Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

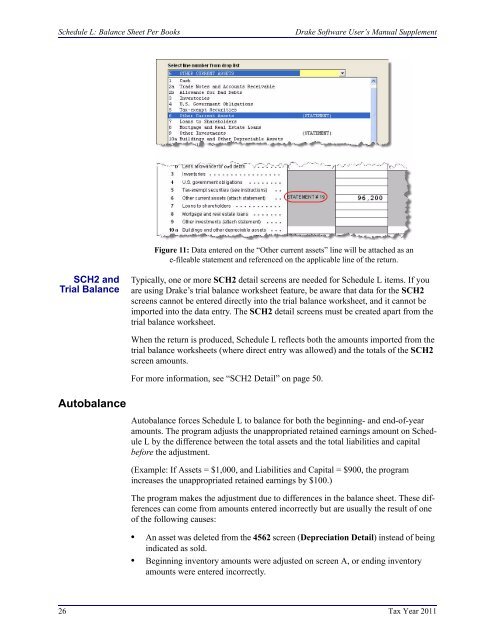

Schedule L: Balance Sheet Per Books<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Figure 11: Data entered on the “Other current assets” line will be attached as ane-fileable statement and referenced on the applicable line of the return.SCH2 andTrial BalanceTypically, one or more SCH2 detail screens are needed for Schedule L items. If youare using <strong>Drake</strong>’s trial balance worksheet feature, be aware that data for the SCH2screens cannot be entered directly into the trial balance worksheet, and it cannot beimported into the data entry. The SCH2 detail screens must be created apart from thetrial balance worksheet.When the return is produced, Schedule L reflects both the amounts imported from thetrial balance worksheets (where direct entry was allowed) and the totals of the SCH2screen amounts.For more information, see “SCH2 Detail” on page 50.AutobalanceAutobalance forces Schedule L to balance for both the beginning- and end-of-yearamounts. The program adjusts the unappropriated retained earnings amount on ScheduleL by the difference between the total assets and the total liabilities and capitalbefore the adjustment.(Example: If Assets = $1,000, and Liabilities and Capital = $900, the programincreases the unappropriated retained earnings by $100.)The program makes the adjustment due to differences in the balance sheet. These differencescan come from amounts entered incorrectly but are usually the result of oneof the following causes:• An asset was deleted from the 4562 screen (Depreciation Detail) instead of beingindicated as sold.• Beginning inventory amounts were adjusted on screen A, or ending inventoryamounts were entered incorrectly.26 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>