Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

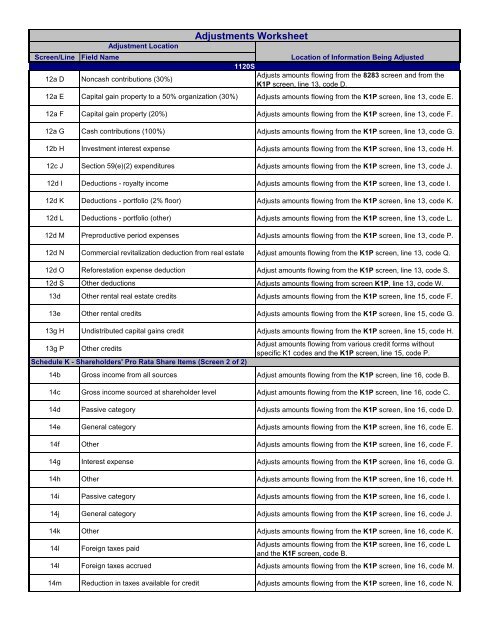

Adjustment LocationAdjustments WorksheetScreen/Line Field Name Location of Information Being Adjusted1120SAdjusts amounts flowing from the 8283 screen and from the12a D Noncash contributions (30%)K1P screen, line 13, code D.12a E Capital gain property to a 50% organization (30%) Adjusts amounts flowing from the K1P screen, line 13, code E.12a F Capital gain property (20%) Adjusts amounts flowing from the K1P screen, line 13, code F.12a G Cash contributions (100%) Adjusts amounts flowing from the K1P screen, line 13, code G.12b H Investment interest expense Adjusts amounts flowing from the K1P screen, line 13, code H.12c J Section 59(e)(2) expenditures Adjusts amounts flowing from the K1P screen, line 13, code J.12d I Deductions - royalty income Adjusts amounts flowing from the K1P screen, line 13, code I.12d K Deductions - portfolio (2% floor) Adjusts amounts flowing from the K1P screen, line 13, code K.12d L Deductions - portfolio (other) Adjusts amounts flowing from the K1P screen, line 13, code L.12d M Preproductive period expenses Adjusts amounts flowing from the K1P screen, line 13, code P.12d N Commercial revitalization deduction from real estate Adjust amounts flowing from the K1P screen, line 13, code Q.12d O Reforestation expense deduction Adjust amounts flowing from the K1P screen, line 13, code S.12d S Other deductions Adjusts amounts flowing from screen K1P, line 13, code W.13d Other rental real estate credits Adjusts amounts flowing from the K1P screen, line 15, code F.13e Other rental credits Adjusts amounts flowing from the K1P screen, line 15, code G.13g H Undistributed capital gains credit Adjusts amounts flowing from the K1P screen, line 15, code H.13g POther creditsSchedule K - Shareholders' Pro Rata Share Items (Screen 2 of 2)Adjust amounts flowing from various credit forms withoutspecific K1 codes and the K1P screen, line 15, code P.14b Gross income from all sources Adjust amounts flowing from the K1P screen, line 16, code B.14c Gross income sourced at shareholder level Adjust amounts flowing from the K1P screen, line 16, code C.14d Passive category Adjusts amounts flowing from the K1P screen, line 16, code D.14e General category Adjusts amounts flowing from the K1P screen, line 16, code E.14f Other Adjusts amounts flowing from the K1P screen, line 16, code F.14g Interest expense Adjusts amounts flowing from the K1P screen, line 16, code G.14h Other Adjusts amounts flowing from the K1P screen, line 16, code H.14i Passive category Adjusts amounts flowing from the K1P screen, line 16, code I.14j General category Adjusts amounts flowing from the K1P screen, line 16, code J.14k Other Adjusts amounts flowing from the K1P screen, line 16, code K.14lForeign taxes paidAdjusts amounts flowing from the K1P screen, line 16, code Land the K1F screen, code B.14l Foreign taxes accrued Adjusts amounts flowing from the K1P screen, line 16, code M.14m Reduction in taxes available for credit Adjusts amounts flowing from the K1P screen, line 16, code N.