Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

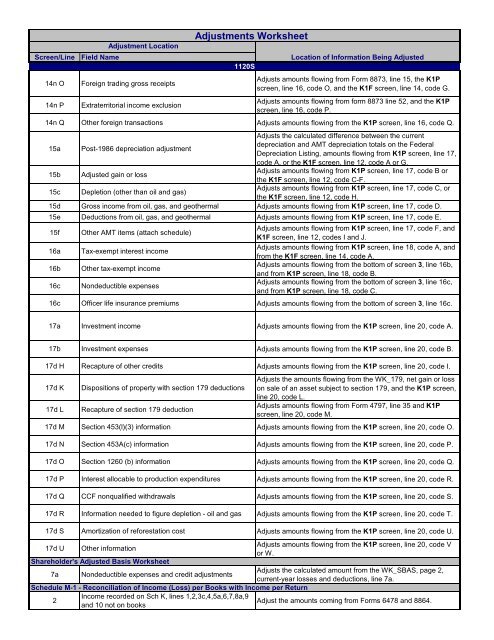

Adjustment LocationAdjustments WorksheetScreen/Line Field Name Location of Information Being Adjusted1120S14n O14n PForeign trading gross receiptsExtraterritorial income exclusionAdjusts amounts flowing from Form 8873, line 15, the K1Pscreen, line 16, code O, and the K1F screen, line 14, code G.Adjusts amounts flowing from form 8873 line 52, and the K1Pscreen, line 16, code P.14n Q Other foreign transactions Adjusts amounts flowing from the K1P screen, line 16, code Q.15a Post-1986 depreciation adjustmentAdjusts the calculated difference between the currentdepreciation and AMT depreciation totals on the FederalDepreciation Listing, amounts flowing from K1P screen, line 17,code A, or the K1F screen, line 12, code A or G.15b Adjusted gain or lossAdjusts amounts flowing from K1P screen, line 17, code B orthe K1F screen, line 12, code C-F.15c Depletion (other than oil and gas)Adjusts amounts flowing from K1P screen, line 17, code C, orthe K1F screen, line 12, code H.15d Gross income from oil, gas, and geothermal Adjusts amounts flowing from K1P screen, line 17, code D.15e Deductions from oil, gas, and geothermal Adjusts amounts flowing from K1P screen, line 17, code E.15f Other AMT items (attach schedule)Adjusts amounts flowing from K1P screen, line 17, code F, andK1F screen, line 12, codes I and J.16a <strong>Tax</strong>-exempt interest incomeAdjusts amounts flowing from K1P screen, line 18, code A, andfrom the K1F screen, line 14, code A.16b Other tax-exempt incomeAdjusts amounts flowing from the bottom of screen 3, line 16b,and from K1P screen, line 18, code B.16c Nondeductible expensesAdjusts amounts flowing from the bottom of screen 3, line 16c,and from K1P screen, line 18, code C.16c Officer life insurance premiums Adjusts amounts flowing from the bottom of screen 3, line 16c.17a Investment income Adjusts amounts flowing from the K1P screen, line 20, code A.17b Investment expenses Adjusts amounts flowing from the K1P screen, line 20, code B.17d H Recapture of other credits Adjusts amounts flowing from the K1P screen, line 20, code I.17d K17d LDispositions of property with section 179 deductionsRecapture of section 179 deductionAdjusts the amounts flowing from the WK_179, net gain or losson sale of an asset subject to section 179, and the K1P screen,line 20, code L.Adjusts amounts flowing from Form 4797, line 35 and K1Pscreen, line 20, code M.17d M Section 453(l)(3) information Adjusts amounts flowing from the K1P screen, line 20, code O.17d N Section 453A(c) information Adjusts amounts flowing from the K1P screen, line 20, code P.17d O Section 1260 (b) information Adjusts amounts flowing from the K1P screen, line 20, code Q.17d P Interest allocable to production expenditures Adjusts amounts flowing from the K1P screen, line 20, code R.17d Q CCF nonqualified withdrawals Adjusts amounts flowing from the K1P screen, line 20, code S.17d R Information needed to figure depletion - oil and gas Adjusts amounts flowing from the K1P screen, line 20, code T.17d S Amortization of reforestation cost Adjusts amounts flowing from the K1P screen, line 20, code U.17d UOther informationShareholder's Adjusted Basis WorksheetAdjusts amounts flowing from the K1P screen, line 20, code Vor W.Adjusts the calculated amount from the WK_SBAS, page 2,7a Nondeductible expenses and credit adjustmentscurrent-year losses and deductions, line 7a.Schedule M-1 - Reconciliation of Income (Loss) per Books with Income per ReturnIncome recorded on Sch K, lines 1,2,3c,4,5a,6,7,8a,92Adjust the amounts coming from Forms 6478 and 8864.and 10 not on books