Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

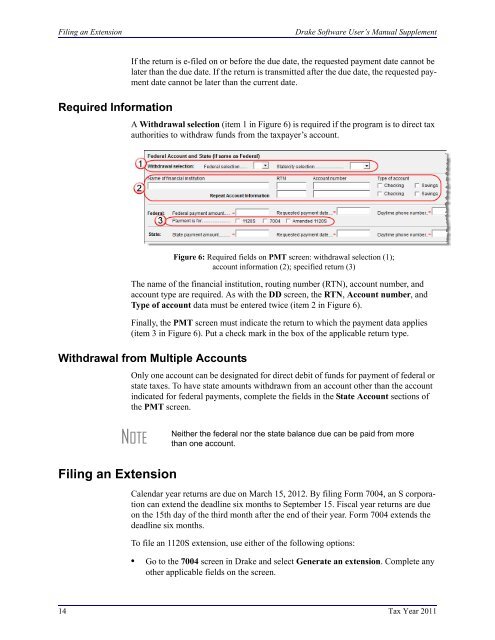

Filing an Extension<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Required InformationIf the return is e-filed on or before the due date, the requested payment date cannot belater than the due date. If the return is transmitted after the due date, the requested paymentdate cannot be later than the current date.A Withdrawal selection (item 1 in Figure 6) is required if the program is to direct taxauthorities to withdraw funds from the taxpayer’s account.Figure 6: Required fields on PMT screen: withdrawal selection (1);account information (2); specified return (3)The name of the financial institution, routing number (RTN), account number, andaccount type are required. As with the DD screen, the RTN, Account number, andType of account data must be entered twice (item 2 in Figure 6).Finally, the PMT screen must indicate the return to which the payment data applies(item 3 in Figure 6). Put a check mark in the box of the applicable return type.Withdrawal from Multiple AccountsOnly one account can be designated for direct debit of funds for payment of federal orstate taxes. To have state amounts withdrawn from an account other than the accountindicated for federal payments, complete the fields in the State Account sections ofthe PMT screen.NOTENeither the federal nor the state balance due can be paid from morethan one account.Filing an ExtensionCalendar year returns are due on March 15, 2012. By filing Form 7004, an S corporationcan extend the deadline six months to September 15. Fiscal year returns are dueon the 15th day of the third month after the end of their year. Form 7004 extends thedeadline six months.To file an 1120S extension, use either of the following options:• Go to the 7004 screen in <strong>Drake</strong> and select Generate an extension. Complete anyother applicable fields on the screen.14 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>