Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

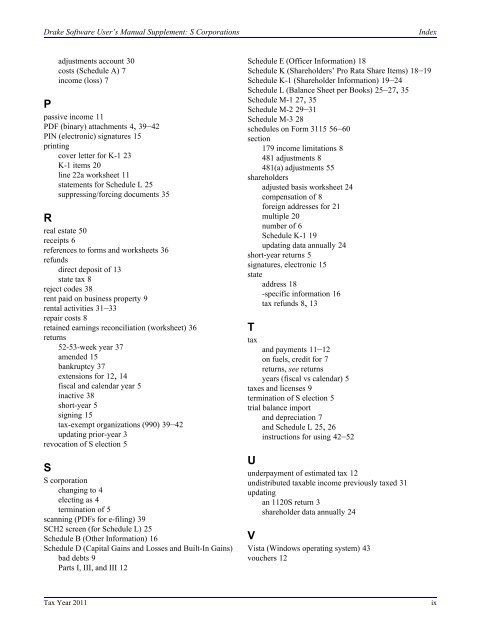

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>: S CorporationsIndexadjustments account 30costs (Schedule A) 7income (loss) 7Ppassive income 11PDF (binary) attachments 4, 39–42PIN (electronic) signatures 15printingcover letter for K-1 23K-1 items 20line 22a worksheet 11statements for Schedule L 25suppressing/forcing documents 35Rreal estate 50receipts 6references to forms and worksheets 36refundsdirect deposit of 13state tax 8reject codes 38rent paid on business property 9rental activities 31–33repair costs 8retained earnings reconciliation (worksheet) 36returns52-53-week year 37amended 15bankruptcy 37extensions for 12, 14fiscal and calendar year 5inactive 38short-year 5signing 15tax-exempt organizations (990) 39–42updating prior-year 3revocation of S election 5SS corporationchanging to 4electing as 4termination of 5scanning (PDFs for e-filing) 39SCH2 screen (for Schedule L) 25Schedule B (Other Information) 16Schedule D (Capital Gains and Losses and Built-In Gains)bad debts 9Parts I, III, and III 12Schedule E (Officer Information) 18Schedule K (Shareholders’ Pro Rata Share Items) 18–19Schedule K-1 (Shareholder Information) 19–24Schedule L (Balance Sheet per Books) 25–27, 35Schedule M-1 27, 35Schedule M-2 29–31Schedule M-3 28schedules on Form 3115 56–60section179 income limitations 8481 adjustments 8481(a) adjustments 55shareholdersadjusted basis worksheet 24compensation of 8foreign addresses for 21multiple 20number of 6Schedule K-1 19updating data annually 24short-year returns 5signatures, electronic 15stateaddress 18-specific information 16tax refunds 8, 13Ttaxand payments 11–12on fuels, credit for 7returns, see returnsyears (fiscal vs calendar) 5taxes and licenses 9termination of S election 5trial balance importand depreciation 7and Schedule L 25, 26instructions for using 42–52Uunderpayment of estimated tax 12undistributed taxable income previously taxed 31updatingan 1120S return 3shareholder data annually 24VVista (Windows operating system) 43vouchers 12<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>ix