Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

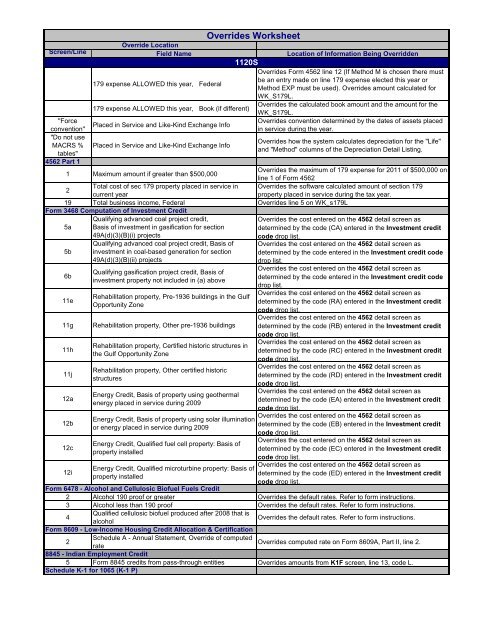

Overrides WorksheetOverride LocationScreen/Line Field Name Location of Information Being Overridden1120SOverrides Form 4562 line 12 (If Method M is chosen there must179 expense ALLOWED this year, Federalbe an entry made on line 179 expense elected this year orMethod EXP must be used). Overrides amount calculated forWK_S179L.179 expense ALLOWED this year, Book (if different)Overrides the calculated book amount and the amount for theWK_S179L."ForceOverrides convention determined by the dates of assets placedPlaced in Service and Like-Kind Exchange Infoconvention"in service during the year."Do not useOverrides how the system calculates depreciation for the "Life"MACRS % Placed in Service and Like-Kind Exchange Infoand "Method" columns of the Depreciation Detail Listing.tables"4562 Part 11 Maximum amount if greater than $500,000Overrides the maximum of 179 expense for <strong>2011</strong> of $500,000 online 1 of Form 45622Total cost of sec 179 property placed in service in Overrides the software calculated amount of section 179current yearproperty placed in service during the tax year.19 Total business income, Federal Overrides line 5 on WK_s179LForm 3468 Computation of Investment Credit5a5b6b11e11g11h11j12a12b12c12iQualifying advanced coal project credit,Basis of investment in gasification for section49A(d)(3)(B)(i) projectsQualifying advanced coal project credit, Basis ofinvestment in coal-based generation for section49A(d)(3)(B)(ii) projectsQualifying gasification project credit, Basis ofinvestment property not included in (a) aboveRehabilitation property, Pre-1936 buildings in the GulfOpportunity ZoneRehabilitation property, Other pre-1936 buildingsRehabilitation property, Certified historic structures inthe Gulf Opportunity ZoneRehabilitation property, Other certified historicstructuresEnergy Credit, Basis of property using geothermalenergy placed in service during 2009Energy Credit, Basis of property using solar illuminationor energy placed in service during 2009Energy Credit, Qualified fuel cell property: Basis ofproperty installedEnergy Credit, Qualified microturbine property: Basis ofproperty installedOverrides the cost entered on the 4562 detail screen asdetermined by the code (CA) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code entered in the Investment credit codedrop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code entered in the Investment credit codedrop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (RA) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (RB) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (RC) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (RD) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (EA) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (EB) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (EC) entered in the Investment creditcode drop list.Overrides the cost entered on the 4562 detail screen asdetermined by the code (ED) entered in the Investment creditcode drop list.Form 6478 - Alcohol and Cellulosic Biofuel Fuels Credit2 Alcohol 190 proof or greater Overrides the default rates. Refer to form instructions.3 Alcohol less than 190 proof Overrides the default rates. Refer to form instructions.Qualified cellulosic biofuel produced after 2008 that is4Overrides the default rates. Refer to form instructions.alcoholForm 8609 - Low-Income Housing Credit Allocation & CertificationSchedule A - Annual Statement, Override of computed2Overrides computed rate on Form 8609A, Part II, line 2.rate8845 - Indian Employment Credit5 Form 8845 credits from pass-through entities Overrides amounts from K1F screen, line 13, code L.Schedule K-1 for 1065 (K-1 P)