Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Drake Software User's Manual Tax Year 2011 Supplement: S ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

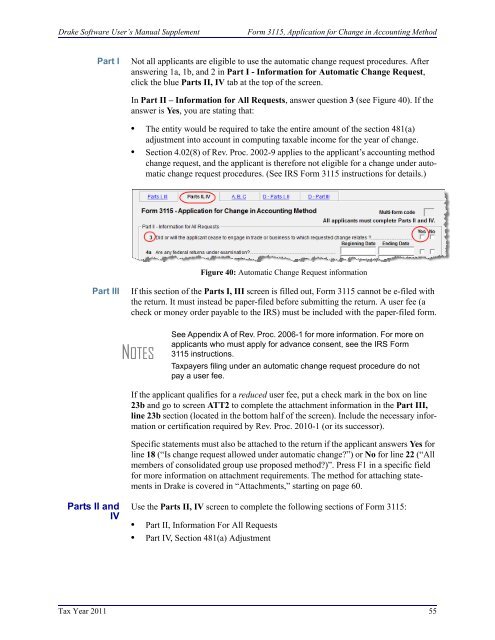

<strong>Drake</strong> <strong>Software</strong> User’s <strong>Manual</strong> <strong>Supplement</strong>Form 3115, Application for Change in Accounting MethodPart INot all applicants are eligible to use the automatic change request procedures. Afteranswering 1a, 1b, and 2 in Part I - Information for Automatic Change Request,click the blue Parts II, IV tab at the top of the screen.In Part II – Information for All Requests, answer question 3 (see Figure 40). If theanswer is Yes, you are stating that:• The entity would be required to take the entire amount of the section 481(a)adjustment into account in computing taxable income for the year of change.• Section 4.02(8) of Rev. Proc. 2002-9 applies to the applicant’s accounting methodchange request, and the applicant is therefore not eligible for a change under automaticchange request procedures. (See IRS Form 3115 instructions for details.)Figure 40: Automatic Change Request informationPart IIIIf this section of the Parts I, III screen is filled out, Form 3115 cannot be e-filed withthe return. It must instead be paper-filed before submitting the return. A user fee (acheck or money order payable to the IRS) must be included with the paper-filed form.NOTESSee Appendix A of Rev. Proc. 2006-1 for more information. For more onapplicants who must apply for advance consent, see the IRS Form3115 instructions.<strong>Tax</strong>payers filing under an automatic change request procedure do notpay a user fee.If the applicant qualifies for a reduced user fee, put a check mark in the box on line23b and go to screen ATT2 to complete the attachment information in the Part III,line 23b section (located in the bottom half of the screen). Include the necessary informationor certification required by Rev. Proc. 2010-1 (or its successor).Specific statements must also be attached to the return if the applicant answers Yes forline 18 (“Is change request allowed under automatic change?”) or No for line 22 (“Allmembers of consolidated group use proposed method?)”. Press F1 in a specific fieldfor more information on attachment requirements. The method for attaching statementsin <strong>Drake</strong> is covered in “Attachments,” starting on page 60.Parts II andIVUse the Parts II, IV screen to complete the following sections of Form 3115:• Part II, Information For All Requests• Part IV, Section 481(a) Adjustment<strong>Tax</strong> <strong>Year</strong> <strong>2011</strong> 55