Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

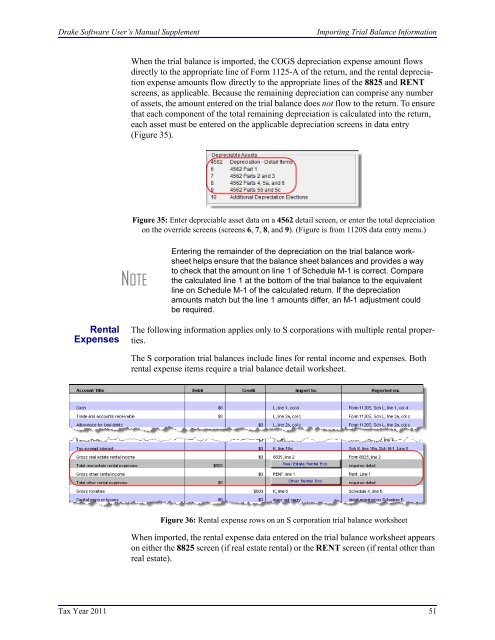

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Importing Trial Balance InformationWhen the trial balance is imported, the COGS depreciation expense amount flowsdirectly to the appropriate line of Form 1125-A of the return, and the rental depreciationexpense amounts flow directly to the appropriate lines of the 8825 and RENTscreens, as applicable. Because the remaining depreciation can comprise any numberof assets, the amount entered on the trial balance does not flow to the return. To ensurethat each component of the total remaining depreciation is calculated into the return,each asset must be entered on the applicable depreciation screens in data entry(Figure 35).Figure 35: Enter depreciable asset data on a 4562 detail screen, or enter the total depreciationon the override screens (screens 6, 7, 8, and 9). (Figure is from 1120S data entry menu.)NOTEEntering the remainder of the depreciation on the trial balance worksheethelps ensure that the balance sheet balances and provides a wayto check that the amount on line 1 of Schedule M-1 is correct. Comparethe calculated line 1 at the bottom of the trial balance to the equivalentline on Schedule M-1 of the calculated return. If the depreciationamounts match but the line 1 amounts differ, an M-1 adjustment couldbe required.RentalExpensesThe following information applies only to S corporations with multiple rental properties.The S corporation trial balances include lines for rental income and expenses. Bothrental expense items require a trial balance detail worksheet.Figure 36: Rental expense rows on an S corporation trial balance worksheetWhen imported, the rental expense data entered on the trial balance worksheet appearson either the 8825 screen (if real estate rental) or the RENT screen (if rental other thanreal estate).<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong> 51