Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

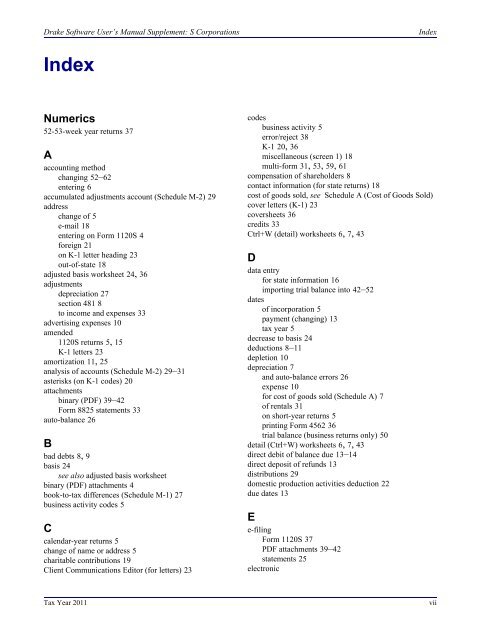

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S CorporationsIndexIndexNumerics52-53-week year returns 37Aaccounting methodchanging 52–62entering 6accumulated adjustments account (Schedule M-2) 29addresschange of 5e-mail 18entering on Form 1120S 4foreign 21on K-1 letter heading 23out-of-state 18adjusted basis worksheet 24, 36adjustmentsdepreciation 27section 481 8to income and expenses 33advertising expenses 10amended1120S returns 5, 15K-1 letters 23amortization 11, 25analysis of accounts (Schedule M-2) 29–31asterisks (on K-1 codes) 20attachmentsbinary (PDF) 39–42Form 8825 statements 33auto-balance 26Bbad debts 8, 9basis 24see also adjusted basis worksheetbinary (PDF) attachments 4book-to-tax differences (Schedule M-1) 27business activity codes 5Ccalendar-year returns 5change of name or address 5charitable contributions 19Client Communications Editor (for letters) 23codesbusiness activity 5error/reject 38K-1 20, 36miscellaneous (screen 1) 18multi-form 31, 53, 59, 61compensation of shareholders 8contact information (for state returns) 18cost of goods sold, see Schedule A (Cost of Goods Sold)cover letters (K-1) 23coversheets 36credits 33Ctrl+W (detail) worksheets 6, 7, 43Ddata entryfor state information 16importing trial balance into 42–52datesof incorporation 5payment (changing) 13tax year 5decrease to basis 24deductions 8–11depletion 10depreciation 7and auto-balance errors 26expense 10for cost of goods sold (Schedule A) 7of rentals 31on short-year returns 5printing Form 4562 36trial balance (business returns only) 50detail (Ctrl+W) worksheets 6, 7, 43direct debit of balance due 13–14direct deposit of refunds 13distributions 29domestic production activities deduction 22due dates 13Ee-filingForm 1120S 37PDF attachments 39–42statements 25electronic<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>vii