amount entered inthe Labor hired field on screen F.The shareholder fields are used for calculating section 179 income limitations;see the WK_S179L worksheet in View mode.CreditAdjustmentsA credit adjustment is made for the following forms:• Form 5884, Work Opportunity Credit• Form 8844, Empowerment Zone and Renewal Community Employment Credit• Form 8845, Indian Employment CreditThe adjustment is indicated on Form 1120S with the ATT_SSW literal. (Figure 3).Actual adjustments are shown on the ATT_SSW worksheet in View mode.Figure 3: ATT_SSW literal on Form 1120SRepairs and MaintenanceEnter repair and maintenance costs on the DED screen. An amount entered there iscombined with the amount, if any, entered in the Repairs and maintenance field onscreen F.8 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>