Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

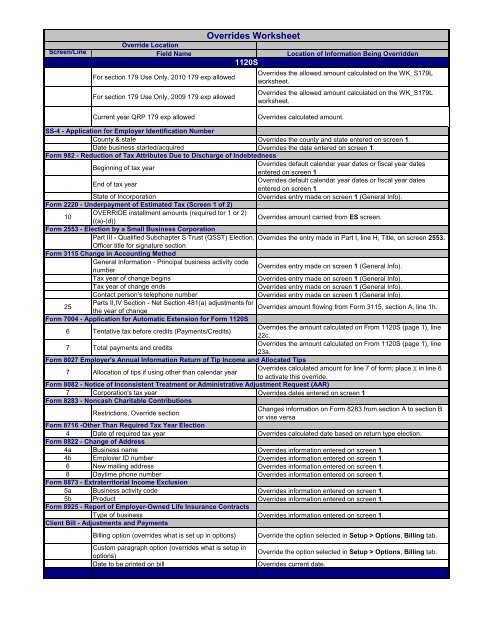

Overrides WorksheetOverride LocationScreen/Line Field Name Location of Information Being Overridden1120SFor section 179 Use Only, 2010 179 exp allowedFor section 179 Use Only, 2009 179 exp allowedOverrides the allowed amount calculated on the WK_S179Lworksheet.Overrides the allowed amount calculated on the WK_S179Lworksheet.Current year QRP 179 exp allowedOverrides calculated amount.SS-4 - Application for Employer Identification NumberCounty & state Overrides the county and state entered on screen 1.Date business started/acquired Overrides the date entered on screen 1.Form 982 - Reduction of <strong>Tax</strong> Attributes Due to Discharge of IndebtednessBeginning of tax yearOverrides default calendar year dates or fiscal year datesentered on screen 1End of tax yearOverrides default calendar year dates or fiscal year datesentered on screen 1State of IncorporationOverrides entry made on screen 1 (General Info).Form 2220 - Underpayment of Estimated <strong>Tax</strong> (Screen 1 of 2)10OVERRIDE installment amounts (required tor 1 or 2)((a)-(d))Overrides amount carried from ES screen.Form 2553 - Election by a Small Business CorporationPart III - Qualified Subchapter S Trust (QSST) Election, Overrides the entry made in Part I, line H, Title, on screen 2553.Officer title for signature sectionForm 3115 Change in Accounting MethodGeneral Information - Principal business activity codenumberOverrides entry made on screen 1 (General Info).<strong>Tax</strong> year of change beginsOverrides entry made on screen 1 (General Info).<strong>Tax</strong> year of change endsOverrides entry made on screen 1 (General Info).Contact person's telephone numberOverrides entry made on screen 1 (General Info).25Parts II,IV Section - Net Section 481(a) adjustments forOverrides amount flowing from Form 3115, section A, line 1h.the year of changeForm 7004 - Application for Automatic Extension for Form 1120S6 Tentative tax before credits (Payments/Credits)Overrides the amount calculated on From 1120S (page 1), line22c.7 Total payments and creditsOverrides the amount calculated on From 1120S (page 1), line23a.Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips7 Allocation of tips if using other than calendar yearOverrides calculated amount for line 7 of form; place X in line 6to activate this override.Form 8082 - Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)7 Corporation's tax year Overrides dates entered on screen 1Form 8283 - Noncash Charitable ContributionsRestrictions, Override sectionChanges information on Form 8283 from section A to section Bor vise versaForm 8716 -Other Than Required <strong>Tax</strong> <strong>Year</strong> Election4 Date of required tax year Overrides calculated date based on return type election.Form 8822 - Change of Address4a Business name Overrides information entered on screen 1.4b Employer ID number Overrides information entered on screen 1.6 New mailing address Overrides information entered on screen 1.8 Daytime phone number Overrides information entered on screen 1.Form 8873 - Extraterritorial Income Exclusion5a Business activity code Overrides information entered on screen 1.5b Product Overrides information entered on screen 1.Form 8925 - Report of Employer-Owned Life Insurance ContractsType of business Overrides information entered on screen 1.Client Bill - Adjustments and PaymentsBilling option (overrides what is set up in options)Custom paragraph option (overrides what is setup inoptions)Date to be printed on billOverride the option selected in Setup > Options, Billing tab.Override the option selected in Setup > Options, Billing tab.Overrides current date.