Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

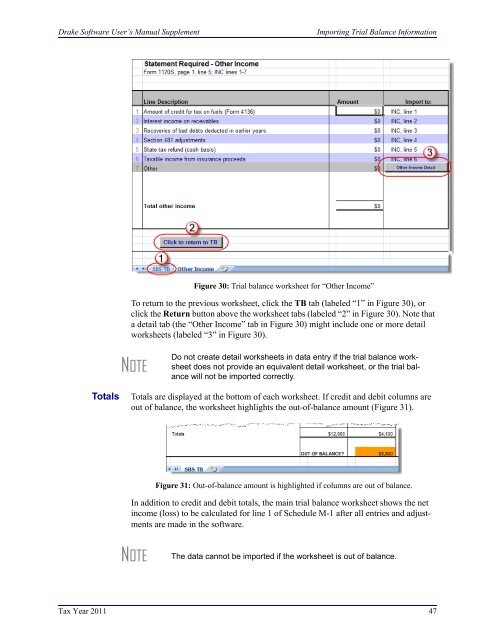

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Importing Trial Balance InformationFigure 30: Trial balance worksheet for “Other Income”To return to the previous worksheet, click the TB tab (labeled “1” in Figure 30), orclick the Return button above the worksheet tabs (labeled “2” in Figure 30). Note thata detail tab (the “Other Income” tab in Figure 30) might include one or more detailworksheets (labeled “3” in Figure 30).NOTEDo not create detail worksheets in data entry if the trial balance worksheetdoes not provide an equivalent detail worksheet, or the trial balancewill not be imported correctly.TotalsTotals are displayed at the bottom of each worksheet. If credit and debit columns areout of balance, the worksheet highlights the out-of-balance amount (Figure 31).Figure 31: Out-of-balance amount is highlighted if columns are out of balance.In addition to credit and debit totals, the main trial balance worksheet shows the netincome (loss) to be calculated for line 1 of Schedule M-1 after all entries and adjustmentsare made in the software.NOTEThe data cannot be imported if the worksheet is out of balance.<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong> 47