Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

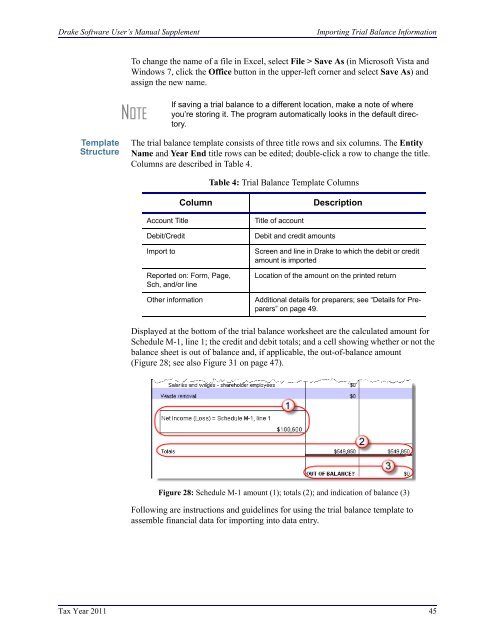

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Importing Trial Balance InformationTo change the name of a file in Excel, select File > Save As (in Microsoft Vista andWindows 7, click the Office button in the upper-left corner and select Save As) andassign the new name.NOTEIf saving a trial balance to a different location, make a note of whereyou’re storing it. The program automatically looks in the default directory.TemplateStructureThe trial balance template consists of three title rows and six columns. The EntityName and <strong>Year</strong> End title rows can be edited; double-click a row to change the title.Columns are described in Table 4.Table 4: Trial Balance Template ColumnsColumnDescriptionAccount TitleDebit/CreditImport toReported on: Form, Page,Sch, and/or lineOther informationTitle of accountDebit and credit amountsScreen and line in <strong>Drake</strong> to which the debit or creditamount is importedLocation of the amount on the printed returnAdditional details for preparers; see “Details for Preparers”on page 49.Displayed at the bottom of the trial balance worksheet are the calculated amount forSchedule M-1, line 1; the credit and debit totals; and a cell showing whether or not thebalance sheet is out of balance and, if applicable, the out-of-balance amount(Figure 28; see also Figure 31 on page 47).Figure 28: Schedule M-1 amount (1); totals (2); and indication of balance (3)Following are instructions and guidelines for using the trial balance template toassemble financial data for importing into data entry.<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong> 45