Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

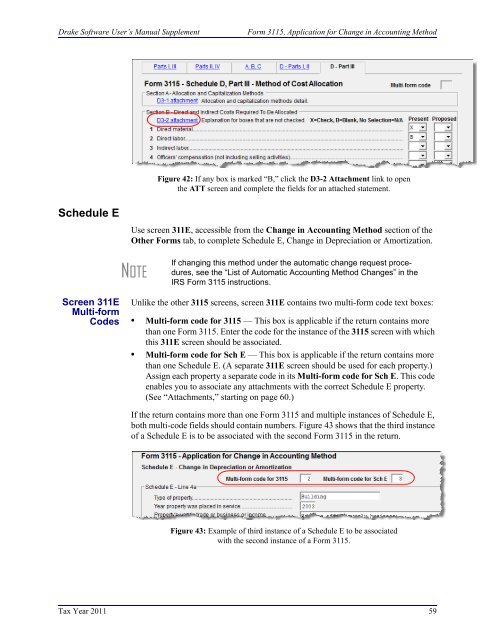

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Form 3115, Application for Change in Accounting MethodFigure 42: If any box is marked “B,” click the D3-2 Attachment link to openthe ATT screen and complete the fields for an attached statement.Schedule EUse screen 311E, accessible from the Change in Accounting Method section of theOther Forms tab, to complete Schedule E, Change in Depreciation or Amortization.NOTEIf changing this method under the automatic change request procedures,see the “List of Automatic Accounting Method Changes” in theIRS Form 3115 instructions.Screen 311EMulti-formCodesUnlike the other 3115 screens, screen 311E contains two multi-form code text boxes:• Multi-form code for 3115 — This box is applicable if the return contains morethan one Form 3115. Enter the code for the instance of the 3115 screen with whichthis 311E screen should be associated.• Multi-form code for Sch E — This box is applicable if the return contains morethan one Schedule E. (A separate 311E screen should be used for each property.)Assign each property a separate code in its Multi-form code for Sch E. This codeenables you to associate any attachments with the correct Schedule E property.(See “Attachments,” starting on page 60.)If the return contains more than one Form 3115 and multiple instances of Schedule E,both multi-code fields should contain numbers. Figure 43 shows that the third instanceof a Schedule E is to be associated with the second Form 3115 in the return.Figure 43: Example of third instance of a Schedule E to be associatedwith the second instance of a Form 3115.<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong> 59