Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

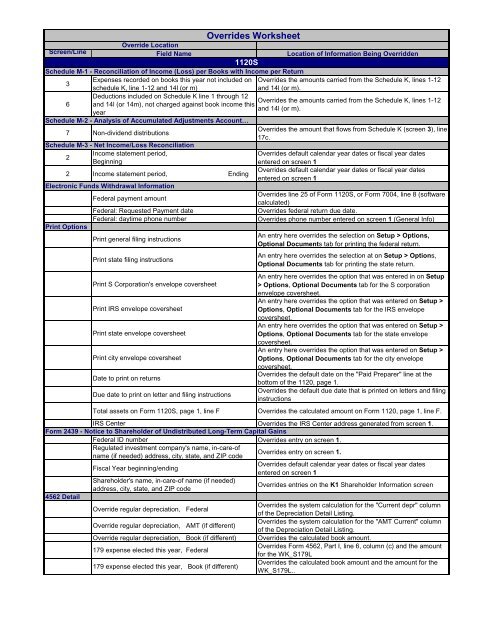

Overrides WorksheetOverride LocationScreen/Line Field Name Location of Information Being Overridden1120SSchedule M-1 - Reconciliation of Income (Loss) per Books with Income per Return3Expenses recorded on books this year not included on Overrides the amounts carried from the Schedule K, lines 1-12schedule K, line 1-12 and 14l (or m)and 14l (or m).6Deductions included on Schedule K line 1 through 12Overrides the amounts carried from the Schedule K, lines 1-12and 14l (or 14m), not charged against book income thisand 14l (or m).yearSchedule M-2 - Analysis of Accumulated Adjustments Account…7 Non-dividend distributionsOverrides the amount that flows from Schedule K (screen 3), line17c.Schedule M-3 - Net Income/Loss Reconciliation2Income statement period,Overrides default calendar year dates or fiscal year datesBeginningentered on screen 12 Income statement period, EndingOverrides default calendar year dates or fiscal year datesentered on screen 1Electronic Funds Withdrawal InformationFederal payment amountOverrides line 25 of Form 1120S, or Form 7004, line 8 (softwarecalculated)Federal: Requested Payment dateOverrides federal return due date.Federal: daytime phone numberOverrides phone number entered on screen 1 (General Info)Print OptionsPrint general filing instructionsAn entry here overrides the selection on Setup > Options,Optional Documents tab for printing the federal return.Print state filing instructionsAn entry here overrides the selection at on Setup > Options,Optional Documents tab for printing the state return.Print S Corporation's envelope coversheetPrint IRS envelope coversheetPrint state envelope coversheetPrint city envelope coversheetDate to print on returnsDue date to print on letter and filing instructionsAn entry here overrides the option that was entered in on Setup> Options, Optional Documents tab for the S corporationenvelope coversheet.An entry here overrides the option that was entered on Setup >Options, Optional Documents tab for the IRS envelopecoversheet.An entry here overrides the option that was entered on Setup >Options, Optional Documents tab for the state envelopecoversheet.An entry here overrides the option that was entered on Setup >Options, Optional Documents tab for the city envelopecoversheet.Overrides the default date on the "Paid Preparer" line at thebottom of the 1120, page 1.Overrides the default due date that is printed on letters and filinginstructionsTotal assets on Form 1120S, page 1, line F Overrides the calculated amount on Form 1120, page 1, line F.IRS Center Overrides the IRS Center address generated from screen 1.Form 2439 - Notice to Shareholder of Undistributed Long-Term Capital GainsFederal ID number Overrides entry on screen 1.Regulated investment company's name, in-care-ofname (if needed) address, city, state, and ZIP codeOverrides entry on screen 1.4562 DetailFiscal <strong>Year</strong> beginning/endingShareholder's name, in-care-of name (if needed)address, city, state, and ZIP codeOverride regular depreciation, FederalOverride regular depreciation, AMT (if different)Override regular depreciation, Book (if different)179 expense elected this year, Federal179 expense elected this year, Book (if different)Overrides default calendar year dates or fiscal year datesentered on screen 1Overrides entries on the K1 Shareholder Information screenOverrides the system calculation for the "Current depr" columnof the Depreciation Detail Listing.Overrides the system calculation for the "AMT Current" columnof the Depreciation Detail Listing.Overrides the calculated book amount.Overrides Form 4562, Part I, line 6, column (c) and the amountfor the WK_S179LOverrides the calculated book amount and the amount for theWK_S179L..