Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

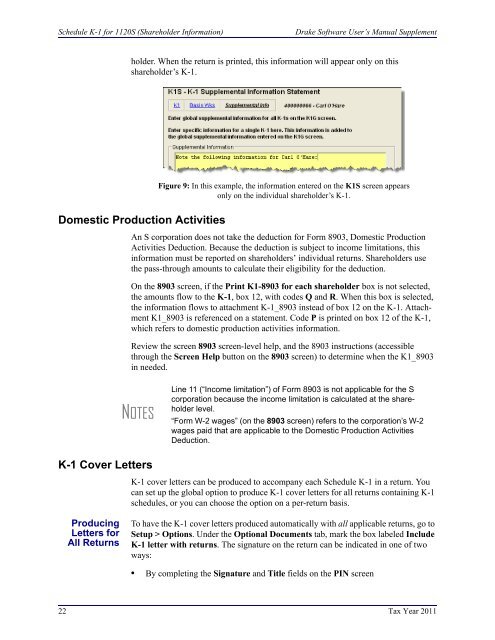

Schedule K-1 for 1120S (Shareholder Information)<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>holder. When the return is printed, this information will appear only on thisshareholder’s K-1.Figure 9: In this example, the information entered on the K1S screen appearsonly on the individual shareholder’s K-1.Domestic Production ActivitiesAn S corporation does not take the deduction for Form 8903, Domestic ProductionActivities Deduction. Because the deduction is subject to income limitations, thisinformation must be reported on shareholders’ individual returns. Shareholders usethe pass-through amounts to calculate their eligibility for the deduction.On the 8903 screen, if the Print K1-8903 for each shareholder box is not selected,the amounts flow to the K-1, box 12, with codes Q and R. When this box is selected,the information flows to attachment K-1_8903 instead of box 12 on the K-1. AttachmentK1_8903 is referenced on a statement. Code P is printed on box 12 of the K-1,which refers to domestic production activities information.Review the screen 8903 screen-level help, and the 8903 instructions (accessiblethrough the Screen Help button on the 8903 screen) to determine when the K1_8903in needed.NOTESLine 11 (“Income limitation”) of Form 8903 is not applicable for the Scorporation because the income limitation is calculated at the shareholderlevel.“Form W-2 wages” (on the 8903 screen) refers to the corporation’s W-2wages paid that are applicable to the Domestic Production ActivitiesDeduction.K-1 Cover LettersK-1 cover letters can be produced to accompany each Schedule K-1 in a return. Youcan set up the global option to produce K-1 cover letters for all returns containing K-1schedules, or you can choose the option on a per-return basis.ProducingLetters forAll ReturnsTo have the K-1 cover letters produced automatically with all applicable returns, go toSetup > Options. Under the Optional Documents tab, mark the box labeled IncludeK-1 letter with returns. The signature on the return can be indicated in one of twoways:• By completing the Signature and Title fields on the PIN screen22 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>