Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

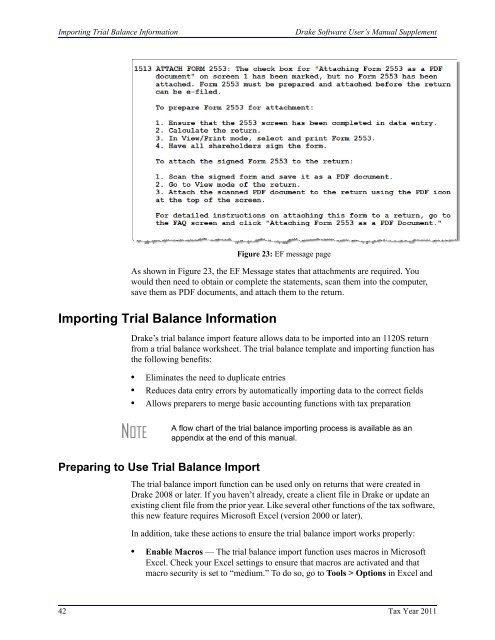

Importing Trial Balance Information<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Figure 23: EF message pageAs shown in Figure 23, the EF Message states that attachments are required. Youwould then need to obtain or complete the statements, scan them into the computer,save them as PDF documents, and attach them to the return.Importing Trial Balance Information<strong>Drake</strong>’s trial balance import feature allows data to be imported into an 1120S returnfrom a trial balance worksheet. The trial balance template and importing function hasthe following benefits:• Eliminates the need to duplicate entries• Reduces data entry errors by automatically importing data to the correct fields• Allows preparers to merge basic accounting functions with tax preparationNOTEA flow chart of the trial balance importing process is available as anappendix at the end of this manual.Preparing to Use Trial Balance ImportThe trial balance import function can be used only on returns that were created in<strong>Drake</strong> 2008 or later. If you haven’t already, create a client file in <strong>Drake</strong> or update anexisting client file from the prior year. Like several other functions of the tax software,this new feature requires Microsoft Excel (version 2000 or later).In addition, take these actions to ensure the trial balance import works properly:• Enable Macros — The trial balance import function uses macros in MicrosoftExcel. Check your Excel settings to ensure that macros are activated and thatmacro security is set to “medium.” To do so, go to Tools > Options in Excel and42 <strong>Tax</strong> <strong>Year</strong> <strong>2011</strong>