Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

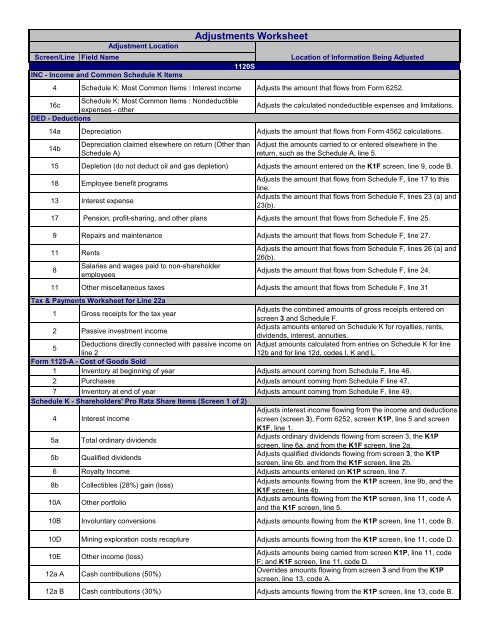

Screen/Line Field Name Location of Information Being Adjusted1120SINC - Income and Common Schedule K Items4 Schedule K: Most Common Items : Interest income Adjusts the amount that flows from Form 6252.Schedule K: Most Common Items : Nondeductible16cexpenses - otherDED - DeductionsAdjusts the calculated nondeductible expenses and limitations.14a Depreciation Adjusts the amount that flows from Form 4562 calculations.14bDepreciation claimed elsewhere on return (Other thanSchedule A)Adjust the amounts carried to or entered elsewhere in thereturn, such as the Schedule A, line 5.15 Depletion (do not deduct oil and gas depletion) Adjusts the amount entered on the K1F screen, line 9, code B.18 Employee benefit programs13 Interest expenseAdjusts the amount that flows from Schedule F, line 17 to thisline.Adjusts the amount that flows from Schedule F, lines 23 (a) and23(b).17 Pension, profit-sharing, and other plans Adjusts the amount that flows from Schedule F, line 25.9 Repairs and maintenance Adjusts the amount that flows from Schedule F, line 27.11 Rents8Salaries and wages paid to non-shareholderemployeesAdjusts the amount that flows from Schedule F, lines 26 (a) and26(b).Adjusts the amount that flows from Schedule F, line 24.11 Other miscellaneous taxes Adjusts the amount that flows from Schedule F, line 31<strong>Tax</strong> & Payments Worksheet for Line 22a1 Gross receipts for the tax yearAdjusts the combined amounts of gross receipts entered onscreen 3 and Schedule F.2 Passive investment incomeAdjusts amounts entered on Schedule K for royalties, rents,dividends, interest, annuities.5Deductions directly connected with passive income on Adjust amounts calculated from entries on Schedule K for lineline 212b and for line 12d, codes I, K and L.Form 1125-A - Cost of Goods Sold1 Inventory at beginning of year Adjusts amount coming from Schedule F, line 46.2 Purchases Adjusts amount coming from Schedule F line 47.7 Inventory at end of year Adjusts amount coming from Schedule F, line 49.Schedule K - Shareholders' Pro Rata Share Items (Screen 1 of 2)4 Interest incomeAdjusts interest income flowing from the income and deductionsscreen (screen 3), Form 6252, screen K1P, line 5 and screenK1F, line 1.5a Total ordinary dividendsAdjusts ordinary dividends flowing from screen 3, the K1Pscreen, line 6a, and from the K1F screen, line 2a.5b Qualified dividendsAdjusts qualified dividends flowing from screen 3, the K1Pscreen, line 6b. and from the K1F screen, line 2b.6 Royalty Income Adjusts amounts entered on K1P screen, line 7.8b Collectibles (28%) gain (loss)Adjusts amounts flowing from the K1P screen, line 9b, and theK1F screen, line 4b.10A Other portfolioAdjusts amounts flowing from the K1P screen, line 11, code Aand the K1F screen, line 5.10B Involuntary conversions Adjusts amounts flowing from the K1P screen, line 11, code B.10D Mining exploration costs recapture Adjusts amounts flowing from the K1P screen, line 11, code D.10EAdjustment LocationOther income (loss)12a A Cash contributions (50%)Adjustments WorksheetAdjusts amounts being carried from screen K1P, line 11, codeF; and K1F screen, line 11, code D.Overrides amounts flowing from screen 3 and from the K1Pscreen, line 13, code A.12a B Cash contributions (30%) Adjusts amounts flowing from the K1P screen, line 13, code B.