Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

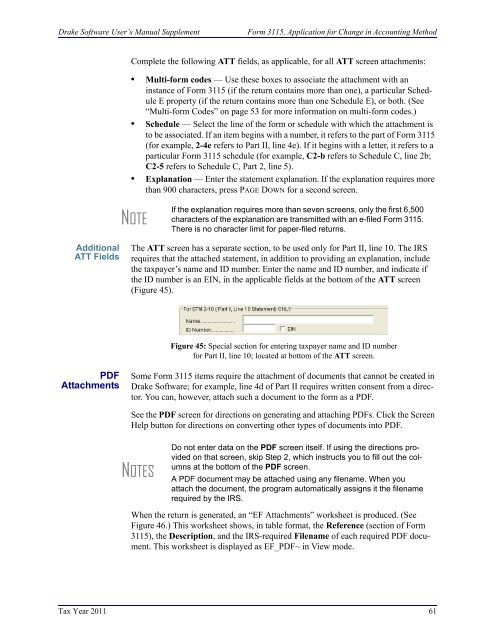

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Form 3115, Application for Change in Accounting MethodComplete the following ATT fields, as applicable, for all ATT screen attachments:• Multi-form codes — Use these boxes to associate the attachment with aninstance of Form 3115 (if the return contains more than one), a particular ScheduleE property (if the return contains more than one Schedule E), or both. (See“Multi-form Codes” on page 53 for more information on multi-form codes.)• Schedule — Select the line of the form or schedule with which the attachment isto be associated. If an item begins with a number, it refers to the part of Form 3115(for example, 2-4e refers to Part II, line 4e). If it begins with a letter, it refers to aparticular Form 3115 schedule (for example, C2-b refers to Schedule C, line 2b;C2-5 refers to Schedule C, Part 2, line 5).• Explanation — Enter the statement explanation. If the explanation requires morethan 900 characters, press PAGE DOWN for a second screen.NOTEIf the explanation requires more than seven screens, only the first 6,500characters of the explanation are transmitted with an e-filed Form 3115.There is no character limit for paper-filed returns.AdditionalATT FieldsThe ATT screen has a separate section, to be used only for Part II, line 10. The IRSrequires that the attached statement, in addition to providing an explanation, includethe taxpayer’s name and ID number. Enter the name and ID number, and indicate ifthe ID number is an EIN, in the applicable fields at the bottom of the ATT screen(Figure 45).Figure 45: Special section for entering taxpayer name and ID numberfor Part II, line 10; located at bottom of the ATT screen.PDFAttachmentsSome Form 3115 items require the attachment of documents that cannot be created in<strong>Drake</strong> <strong>Software</strong>; for example, line 4d of Part II requires written consent from a director.You can, however, attach such a document to the form as a PDF.See the PDF screen for directions on generating and attaching PDFs. Click the ScreenHelp button for directions on converting other types of documents into PDF.NOTESDo not enter data on the PDF screen itself. If using the directions providedon that screen, skip Step 2, which instructs you to fill out the columnsat the bottom of the PDF screen.A PDF document may be attached using any filename. When youattach the document, the program automatically assigns it the filenamerequired by the IRS.When the return is generated, an “EF Attachments” worksheet is produced. (SeeFigure 46.) This worksheet shows, in table format, the Reference (section of Form3115), the Description, and the IRS-required Filename of each required PDF document.This worksheet is displayed as EF_PDF~ in View mode.<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong> 61