Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

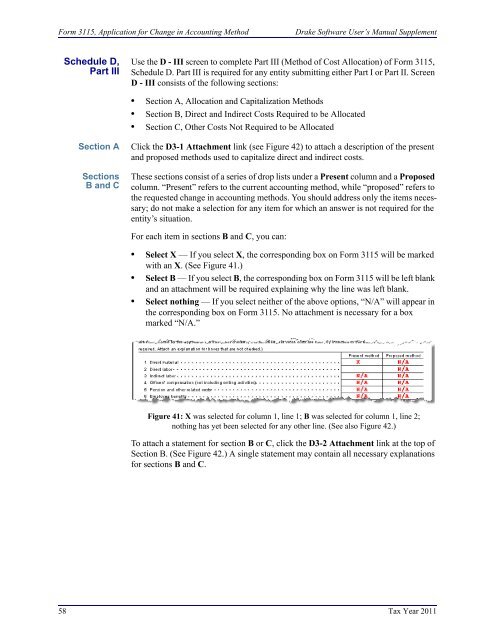

Form 3115, Application for Change in Accounting Method<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Schedule D,Part IIIUse the D - III screen to complete Part III (Method of Cost Allocation) of Form 3115,Schedule D. Part III is required for any entity submitting either Part I or Part II. ScreenD - III consists of the following sections:• Section A, Allocation and Capitalization Methods• Section B, Direct and Indirect Costs Required to be Allocated• Section C, Other Costs Not Required to be AllocatedSection ASectionsB and CClick the D3-1 Attachment link (see Figure 42) to attach a description of the presentand proposed methods used to capitalize direct and indirect costs.These sections consist of a series of drop lists under a Present column and a Proposedcolumn. “Present” refers to the current accounting method, while “proposed” refers tothe requested change in accounting methods. You should address only the items necessary;do not make a selection for any item for which an answer is not required for theentity’s situation.For each item in sections B and C, you can:• Select X — If you select X, the corresponding box on Form 3115 will be markedwith an X. (See Figure 41.)• Select B — If you select B, the corresponding box on Form 3115 will be left blankand an attachment will be required explaining why the line was left blank.• Select nothing — If you select neither of the above options, “N/A” will appear inthe corresponding box on Form 3115. No attachment is necessary for a boxmarked “N/A.”Figure 41: X was selected for column 1, line 1; B was selected for column 1, line 2;nothing has yet been selected for any other line. (See also Figure 42.)To attach a statement for section B or C, click the D3-2 Attachment link at the top ofSection B. (See Figure 42.) A single statement may contain all necessary explanationsfor sections B and C.58 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>